Question: Judy is preparing a client's return. The client is claiming the EIC, CTC / ACTC / ODC , and AOTC. Which of the following best

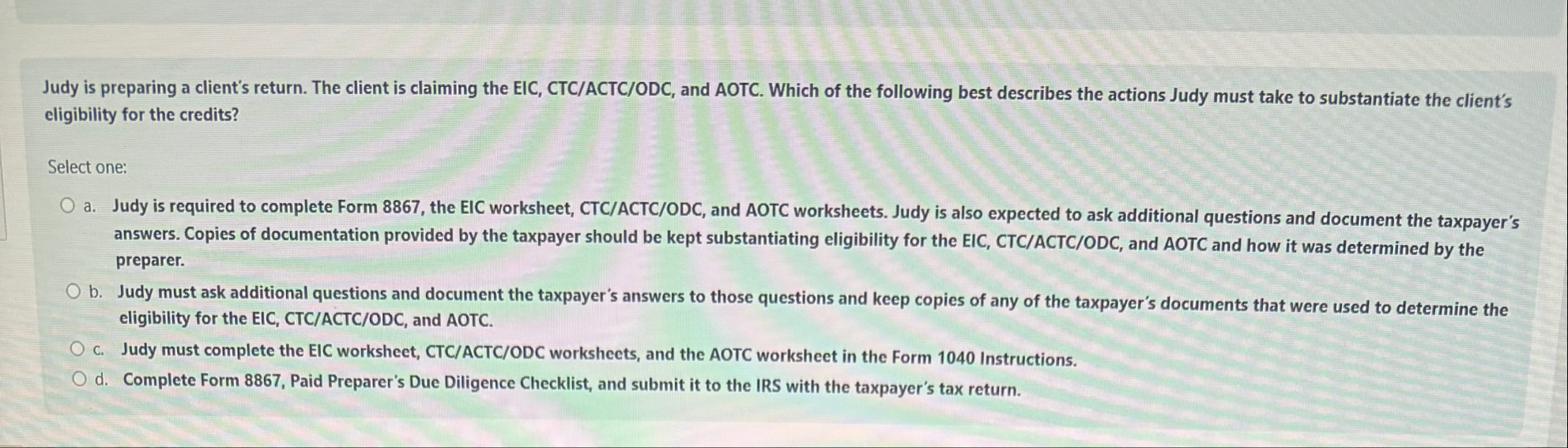

Judy is preparing a client's return. The client is claiming the EIC, CTCACTCODC and AOTC. Which of the following best describes the actions Judy must take to substantiate the client's eligibility for the credits?

Select one:

a Judy is required to complete Form the EIC worksheet, CTCACTCODC and AOTC worksheets. Judy is also expected to ask additional questions and document the taxpayer's answers. Copies of documentation provided by the taxpayer should be kept substantiating eligibility for the EIC, CTCACTCODC and AOTC and how it was determined by the preparer.

b Judy must ask additional questions and document the taxpayer's answers to those questions and keep copies of any of the taxpayer's documents that were used to determine the eligibility for the EIC, CTCACTCODC and AOTC.

c Judy must complete the EIC worksheet, CTCACTCODC worksheets, and the AOTC worksheet in the Form Instructions.

d Complete Form Paid Preparer's Due Diligence Checklist, and submit it to the IRS with the taxpayer's tax return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock