Question: just do #10 9. You are saving so that you can take your dream trip around the world in 5 years. To do so, you

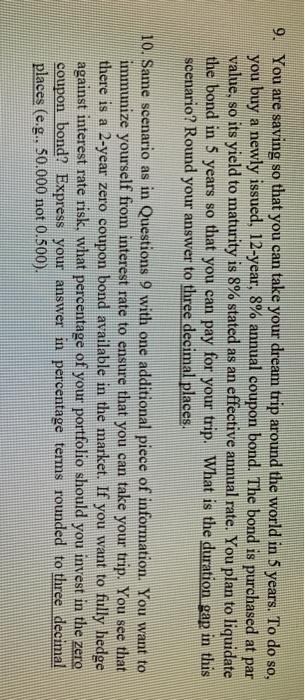

9. You are saving so that you can take your dream trip around the world in 5 years. To do so, you buy a newly issued, 12-year, 8% annual coupon bond. The bond is purchased at par value, so its yield to maturity is 8% stated as an effective annual rate. You plan to liquidate the bond in 5 years so that you can pay for your trip. What is the duration gap in this scenario? Round your answer to three decimal places. 10. Same scenario as in Questions 9 with one additional piece of information. You want to immunize yourself from interest rate to ensure that you can take your trip. You see that there is a 2-year zero coupon bond available in the market. If you want to fully hedge against interest rate risk, what percentage of your portfolio should you invest in the zero coupon bond? Express your answer in percentage terms rounded to three decimal places (e.g., 50.000 not 0.500)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts