Question: just answer is fine no process 1. 2. 3. Suppose you are considering a project that will generate quarterly cash flows of $500 at the

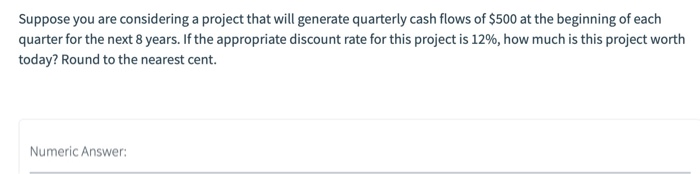

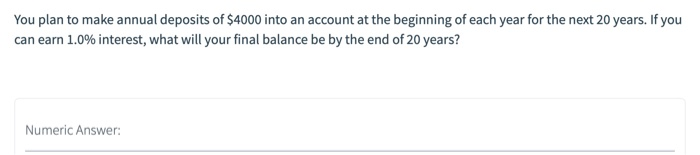

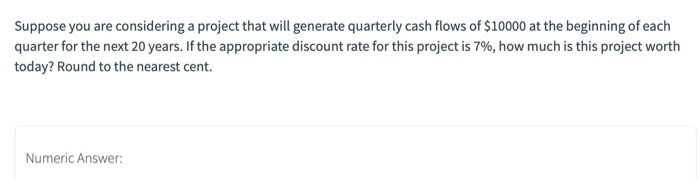

Suppose you are considering a project that will generate quarterly cash flows of $500 at the beginning of each quarter for the next 8 years. If the appropriate discount rate for this project is 12%, how much is this project worth today? Round to the nearest cent. Numeric Answer: You plan to make annual deposits of $4000 into an account at the beginning of each year for the next 20 years. If you can earn 1.0% interest, what will your final balance be by the end of 20 years? Numeric Answer: Suppose you are considering a project that will generate quarterly cash flows of $10000 at the beginning of each quarter for the next 20 years. If the appropriate discount rate for this project is 7%, how much is this project worth today? Round to the nearest cent. Numeric

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts