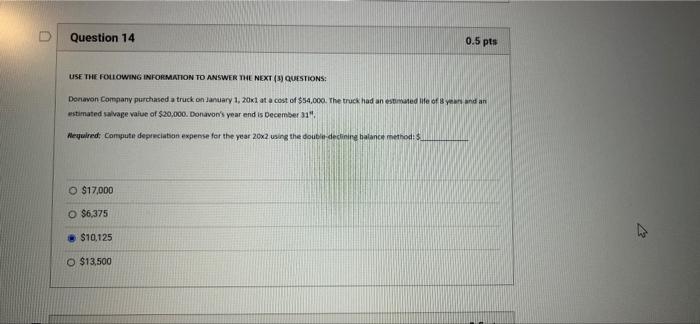

Question: Just answer Q16 ASAP Question 14 0.5 pts USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (9) QUESTIONS: Donavon Company purchased a truck on January

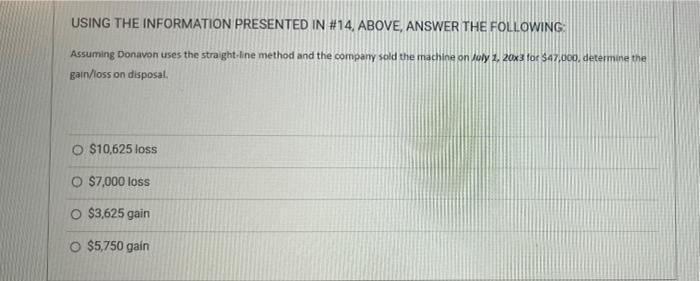

Question 14 0.5 pts USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (9) QUESTIONS: Donavon Company purchased a truck on January 1, 2011 at a cost of $54,000. The truck had an estimated life of yandan estimated salvage value of $20,000. Donavan's year and is December 31 Hequired; Compute depreciation expense for the year 20x2 using the double-declining balance method: O $17,000 O $6,375 $10,125 O $13.500 USING THE INFORMATION PRESENTED IN #14. ABOVE, ANSWER THE FOLLOWING: Assuming Donavon uses the straight-line method and the company sold the machine on Joly 2, 20x3 for $47.000, determine the gain/loss on disposal O $10,625 loss O $7,000 loss O $3,625 gain O $5,750 gain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts