Question: just need answer to #2 please! ABC and CVP Analysis: Multiple Products Good Scent, Inc., produces two colognes: Rose and Violet. Of the two, Rose

just need answer to #2 please!

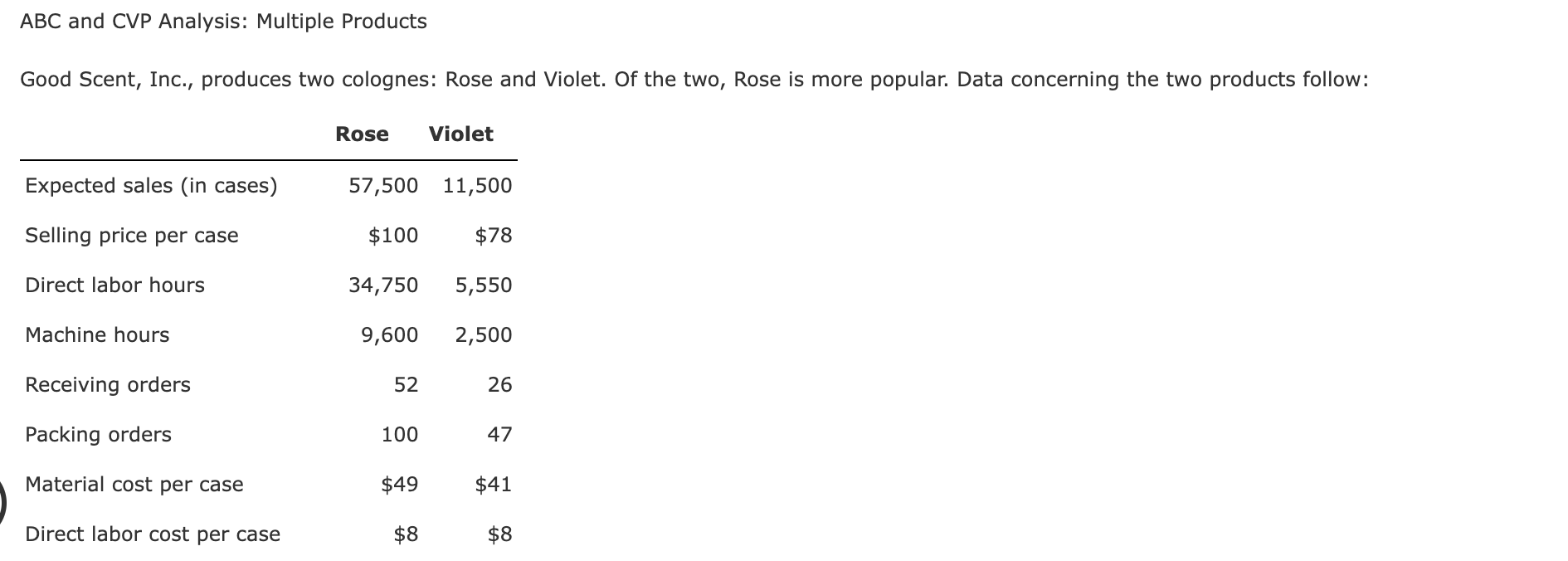

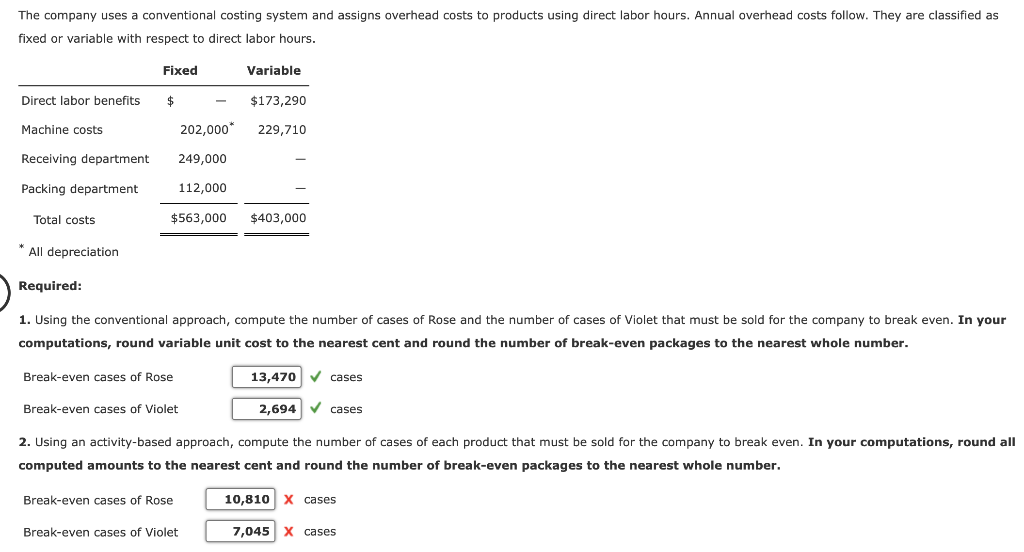

ABC and CVP Analysis: Multiple Products Good Scent, Inc., produces two colognes: Rose and Violet. Of the two, Rose is more popular. Data concerning the two products follow: Rose Violet Expected sales (in cases) 57,500 11,500 Selling price per case $100 $78 Direct labor hours 34,750 5,550 Machine hours 9,600 2,500 Receiving orders 52 26 Packing orders 100 47 Material cost per case $49 $41 Direct labor cost per case $8 $8 The company uses a conventional costing system and assigns overhead costs to products using direct labor hours. Annual overhead costs follow. They are classified as fixed or variable with respect to direct labor hours. Fixed Variable Direct labor benefits $ $173,290 Machine costs 202,000* 229,710 Receiving department 249,000 Packing department 112,000 Total costs $563,000 $403,000 * All depreciation Required: 1. Using the conventional approach, compute the number of cases of Rose and the number of cases of Violet that must be sold for the company to break even. In your computations, round variable unit cost to the nearest cent and round the number of break-even packages to the nearest whole number. Break-even cases of Rose 13,470 cases Break-even cases of Violet 2,694 cases 2. Using an activity-based approach, compute the number of cases of each product that must be sold for the company to break even. In your computations, round all computed amounts to the nearest cent and round the number of break-even packages to the nearest whole number. Break-even cases of Rose 10,810 X cases Break-even cases of Violet 7,045 X cases Feedback Check My Work 1. Remember to calculate package contribution margin per unit. 2. Benefits and Machine costs are unit based variable costs. The CVP formula will utilize three costs that utilize X1 (number of packages), X2 (receiving orders), and X3 (packing orders)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts