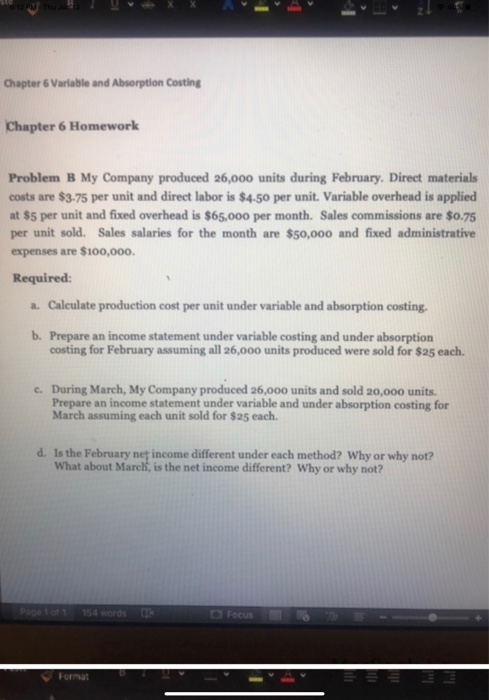

Question: Just follow spreadsheet format Chapter 6 Varlable and Absorption Costing jChapter 6 Homework Problem B My Company produced 26,000 units during February. Direct materials costs

Just follow spreadsheet format

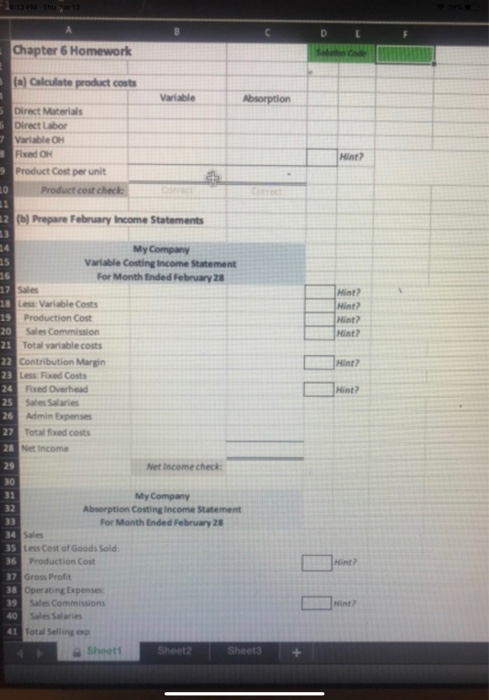

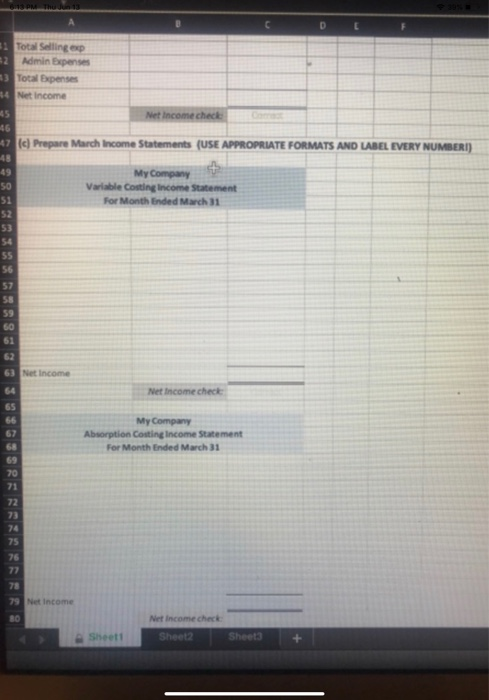

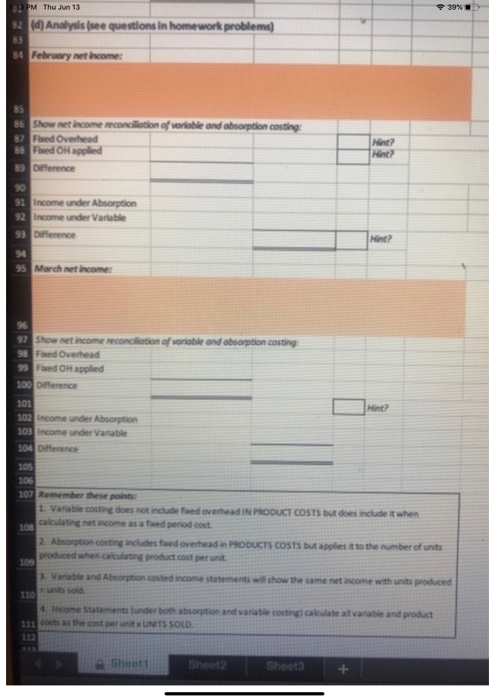

Just follow spreadsheet formatChapter 6 Varlable and Absorption Costing jChapter 6 Homework Problem B My Company produced 26,000 units during February. Direct materials costs are $3.75 per unit and direct labor is $4.50 per unit. Variable overhead is applied at $5 per unit and fixed overhead is $65,000 per month. Sales commissions are $o.75 per unit sold. Sales salaries for the month are $50,000 and fixed administrative expenses are $100,000. Required: Calculate production cost per unit under variable and absorption costing. a. b. Prepare an income statement under variable costing and under absorption costing for February assuming all 26,000 units produced were sold for $25 each. e. During March, My Company produced 26,000 units and sold 20,000 units. Prepare an income statement under variable and under absorption costing for March assuming each unit sold for $25 each. d. Is the February net income different under each method? Why or why not? What about March, is the net income different? Why or why not? Page 1 of 1 154 words Focus Format D Chapter 6 Homework Cod a) Calculate product costs Variable Absorption Direct Materials Direct Labor 7Variable OH Fixed OH Hint? 9 Product Cost per unit 10 Product cost check 11 2 (b) Prepare February Income Statements 13 14 My Company Variable Costing Income Statement For Month Ended February 28 15 16 17 Sales 18 Less Variable Costs Production Cost Hint? Hint? Hint? Hint? 19 Sales Commission 20 Total variable costs 21 22 Contribution Margin 23 Less Fixed Costs Hint? Fixed Overhead Hint? 24 25 Sales Salaries Admin Expenses 26 27 Total fxed costs 28 Net Income 29 Net Income check 30 31 My Company Absorption Costing Income Statement For Month Ended February 28 34 Sales 35 Less Cost of Goods Sold 36 Production Cost Hint? 37 Gross Profit 38 Operating Expenses Hint? 39 Sales Salaries 41 Total Selling exp Sales Commissions 40 Sheett Sheet2 Sheet3 D 1Total Selling exp Admin Expenses 12 3 Total Expenses 44 Net Income 45 46 47 (c) Prepare March Income Statements (USE APPROPRIATE FORMATS AND LABEL EVERY NUMBERI) 48 Net Income check 49 My Company Variable Costing Income Statement For Month Ended March 31 50 51 52 53 54 55 56 57 58 59 60 61 62 63 Net Income 64 Net Income check 65 66 My Company Absorption Costing Income Statement 67 68 For Month Ended March 31 69 70 71 72 73 74 75 76 77 78 79 Net Income 80 Net Income check Sheett Sheet3 Sheet2 a3 PM Thu Jun 134 39%1 4) Analysis (see questions In homework problems) 84 February net Income 8 Show net income reconcilation of varioble and absorption costing 87 Fed Overhead 88 Fed OH applied Hint? Hint? 89 Difference 91 Income under Absorption 92 Income under Variable 93 Difference Hint? March net income: 97 Show net income reconcillation of variable and obsorption costing 98 Fxed Overhead 99 Fxed OH applied 100 Difference 101 Hint? 102 Income under Absorption 103 Income under Variable 104 Difference 105 106 107 Remember these points 1 Varable costing does not include fed overhead IN PRODUCT COSTS but does include it when cakulating net income as a faed period cost 108 2 Absorption costing includes fed overhead in PRODUCTS COSTS but applies it to the number of units produced when calculating product cost per unit 109 3 Variable and Absorption costed income statements will show the same net income with units produced 110unts sold 4 Income Statements funder both absorption and variable costingl calkulate allvarable and product 111 costs as the cost per unit x UNITS SOLD 112 Shoet Sheet2 Sheet3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts