Question: JUST ANSWER THE DROP DOWN DROP DOWNS 1. Liabilities, properties , assets 2. Latest outstanding loan balance, loan balance plus any current Interest due, principal

JUST ANSWER THE DROP DOWN

DROP DOWNS

1. Liabilities, properties , assets

2. Latest outstanding loan balance, loan balance plus any current Interest due, principal borrowed

3. first one is -total, Initial, current second one-is a long-term principal and any Interest due, was Originally borrowed, is split between current and longterm on the balance sheet

4. total principal and interest not yet paid , current portion (e.g monthly payment) due on the loan, loan's principal

5. Financial security, Solvency, net worth

6. Financial security, Equity, Solvency

7.Proceeding g to bankruptcy, In need of assets , Insolvency

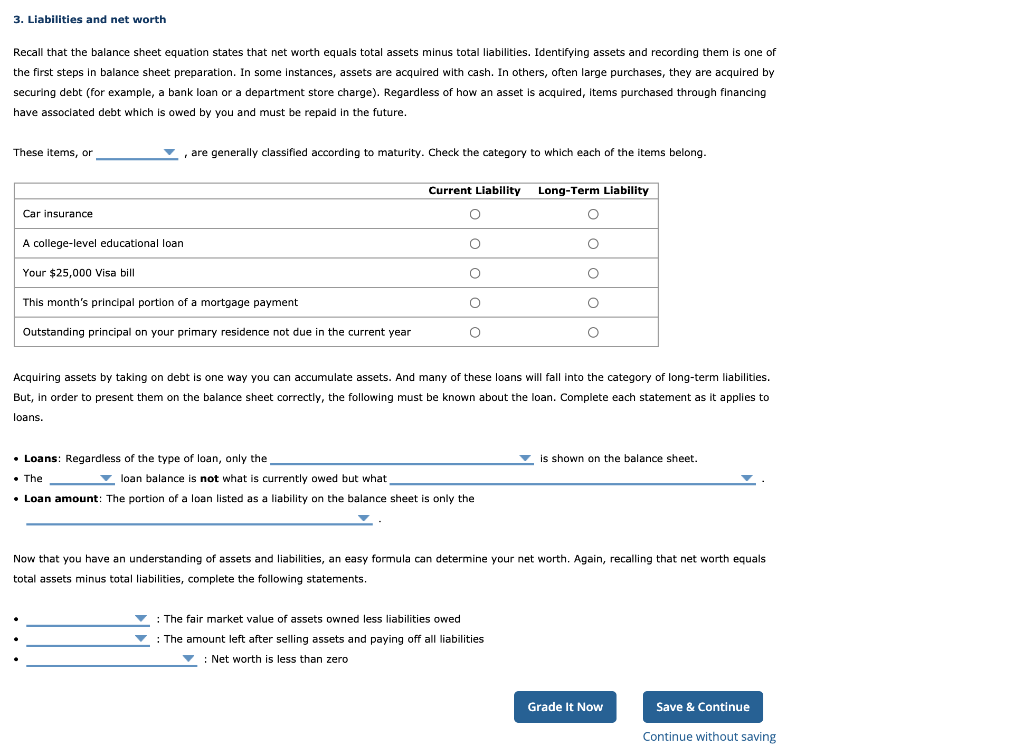

3. Liabilities and net worth Recall that the balance sheet equation states that net worth equals total assets minus total liabilities. Identifying assets and recording them is one of the first steps in balance sheet preparation. In some instances, assets are acquired with cash. In others, often large purchases, they are acquired by securing debt (for example, a bank loan or a department store charge). Regardless of how an asset is acquired, items purchased through financing have associated debt which is owed by you and must be repaid in the future. These items, or are generally classified according to maturity. Check the category to which each of the items belong. Current Liability Long-Term Liability Car insurance O A college-level educational loan O Your $25,000 Visa bill 0 O This month's principal portion of a mortgage payment 0 0 Outstanding principal on your primary residence not due in the current year 0 O Acquiring assets by taking on debt is one way you can accumulate assets. And many of these loans will fall into the category of long-term liabilities. But, in order to present them on the balance sheet correctly, the following must be known about the loan. Complete each statement as it applies to loans. is shown on the balance sheet. Loans: Regardless of the type of loan, only the . The loan balance is not what is currently owed but what Loan amount: The portion of a loan listed as a liability on the balance sheet only the Now that you have an understanding of assets and liabilities, an easy formula can determine your net worth. Again, recalling that net worth equals total assets minus total liabilities, complete the following statements, The fair market value of assets owned less liabilities owed : The amount left after selling assets and paying off all liabilities : Net worth is less than zero Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts