Question: just looking for help and a walk through on it all sections of problem to make sure they are correct The general ledger of the

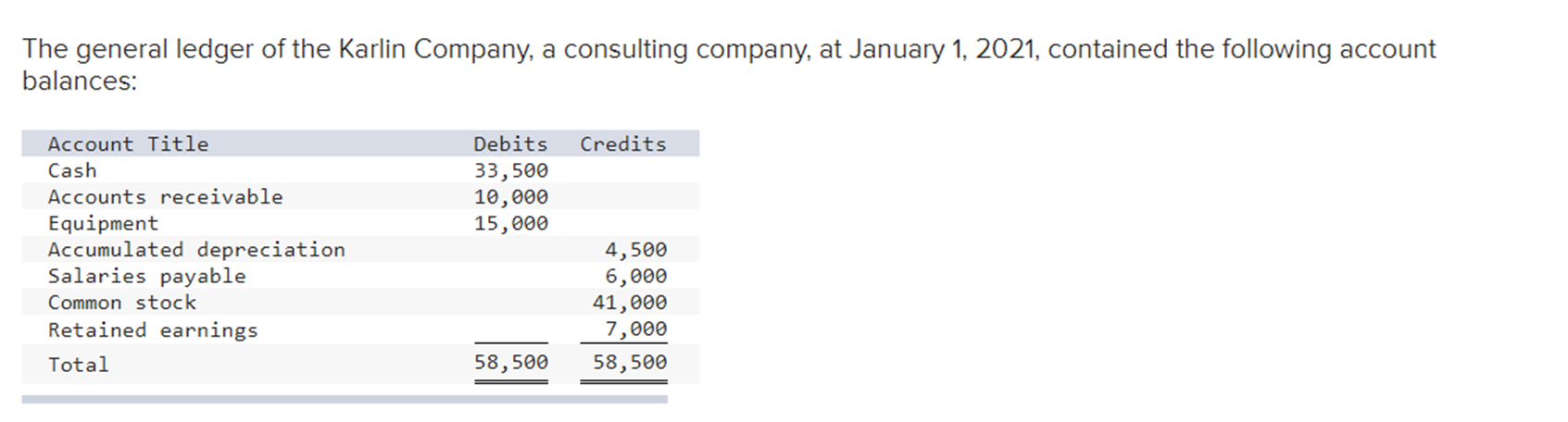

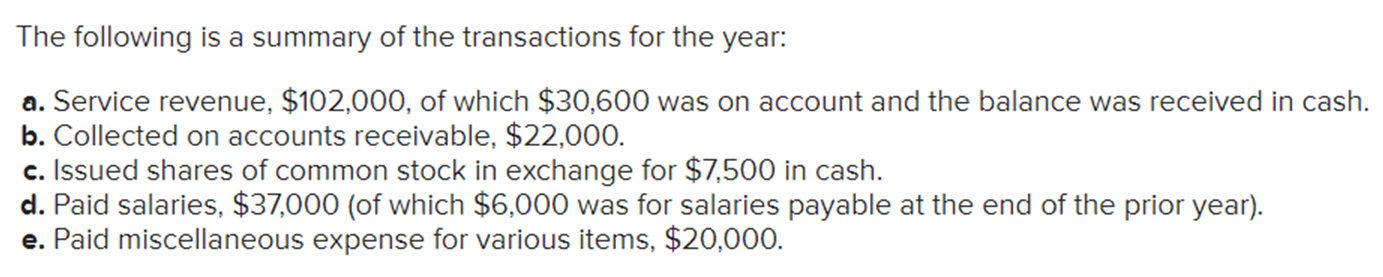

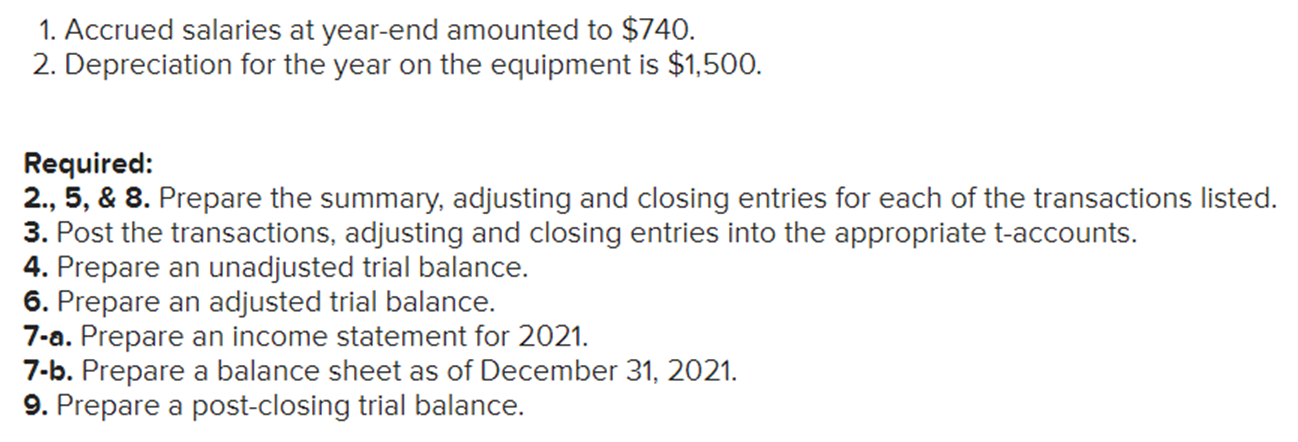

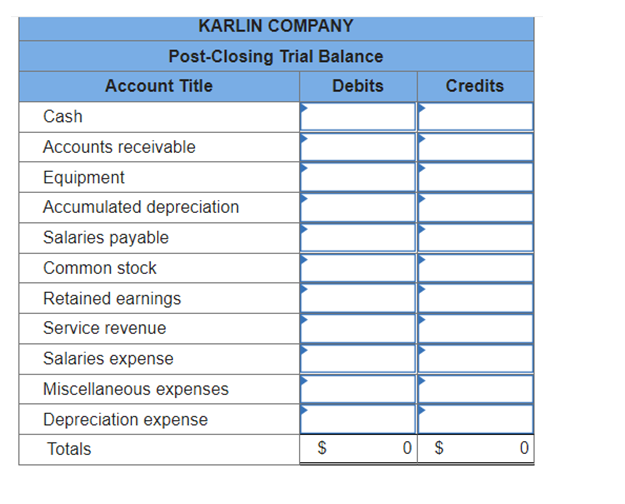

The general ledger of the Karlin Company, a consulting company, at January 1,2021 , contained the following account balances: The following is a summary of the transactions for the year: a. Service revenue, $102,000, of which $30,600 was on account and the balance was received in cash. b. Collected on accounts receivable, $22,000. c. Issued shares of common stock in exchange for $7,500 in cash. d. Paid salaries, $37,000 (of which $6,000 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $20,000. 1. Accrued salaries at year-end amounted to $740. 2. Depreciation for the year on the equipment is $1,500. Required: 2., 5, \& 8. Prepare the summary, adjusting and closing entries for each of the transactions listed. 3. Post the transactions, adjusting and closing entries into the appropriate t-accounts. 4. Prepare an unadjusted trial balance. 6. Prepare an adjusted trial balance. 7-a. Prepare an income statement for 2021. 7-b. Prepare a balance sheet as of December 31,2021. 9. Prepare a post-closing trial balance. \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ KARLIN COMPANY } & \multicolumn{1}{|c|}{ Post-Closing Trial Balance } \\ \hline \multicolumn{1}{|c|}{ Account Title } & & \\ \hline Cash & & \\ \hline Accounts receivable & & \\ \hline Equipment & & \\ \hline Accumulated depreciation & & \\ \hline Salaries payable & & \\ \hline Common stock & & \\ \hline Retained earnings & & \\ \hline Service revenue & & \\ \hline Salaries expense & & \\ \hline Miscellaneous expenses & & \\ \hline Depreciation expense & & \\ \hline Totals & $ \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts