Question: just comment the answer Question 27 2 pts Lilly Dilly Delivery Service purchased a delivery van for $50,000 on 1/1/19. Lilly estimates that the van

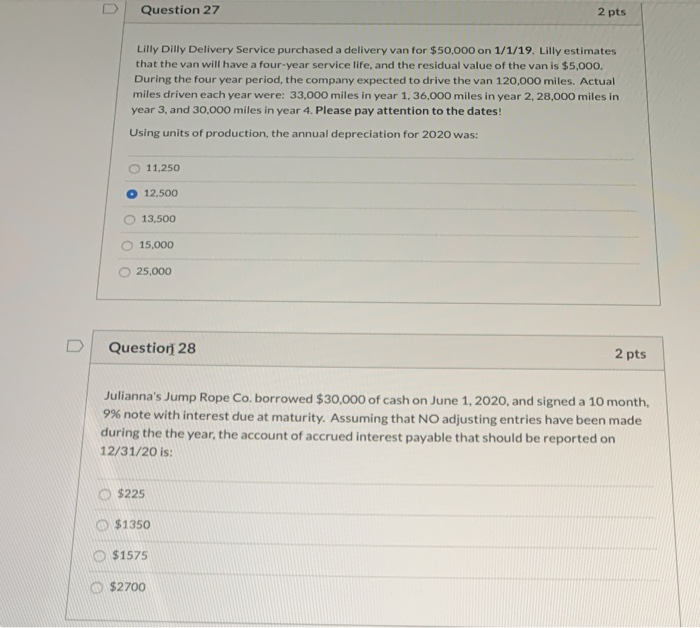

Question 27 2 pts Lilly Dilly Delivery Service purchased a delivery van for $50,000 on 1/1/19. Lilly estimates that the van will have a four-year service life, and the residual value of the van is $5,000. During the four year period, the company expected to drive the van 120,000 miles. Actual miles driven each year were: 33,000 miles in year 1, 36,000 miles in year 2, 28,000 miles in year 3, and 30,000 miles in year 4. Please pay attention to the dates! Using units of production, the annual depreciation for 2020 was: 11.250 12,500 13,500 15.000 25,000 Question 28 2 pts Julianna's Jump Rope Co. borrowed $30,000 of cash on June 1, 2020, and signed a 10 month, 9% note with interest due at maturity. Assuming that NO adjusting entries have been made during the the year, the account of accrued interest payable that should be reported on 12/31/20 is: $225 $1350 O $1575 $2700 The following questions require you to make calculations to determine the final answer. If you would like to receive partial credit for your answer, please show your work and upload it with the Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts