Question: Just Answer Exercise 3. Please! Exercise 1. Imagine you have 500 dollars you want to invest for two periods. Swift corporation's stock is currently selling

Just Answer Exercise 3. Please!

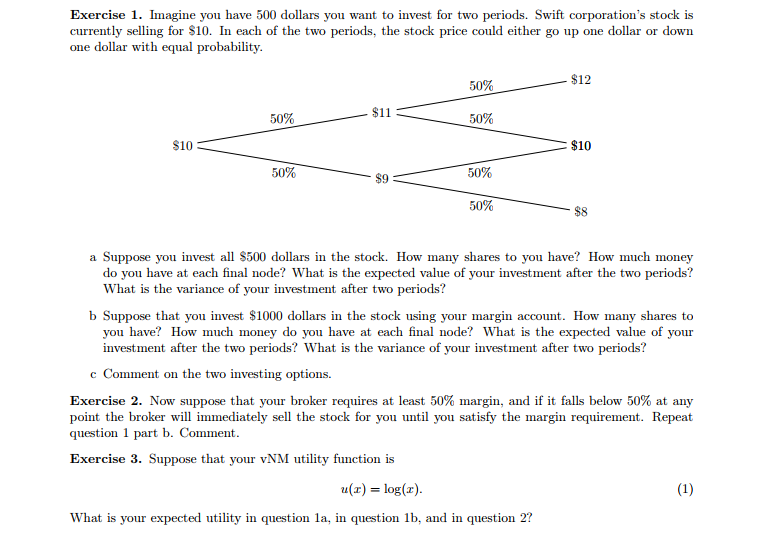

Exercise 1. Imagine you have 500 dollars you want to invest for two periods. Swift corporation's stock is currently selling for S10. In each of the two periods, the stock price could either go up one dollar or down one dollar with equal probability. $12 50% $11 50% 50% $10 $10 50% 50% $9 50% $8 a Suppose you invest all S500 dollars in the stock. How many shares to you have? How much money do you have at each final node? What is the expected value of your investment after the two periods? What is the variance of your investment after two periods? b Suppose that you invest $1000 dollars in the stock using your margin account. How many shares to you have? How much money do you have at each final node? What is the expected value of your investment after the two periods? What is the variance of your investment after two periods? c Comment on the two investing options. Exercise 2. Now suppose that your broker requires at least 50% margin, and if it falls below 50% at any point the broker will immediately sell the stock for you until you satisfy the margin requirement. Repeat question 1 part b. Comment Exercise 3. Suppose that your vNM utility function is a(z) = log(z) What is your expected utility in question la, in question 1b, and in question 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts