Question: just give answer for all without explanations Tableau DA 6-4: Mini-Case, Perpetual: Income effects of Weighted average and FIFO LO8 ATV Co. began operations on

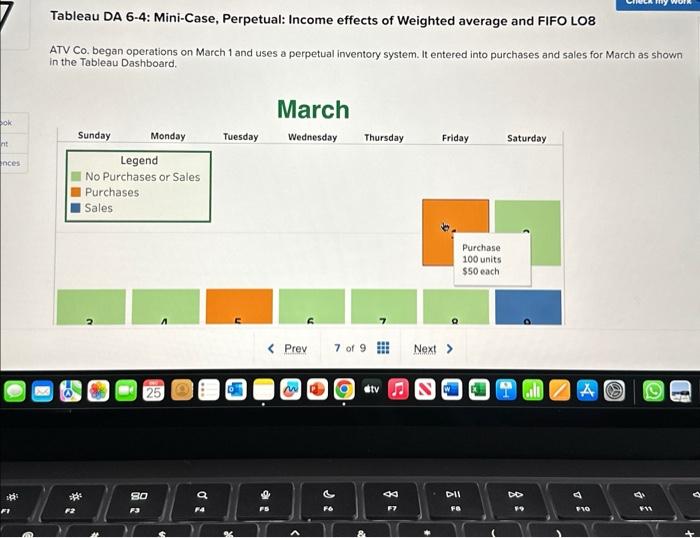

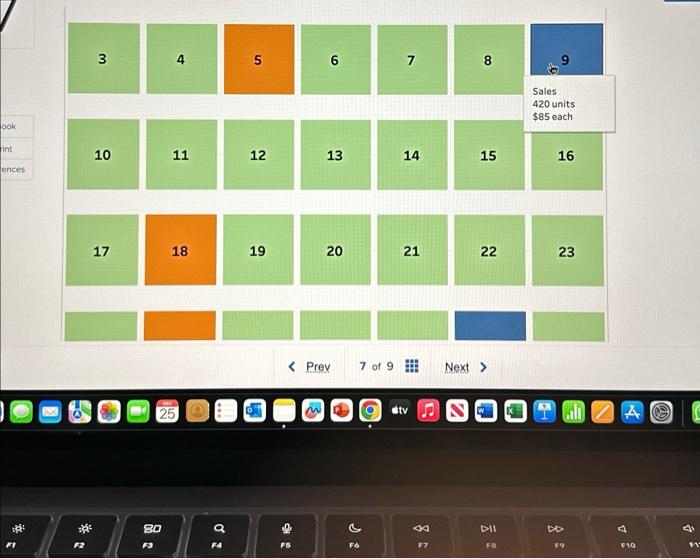

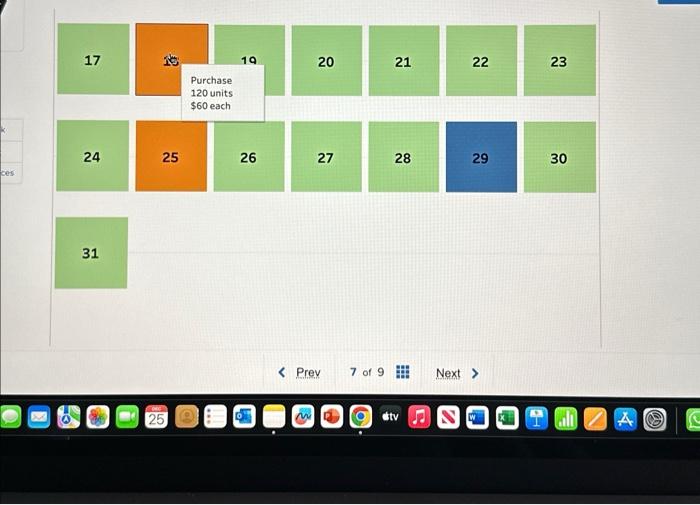

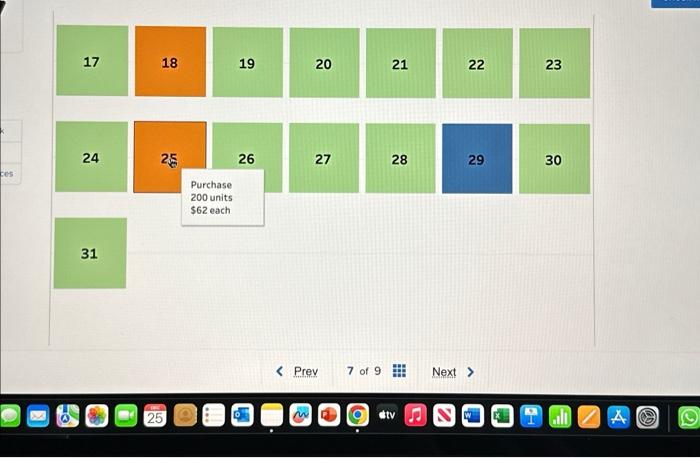

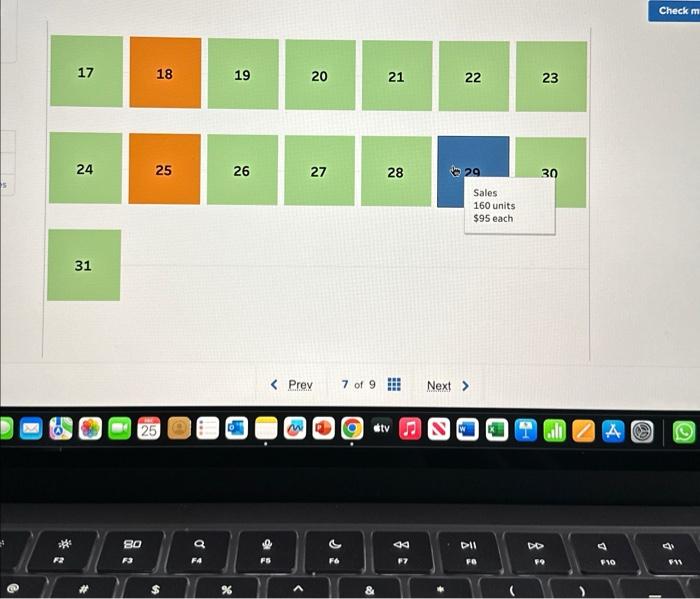

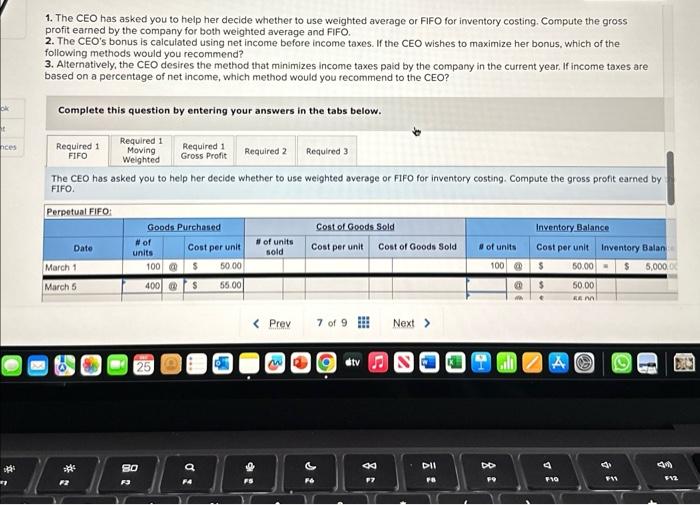

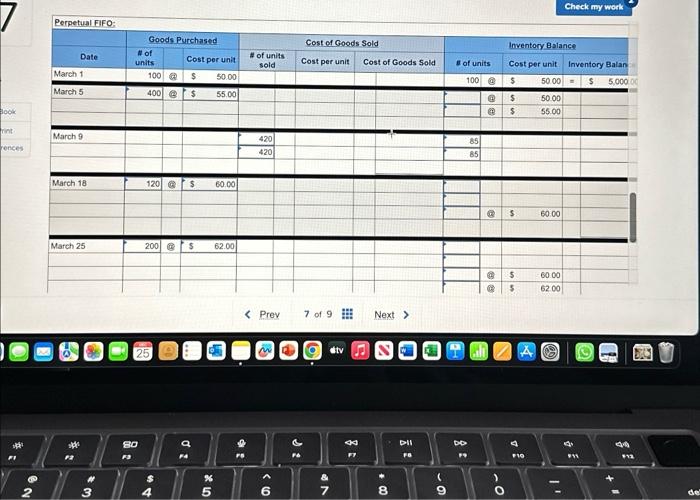

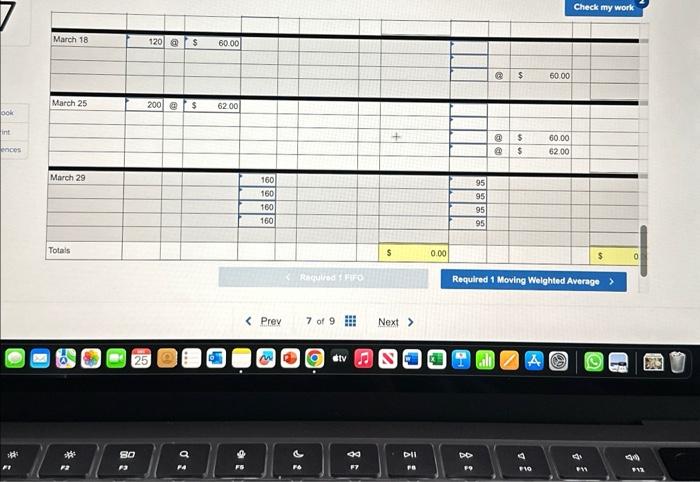

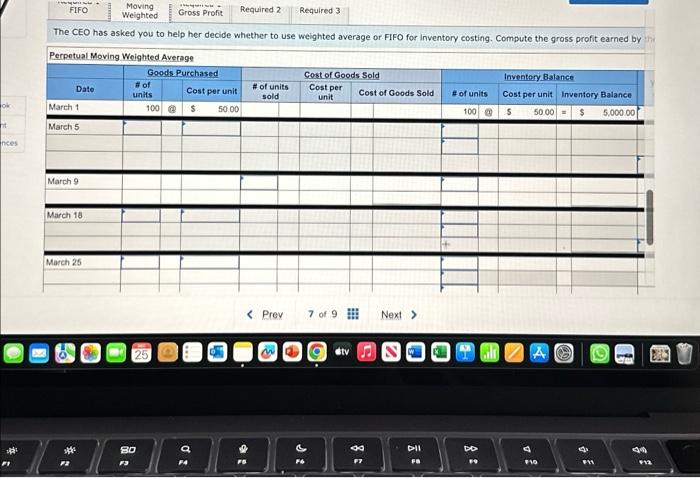

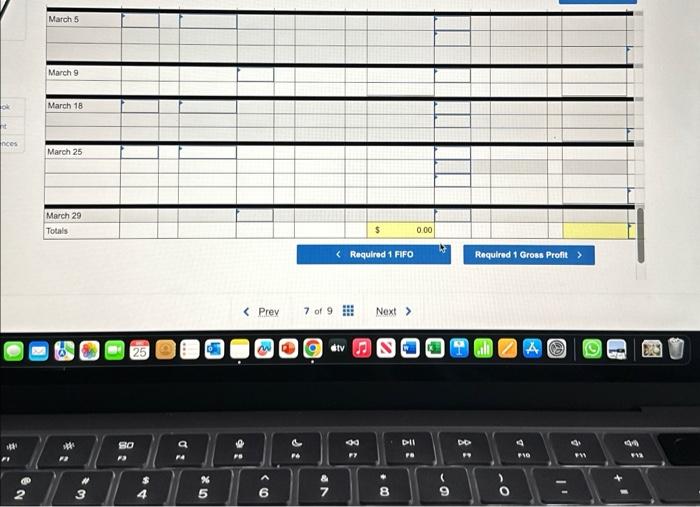

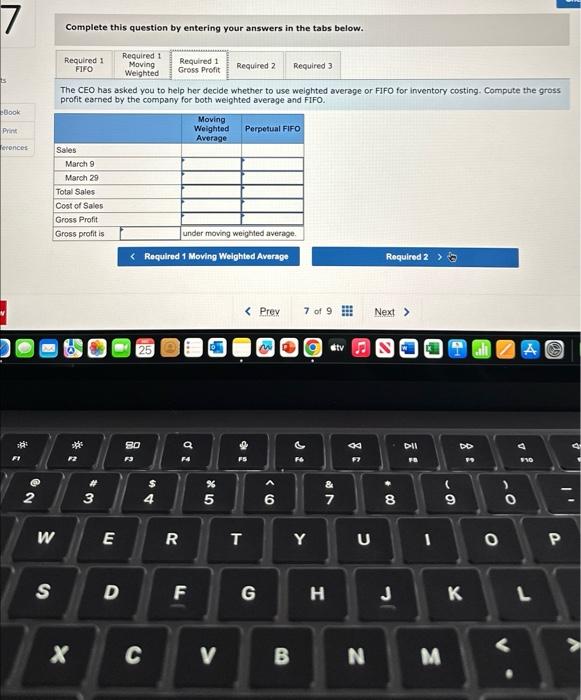

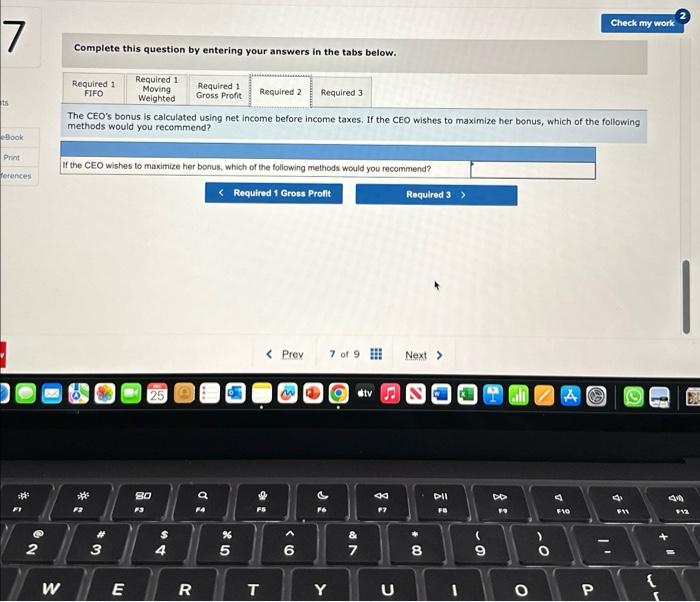

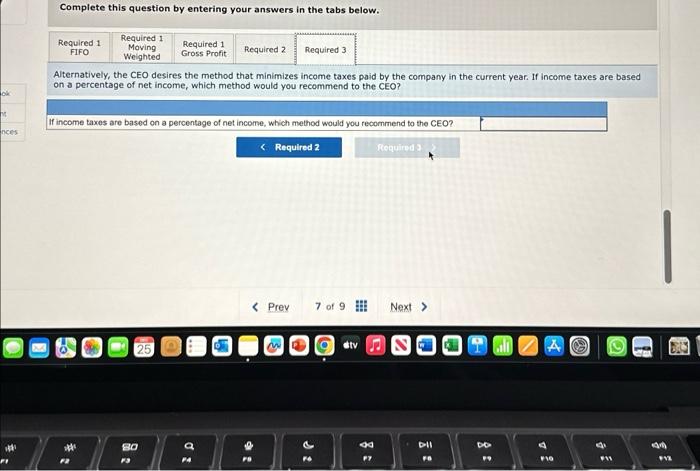

Tableau DA 6-4: Mini-Case, Perpetual: Income effects of Weighted average and FIFO LO8 ATV Co. began operations on March 1 and uses a perpetual inventory system. It entered into purchases and sales for March as shown in the Tableau Dashboard. 31 Prev 7 of 9 Next Check m 1. The CEO has asked you to help her decide whether to use weighted average or FIFO for inventory costing. Compute the gross profit earned by the company for both weighted average and FIFO. 2. The CEO's bonus is calculated using net income before income taxes. If the CEO wishes to maximize her bonus, which of the following methods would you recommend? 3. Alternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are based on a percentage of net income, which method would you recommend to the CEO? Complete this question by entering your answers in the tabs below. The CEO has asked you to help her decide whether to use weighted average or flFo for inventory costing. Compute the gross profic earned by FIFO. Pernetieal Ficn- Check my work Rnculiod : Hire Required 1 Moving Welghted Average Prev 7 of 9 Next Complete this question by entering your answers in the tabs below. The CEO has asked you to help her decide whether to use weighted average or FIFO for inventory costing. Compute the gross profit earned by the company for both weighted average and FIFO. Complete this question by entering your answers in the tabs below. The CEO's bonus is calculated using net income before income taxes, If the CEO wishes to maximize her bonus, which of the methods would you recommend? Complete this question by entering your answers in the tabs below. Iternatively, the CEO desires the method that minimizes income taxes paid by the company in the current year. If income taxes are ba: n a percentage of net income, which method would you recommend to the CEO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts