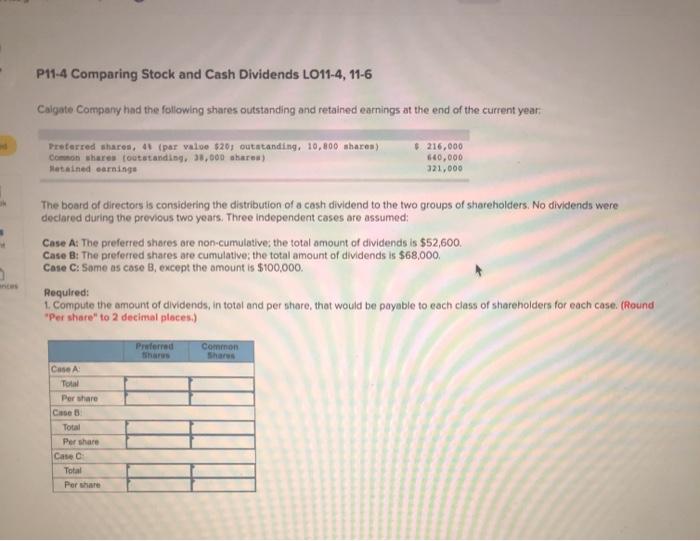

Question: just need 1 & 2 P11-4 Comparing Stock and Cash Dividends LO11-4, 11-6 Calgate Company had the following shares outstanding and retained earnings at the

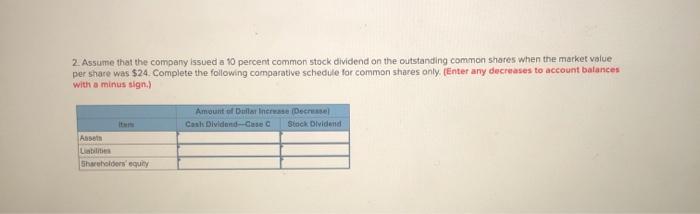

P11-4 Comparing Stock and Cash Dividends LO11-4, 11-6 Calgate Company had the following shares outstanding and retained earnings at the end of the current year Preferred sharon, 45 (par value $20outstanding, 10,800 shares) Common shares outstanding, 38,000 shares) Metained earning $216,000 640,000 321,000 The board of directors is considering the distribution of a cash dividend to the two groups of shareholders. No dividends were declared during the previous two years. Three Independent cases are assumed: Case A: The preferred shores are non-cumulative: the total amount of dividends is $52,600. Case B: The preferred shares are cumulative; the total amount of dividends is $68,000 Case C: Same as cose B, except the amount is $100,000. Required: 1. Compute the amount of dividends, in toto and per store, that would be payable to each class of shareholders for each case. (Round "Per share" to 2 decimal places.) Preferred Common Case Total Per share Case Total Per share Case 0 Total Por share 2. Assume that the company issued a 10 percent common stock dividend on the outstanding common shares when the market value per share was $24. Complete the following comparative schedule for common shares only. (Enter any decreases to account balances with a minus sign.) Amount of Built Increase (Decrease Carl Olvidondase Stock Dividend Asset Lab Shareholders equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts