Question: just E part krna ha Finance Task 01 The statements of financial position of Parifar Co. and Sarifar Co. as at 30 June 2022 are

just E part krna ha

just E part krna ha

Finance

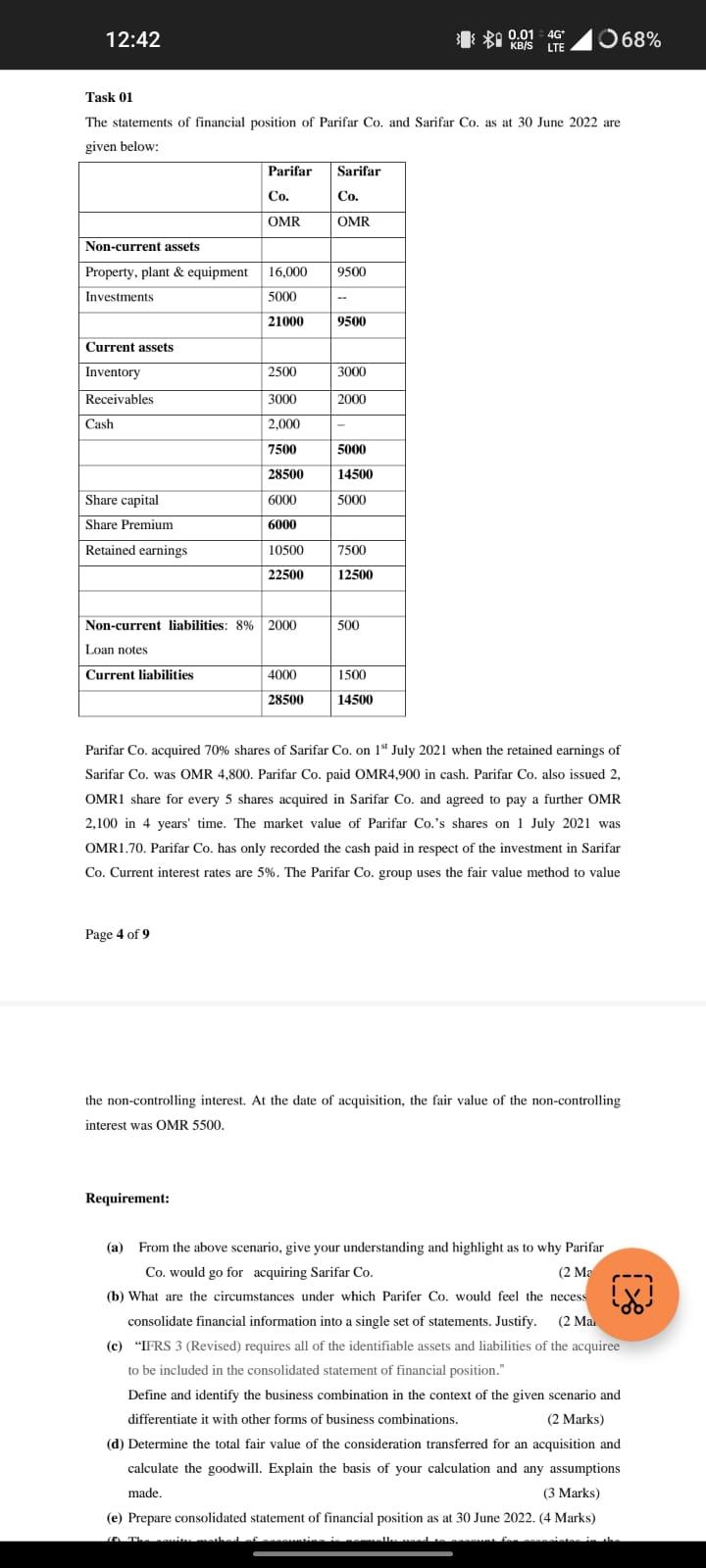

Task 01 The statements of financial position of Parifar Co. and Sarifar Co. as at 30 June 2022 are given below: Parifar Co. acquired 70% shares of Sarifar Co. on 1stJuly2021 when the retained earnings of Sarifar Co. was OMR 4,800. Parifar Co. paid OMR4,900 in cash. Parifar Co. also issued 2, OMR1 share for every 5 shares acquired in Sarifar Co. and agreed to pay a further OMR 2,100 in 4 years' time. The market value of Parifar Co.'s shares on 1 July 2021 was OMR1.70. Parifar Co. has only recorded the cash paid in respect of the investment in Sarifar Co. Current interest rates are 5%. The Parifar Co. group uses the fair value method to value Page 4 of 9 the non-controlling interest. At the date of acquisition, the fair value of the non-controlling interest was OMR 5500. Requirement: (a) From the above scenario, give your understanding and highlight as to why Par Co. would go for acquiring Sarifar Co. (2N (b) What are the circumstances under which Parifer Co. would feel the neces: consolidate financial information into a single set of statements. Justify. (2 N (c) "IFRS 3 (Revised) requires all of the identifiable assets and liabilities of the ac. to be included in the consolidated statement of financial position." Define and identify the business combination in the context of the given scenario and differentiate it with other forms of business combinations. (2 Marks) (d) Determine the total fair value of the consideration transferred for an acquisition and calculate the goodwill. Explain the basis of your calculation and any assumptions made. (3 Marks) (e) Prepare consolidated statement of financial position as at 30 June 2022. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts