Question: Just Answer Part B Question Question 3 (25 points) Part A An all-equity firm, Poly Inc., is considering the following projects: Beta 0.2 0.5 Proposed

Just Answer Part B Question

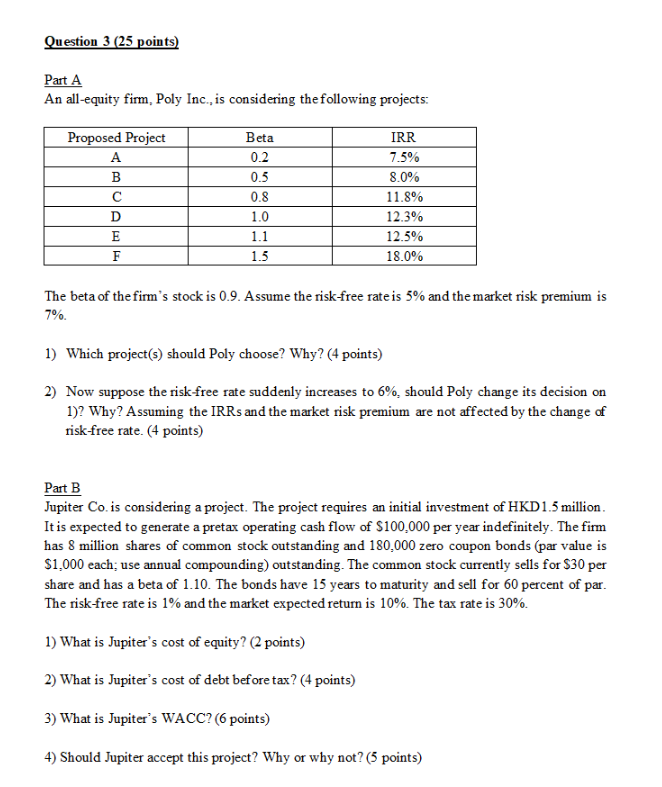

Question 3 (25 points) Part A An all-equity firm, Poly Inc., is considering the following projects: Beta 0.2 0.5 Proposed Project A B D E F 0.8 IRR 7.5% 8.0% 11.8% 12.3% 12.5% 18.0% 1.0 1.1 1.5 The beta of the firm's stock is 0.9. Assume the risk-free rate is 5% and the market risk premium is 7% 1) Which project(s) should Poly choose? Why? (4 points) 2) Now suppose the risk-free rate suddenly increases to 6%, should Poly change its decision on 1). Why? Assuming the IRRs and the market risk premium are not affected by the change of risk-free rate. (4 points) Part B Jupiter Co. is considering a project. The project requires an initial investment of HKD1.5 million. It is expected to generate a pretax operating cash flow of $100.000 per year indefinitely. The fimm has 8 million shares of common stock outstanding and 180.000 zero coupon bonds (par value is $1,000 each: use annual compounding) outstanding. The common stock currently sells for $30 per share and has a beta of 1.10. The bonds have 15 years to maturity and sell for 60 percent of par. The risk-free rate is 1% and the market expected return is 10%. The tax rate is 30%. 1) What is Jupiter's cost of equity? (2 points) 2) What is Jupiter's cost of debt before tax? (4 points) 3) What is Jupiter's WACC? (6 points) 4) Should Jupiter accept this project? Why or why not? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts