Question: just handwritten answer will be acceptable TM and SJ, having capital balances of P980,000 and P525,000 respectively, decided to admit GD into the partnership. If

just handwritten answer will be acceptable

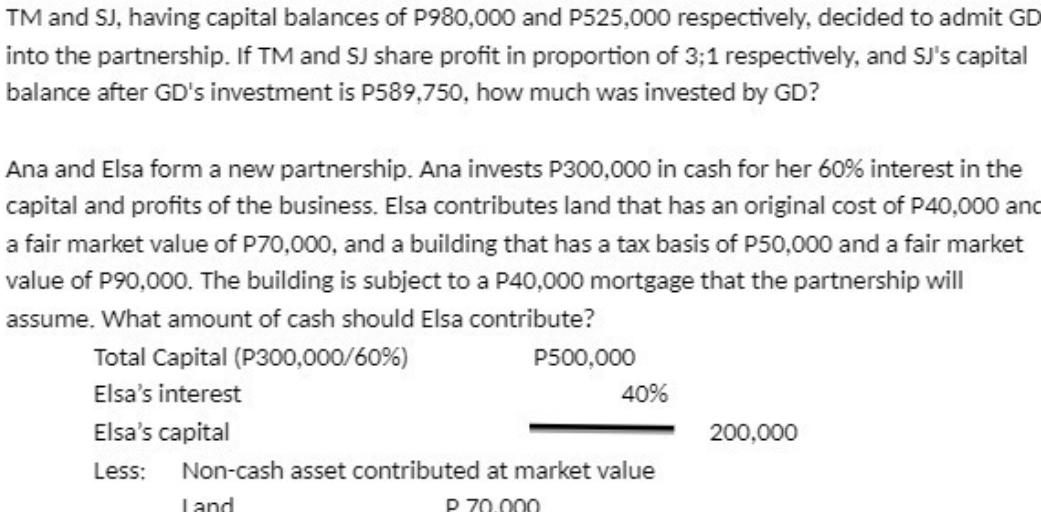

TM and SJ, having capital balances of P980,000 and P525,000 respectively, decided to admit GD into the partnership. If TM and SJ share profit in proportion of 3;1 respectively, and SJ's capital balance after GD's investment is P589,750, how much was invested by GD? Ana and Elsa form a new partnership. Ana invests P300,000 in cash for her 60% interest in the capital and profits of the business. Elsa contributes land that has an original cost of P40,000 and a fair market value of P70,000, and a building that has a tax basis of P50,000 and a fair market value of P90,000. The building is subject to a P40,000 mortgage that the partnership will assume. What amount of cash should Elsa contribute? Total Capital (P300,000/60%) P500,000 Elsa's interest 40% Elsa's capital 200,000 Less: Non-cash asset contributed at market value P 70.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts