Question: Julstan Multi - Enterprise Limited ( JML ) is a Canadian - controlled private corporation. It has operated with a December 3 1 year -

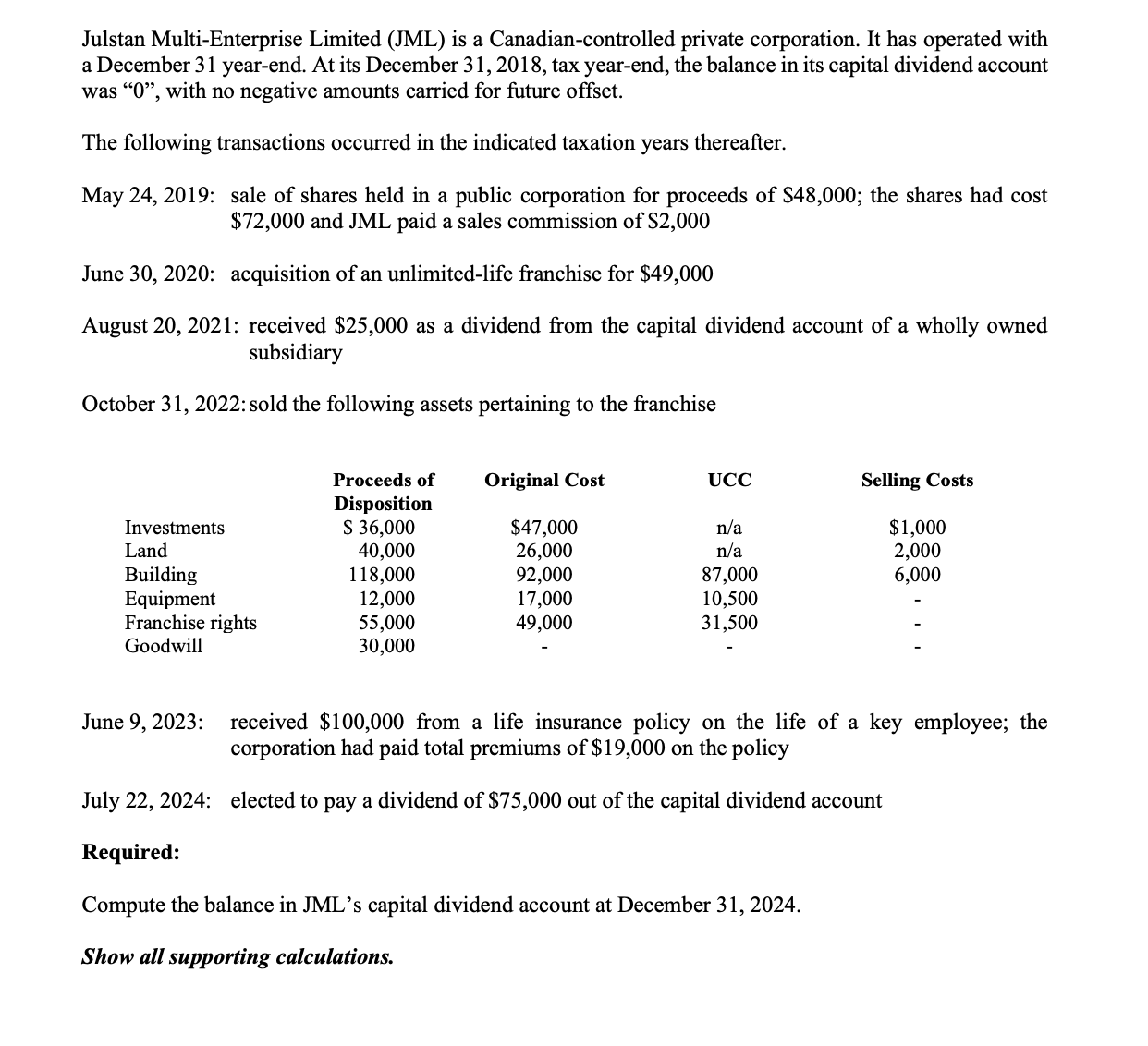

Julstan MultiEnterprise Limited JML is a Canadiancontrolled private corporation. It has operated with a December yearend. At its December tax yearend, the balance in its capital dividend account was with no negative amounts carried for future offset. The following transactions occurred in the indicated taxation years thereafter. May : sale of shares held in a public corporation for proceeds of $ ; the shares had cost $ and JML paid a sales commission of $ June : acquisition of an unlimitedlife franchise for $ August : received $ as a dividend from the capital dividend account of a wholly owned subsidiary October : sold the following assets pertaining to the franchise June : received $ from a life insurance policy on the life of a key employee; the corporation had paid total premiums of $ on the policy July : elected to pay a dividend of $ out of the capital dividend account Required: Compute the balance in JMLs capital dividend account at December Show all supporting calculations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock