Question: Just I need answer for A,B,C or D No need for explanation q1. q2. i don't understand what you want ? The following case study

Just I need answer for A,B,C or D No need for explanation

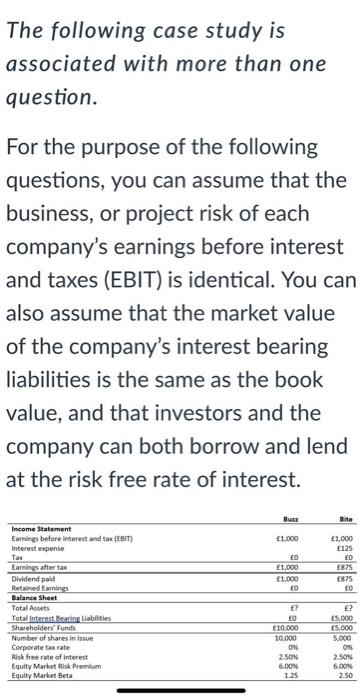

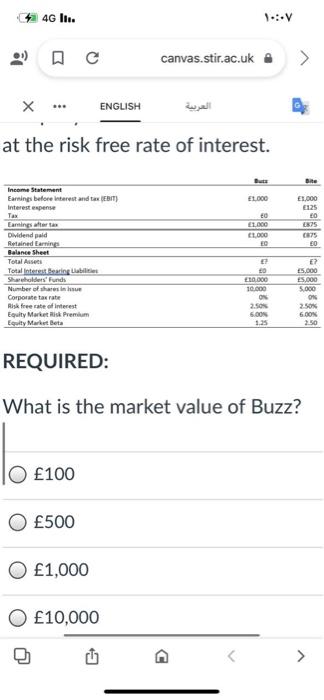

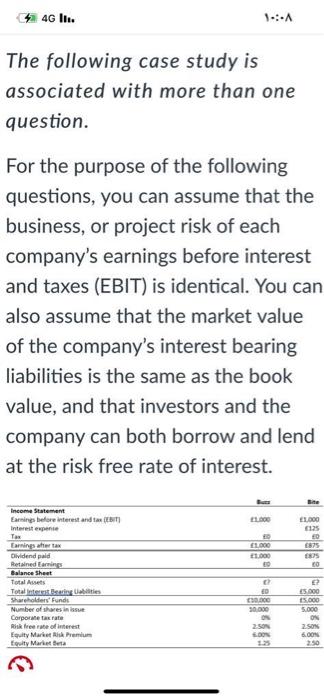

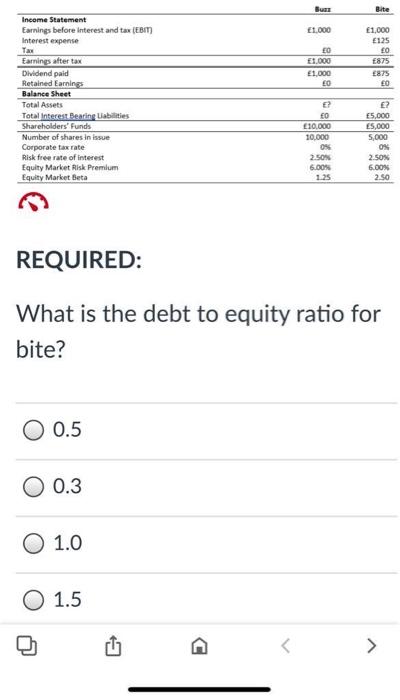

The following case study is associated with more than one question. For the purpose of the following questions, you can assume that the business, or project risk of each company's earnings before interest and taxes (EBIT) is identical. You can also assume that the market value of the company's interest bearing liabilities is the same as the book value, and that investors and the company can both borrow and lend at the risk free rate of interest. But Bite 1,000 ED 1.000 1,000 LO E1.000 125 ED 1875 875 to Income Statement Earnings before interest and tax (EBIT) Interest expense Earnings after tax Dividend paid Retained Earnings Balance Sheet Total Assets Total Interest Bearing Liabilities Shareholders Funds Number of shares in issue Corporate tax rate Risk free rate of interest Equity Market Risk Premium Equity Market Beta 6? LO 10,000 10,000 ON 2.50% 6.00% 1.25 ? 5.000 5.000 5.000 ON 2.50N 6.00 2.50 4G lt. : canvas.stir.ac.uk X ENGLISH at the risk free rate of interest. Bite EL000 E1.000 E125 LO ED ELDO 1.000 EC 875 20 Income Statement Earnings before interest and tax EBIT) Interest pense Earnings for Dividend paid Retained Earning Balance Sheet Total Assets Total Interest being abilities Shareholders Funds Number of shares in Corporate tax rate Risk free rate of interest Equity Market Risk Premium Equity Market Beta 10.000 10.000 ON E? 15.000 5.000 5.000 ON 2.50% 6.00 250 5.00 1.25 REQUIRED: What is the market value of Buzz? 100 500 1,000 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts