Question: Just answer needed A company issues a callable (at par) ten-year, 6% coupon bond with annual coupon payments. The bond can be called at par

Just answer needed

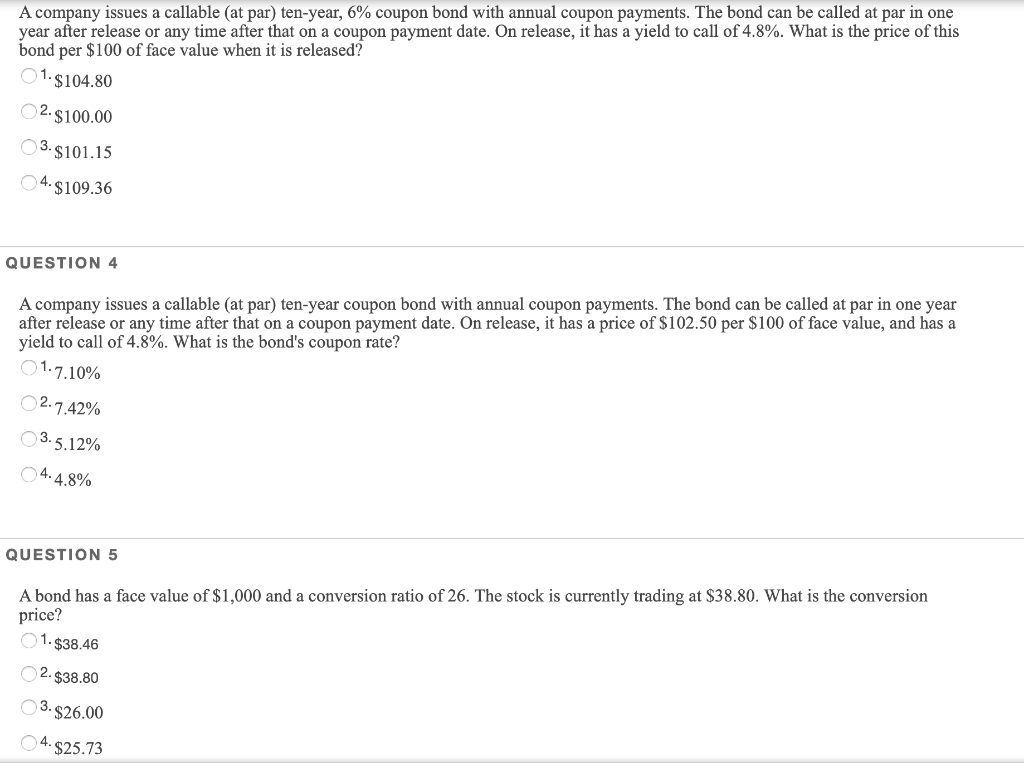

A company issues a callable (at par) ten-year, 6% coupon bond with annual coupon payments. The bond can be called at par in one year after release or any time after that on a coupon payment date. On release, it has a yield to call of 4.8%. What is the price of this bond per $100 of face value when it is released? 1.$104.80 2.$100.00 3.$101.15 4.$109.36 QUESTION 4 A company issues a callable (at par) ten-year coupon bond with annual coupon payments. The bond can be called at par in one year after release or any time after that on a coupon payment date. On release, it has a price of $102.50 per $100 of face value, and has a yield to call of 4.8%. What is the bond's coupon rate? 01.7.10% 2.7.42% 3.5.12% 4.4.8% QUESTION 5 A bond has a face value of $1,000 and a conversion ratio of 26. The stock is currently trading at $38.80. What is the conversion price? 01.$38.46 2. $38.80 3. $26.00 4. $25.73

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts