Question: just can't get the profit margin right, please help View Policies Show Attempt History Current Attempt in Progress Suppose in its income statement for the

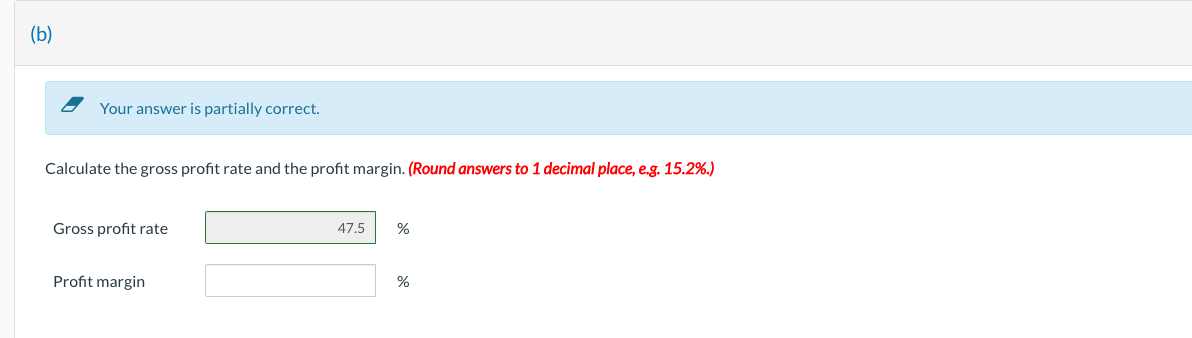

just can't get the profit margin right, please help

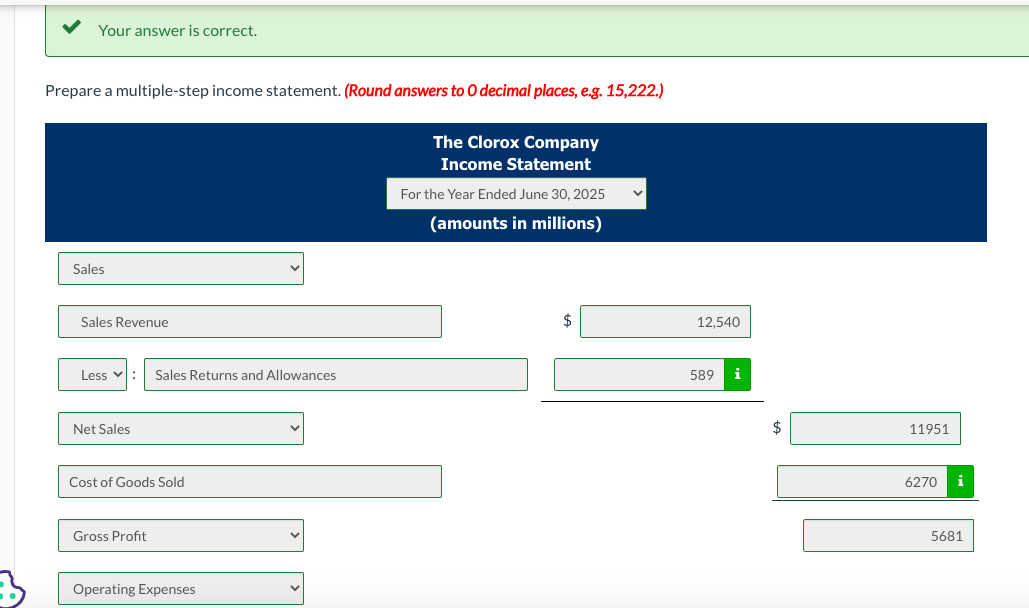

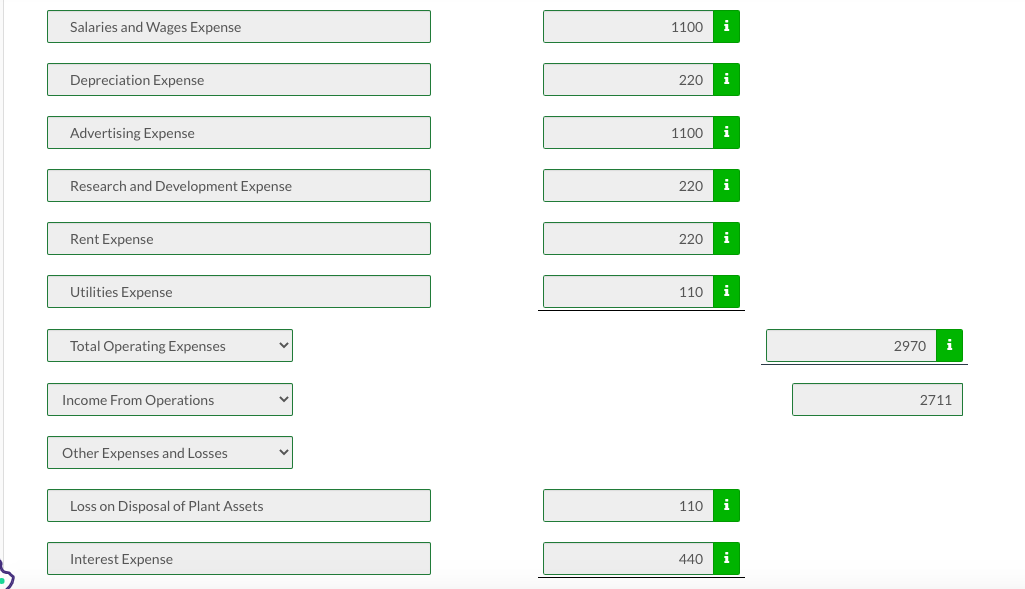

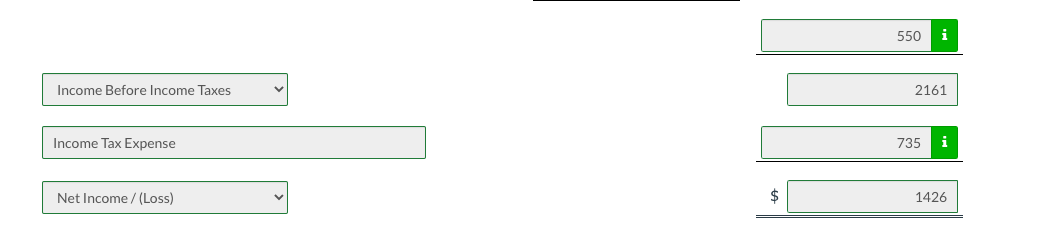

View Policies Show Attempt History Current Attempt in Progress Suppose in its income statement for the year ended June 30, 2025, The Clorox Company reported the following condensed data (dollars in millions). Assume a tax rate of 34%. Your answer is correct. Prepare a multiple-step income statement. (Round answers to 0 decimal places, e.g. 15,222.) Salaries and Wages Expense \begin{tabular}{|r|r|} \hline 1100 \\ \hline \end{tabular} Depreciation Expense \begin{tabular}{|l|l|} \hline 220 & i \\ \hline \end{tabular} Advertising Expense \begin{tabular}{|l|l|} \hline 1100 & i \\ \hline \end{tabular} Research and Development Expense \begin{tabular}{|l|l|} \hline 220 & i \\ \hline \end{tabular} Rent Expense Utilities Expense \begin{tabular}{|r|r|} \hline 220 & i \\ \hline 110 & i \\ \hline \end{tabular} Total Operating Expenses Loss on Disposal of Plant Assets \begin{tabular}{|l|l|} \hline 110 & i \\ \hline 440 & i \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline 550 \\ \hline \end{tabular} Income Before Income Taxes Income Tax Expense Net Income / (Loss) - Your answer is partially correct. Calculate the gross profit rate and the profit margin. (Round answers to 1 decimal place, e.g. 15.2\%.) Gross profit rate % Profit margin %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts