Question: just answer is fine no process 1. 2. 3. A potential investment is projected to earn you $6,000 in two years, $4,000 in three years,

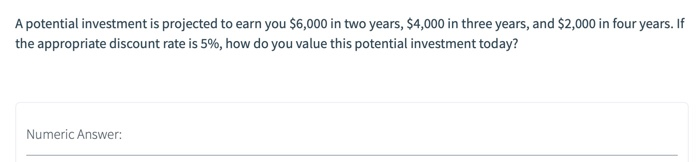

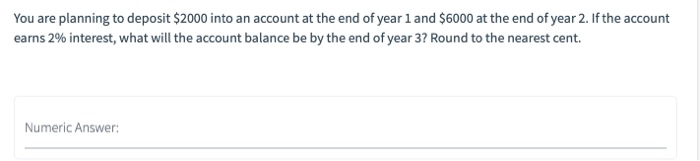

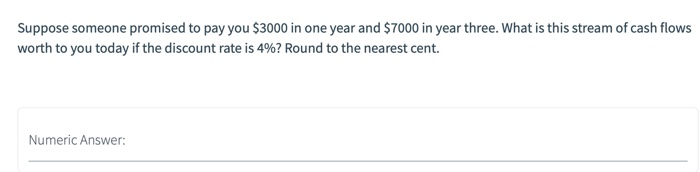

A potential investment is projected to earn you $6,000 in two years, $4,000 in three years, and $2,000 in four years. If the appropriate discount rate is 5%, how do you value this potential investment today? Numeric Answer: You are planning to deposit $2000 into an account at the end of year 1 and $6000 at the end of year 2. If the account earns 2% interest, what will the account balance be by the end of year 3? Round to the nearest cent. Numeric Answer: Suppose someone promised to pay you $3000 in one year and $7000 in year three. What is this stream of cash flows worth to you today if the discount rate is 4%? Round to the nearest cent. Numeric

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts