Question: June 8 Ruby Gordon, L.L.B. is a sole proprietor providing legal services in the province of Newfoundland and Labrador, where the HST rate is 15%.

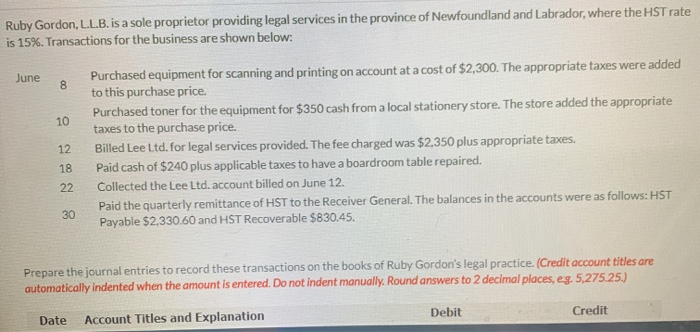

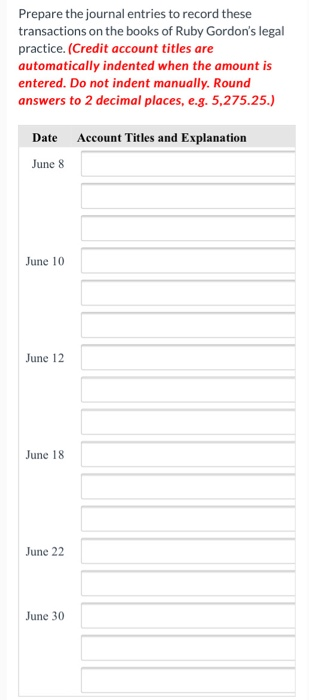

June 8 Ruby Gordon, L.L.B. is a sole proprietor providing legal services in the province of Newfoundland and Labrador, where the HST rate is 15%. Transactions for the business are shown below: Purchased equipment for scanning and printing on account at a cost of $2,300. The appropriate taxes were added to this purchase price. Purchased toner for the equipment for $350 cash from a local stationery store. The store added the appropriate taxes to the purchase price. Billed Lee Ltd. for legal services provided. The fee charged was $2,350 plus appropriate taxes. Paid cash of $240 plus applicable taxes to have a boardroom table repaired. Collected the Lee Ltd. account billed on June 12. Paid the quarterly remittance of HST to the Receiver General. The balances in the accounts were as follows: HST Payable $2,330.60 and HST Recoverable $830.45. 10 12 18 22 30 Prepare the journal entries to record these transactions on the books of Ruby Gordon's legal practice. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, eg. 5,275.25.) Debit Credit Date Account Titles and Explanation Prepare the journal entries to record these transactions on the books of Ruby Gordon's legal practice. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 5,275.25.) Date Account Titles and Explanation June 8 June 10 June 12 June 18 June 22 June 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts