Question: just 3 4 and 5 please QUESTION 3: 20 marks SHOW ALL SUPPORTING CALCULATIONS FOR THIS PROBLEM. NO MARKS WILL BE AWARDED FOR ANSWERS TO

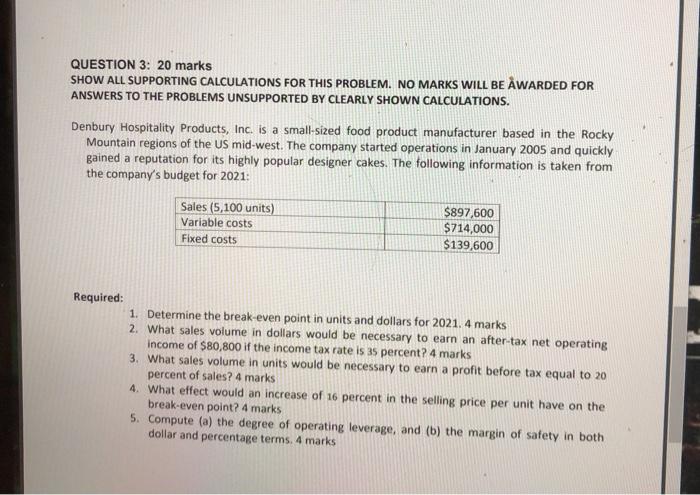

QUESTION 3: 20 marks SHOW ALL SUPPORTING CALCULATIONS FOR THIS PROBLEM. NO MARKS WILL BE AWARDED FOR ANSWERS TO THE PROBLEMS UNSUPPORTED BY CLEARLY SHOWN CALCULATIONS. Denbury Hospitality Products, Inc. is a small-sized food product manufacturer based in the Rocky Mountain regions of the US mid-west. The company started operations in January 2005 and quickly gained a reputation for its highly popular designer cakes. The following information is taken from the company's budget for 2021: Sales (5,100 units) Variable costs Fixed costs $897,600 $714,000 $139,600 Required: 1. Determine the break-even point in units and dollars for 2021. 4 marks 2. What sales volume in dollars would be necessary to earn an after-tax net operating income of $80,800 if the income tax rate is 35 percent? 4 marks 3. What sales volume in units would be necessary to earn a profit before tax equal to 20 percent of sales? 4 marks 4. What effect would an increase of 16 percent in the selling price per unit have on the break-even point? 4 marks 5. Compute (a) the degree of operating leverage, and (b) the margin of safety in both dollar and percentage terms. 4 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts