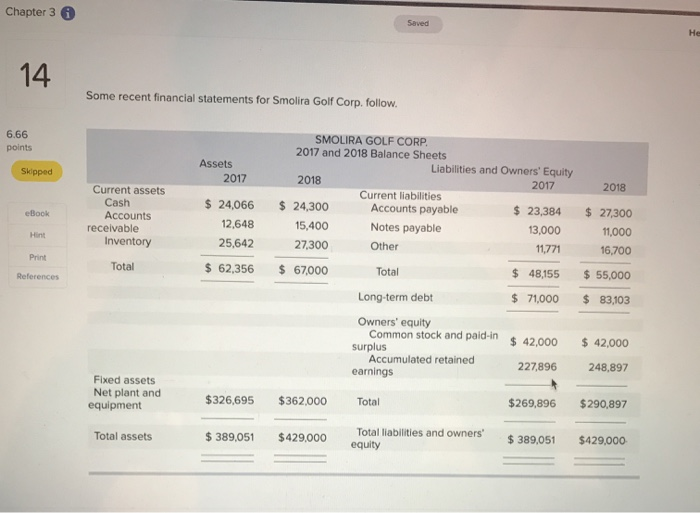

Question: just need correct answers please Chapter 3 He 14 Some recent financial statements for Smolira Golf Corp. follow 6.66 points Skipped Assets 2017 eBook Current

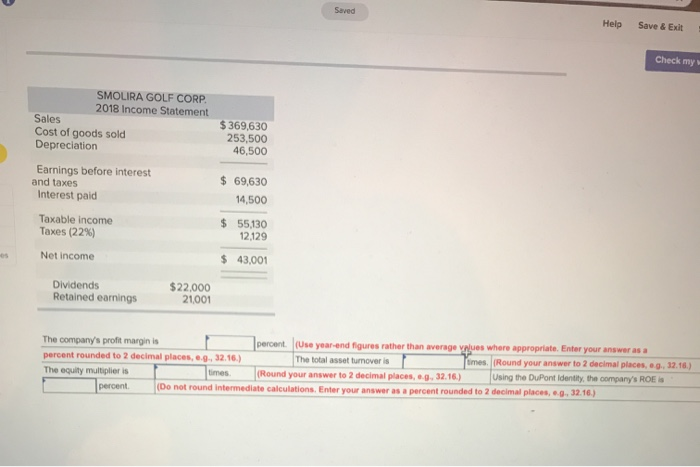

Chapter 3 He 14 Some recent financial statements for Smolira Golf Corp. follow 6.66 points Skipped Assets 2017 eBook Current assets Cash Accounts receivable Inventory Hint $ 24,066 12,648 25,642 $ 62,356 2018 $ 27,300 11,000 16,700 $ 55,000 $ 83,103 Print SMOLIRA GOLF CORP. 2017 and 2018 Balance Sheets Liabilities and Owners' Equity 2018 2017 Current liabilities $ 24,300 Accounts payable $ 23,384 15,400 Notes payable 13,000 27,300 Other 11,771 $ 67,000 Total $ 48,155 Long-term debt $ 71,000 Owners' equity Common stock and paid in $ 42.000 surplus Accumulated retained 227,896 earnings Total References $ 42,000 248,897 Fixed assets Net plant and equipment $326,695 $362,000 Total $269,896 $290,897 Total assets $ 389,051 $429,000 Total liabilities and owners' equity $ 389,051 $429,000 Saved Help Save & Exit Check my SMOLIRA GOLF CORP. 2018 Income Statement Sales Cost of goods sold Depreciation $369,630 253,500 46,500 Earnings before interest and taxes Interest paid $ 69,630 14,500 Taxable income Taxes (22%) $ 55,130 12.129 Net income $ 43,001 Dividends Retained earnings $22.000 21001 The company's profit marginis percent (Use year-end figures rather than average values where appropriate Enter your answer as a percent rounded to 2 decimal places, ... 32.16.) The total asset turnover is imes. (Round your answer to 2 decimal places, ... 32.16.) The equity multiplier is times. times. (Round your answer to 2 deci Round your answer to 2 decimal places, ... 32. 16.) Using the DuPont identity, the company's ROES percent. Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places g. 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts