Question: Just c d e 5. A stock is priced at $30/share. The interest rate is 7%/year. A three-month European call option with a strike price

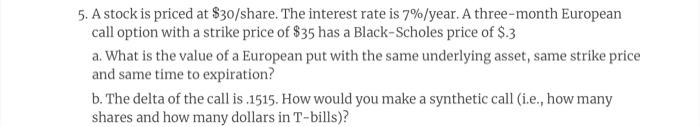

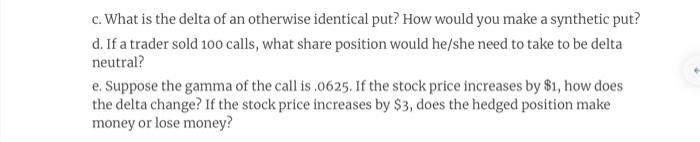

5. A stock is priced at $30/share. The interest rate is 7%/year. A three-month European call option with a strike price of $35 has a Black-Scholes price of $.3 a. What is the value of a European put with the same underlying asset, same strike price and same time to expiration? b. The delta of the call is 1515. How would you make a synthetic call (i.e., how many shares and how many dollars in T-bills)? c. What is the delta of an otherwise identical put? How would you make a synthetic put? d. If a trader sold 100 calls, what share position would he/she need to take to be delta neutral? e. Suppose the gamma of the call is .0625. If the stock price increases by $1, how does the delta change? If the stock price increases by $3, does the hedged position make money or lose money? 5. A stock is priced at $30/share. The interest rate is 7%/year. A three-month European call option with a strike price of $35 has a Black-Scholes price of $.3 a. What is the value of a European put with the same underlying asset, same strike price and same time to expiration? b. The delta of the call is 1515. How would you make a synthetic call (i.e., how many shares and how many dollars in T-bills)? c. What is the delta of an otherwise identical put? How would you make a synthetic put? d. If a trader sold 100 calls, what share position would he/she need to take to be delta neutral? e. Suppose the gamma of the call is .0625. If the stock price increases by $1, how does the delta change? If the stock price increases by $3, does the hedged position make money or lose money

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts