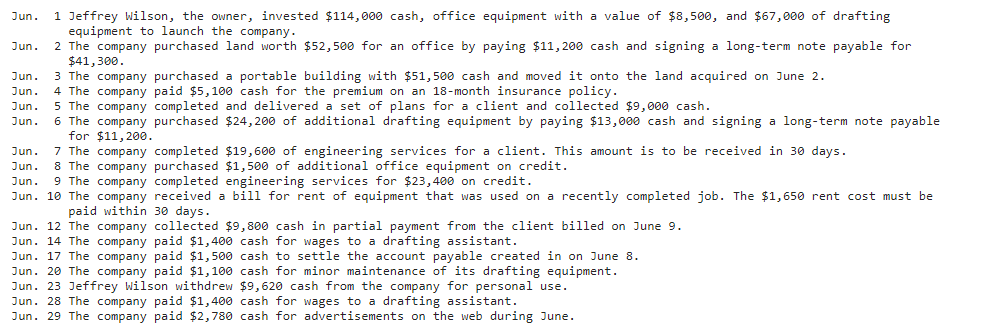

Question: Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. M Gum-law LDOO'HI 16 14 17 28 23

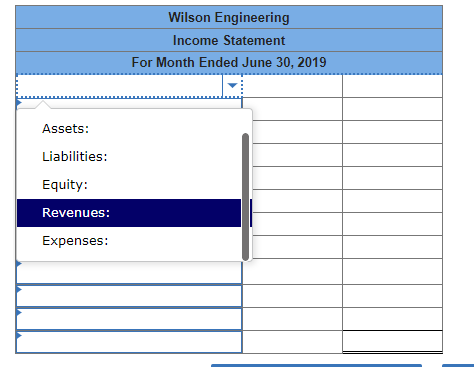

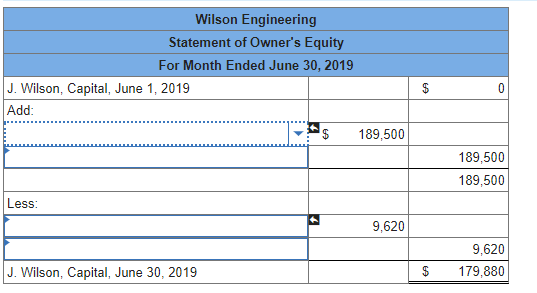

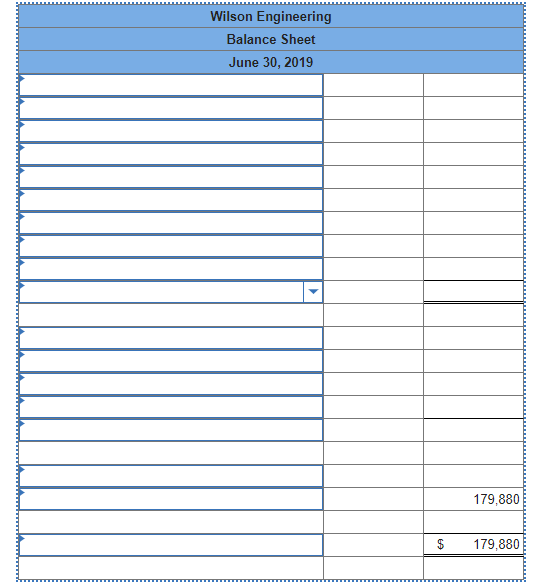

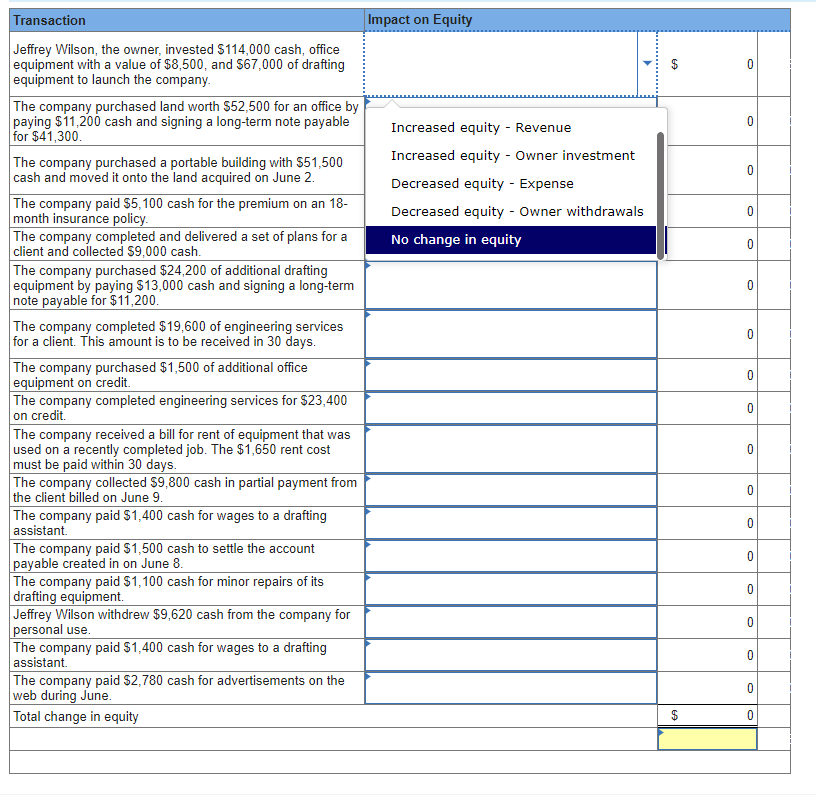

Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. Jun. M Gum-law LDOO'HI 16 14 17 28 23 28 29 Jeffrey Wilson, the owner, invested $114,888 cash, office equipment with a value of $8,588, and $6?,888 of drafting equipment to launch the company. The company purchased land worth $52,588 for an office by paying $11,288 cash and signing a long-term note payable for $41,388. The company purchased a portable building with $51,508 cash and moved it onto the land acquired on June 2. The company paid $5,188 cash for the premium on an 18month insurance policy. The company completed and delivered a set of plans for a client and collected $9,888 cash. The company purchased $24,288 of additional drafting equipment by paying $13,888 cash and signing a longterm note payable for $11,288. The company completed $19,688 of engineering services for a client. This amount is to be received in 38 days. The company purchased $1,588 of additional office equipment on credit. The company completed engineering services for $23,488 on credit. The company received a bill for rent of equipment that was used on a recently completed job. The $1,658 rent cost must be paid within 38 days. The company collected $9,888 cash in partial payment from the client billed on June 9. The company paid $1,488 cash for wages to a drafting assistant. The company paid $1,588 cash to settle the account payable created in on June 8. The company paid $1,188 cash for minor maintenance of its drafting equipment. Jeffrey Hilson withdrew $9,628 cash from the company for personal use. The company paid $1,488 cash for wages to a drafting assistant. The company paid $2,788 cash for advertisements on the web during June. Wilson Engineering Income Statement For Month Ended June 30, 2019 Assets: Liabilities: Equity: Revenues: Expenses:Wilson Engineering Statement of Owner's Equity For Month Ended June 30, 2019 J. Wilson, Capital, June 1, 2019 Add: 189,500 189,500 189,500 Less: + 9.620 9,620 J. Wilson, Capital, June 30, 2019 $ 179,880Wilson Engineering Balance Sheet June 30, 2019 179,880 179,880Jeffrey Wilson, the owner, invested $114,000 cash, ofce equipment with a value of $8,500, and $5?,000 of drafting equipment to launch the company. The company purchased land worth $52,500 for an ofce by paying $11,200 cash and signing a long-term note payable for $41,300. The company purchased a portable building with $51,500 cash and moved it onto the land acquired on June 2. The company paid $5,100 cash for the premium on an 18 month insurance policy. The company completed and delivered a set of plans for a client and collected $9,000 cash. The company purchased $24,200 of additional drafting equipment by paying $13,000 cash and signing a long-ten11 note payable for $11,200. The company completed $19,500 of engineering services for a client. This amount is to be received in 30 days. The company purchased $1,500 of additional ofce equipment on credit. The company completed engineering services for $23,400 on credit. The company received a bill for rent of equipment that was used on a recently completed job. The $1 ,550 rent cost must be paid within 30 days. The company collected $9,900 cash in partial payment from the client billed on June 9. The company paid $1,400 cash for wages to a drafting assistant The company paid $1,500 cash to settle the account payable created in on June 8. The company paid $1,100 cash for minor repairs of its drafting equipment. Jeffrey Wilson withdrew $9,520 cash from the company for personal use. The company paid $1,400 cash for wages to a drafting assistant The company paid $2,330 cash for advertisements on the web during June. Total change in equity Increased equity - Revenue Increased equity - Owner investment Decreased equity - Expense Decreased equity - Owner withdrawals No change in equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts