Question: Just need help for (c) Thanks! Natalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure

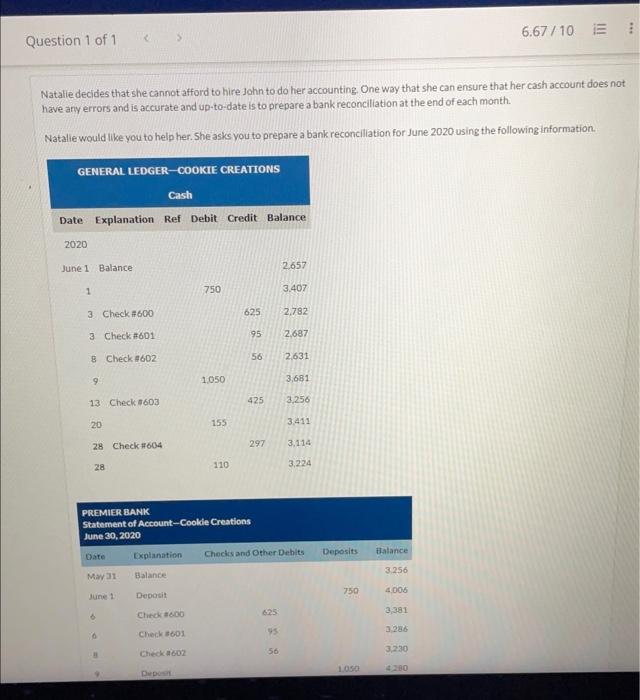

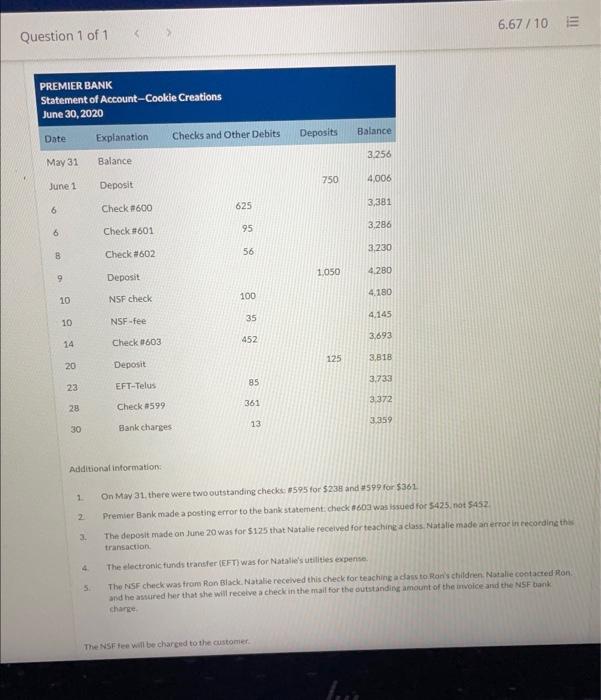

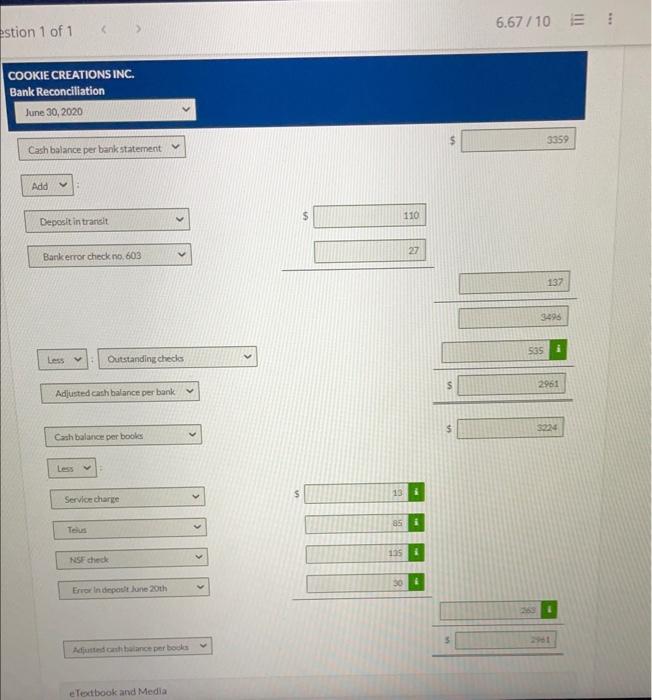

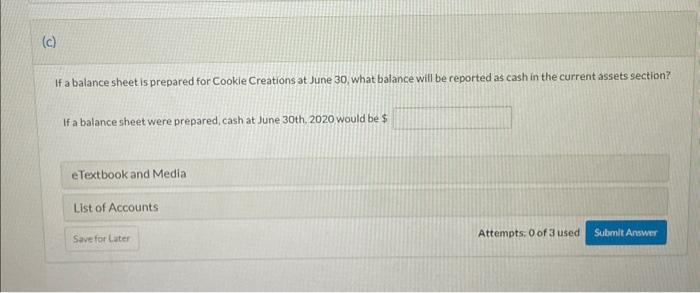

Natalie decides that she cannot afford to hire John to do her accounting. One way that she can ensure that her cash account does not have any errors and is accurate and up-to-date is to prepare a bank reconcillation at the end of each month. Natalie would like you to help her. She asks you to prepare a bank reconciliation for June 2020 using the following information. Additional information: 1. On Miny 31, there were two outstanding checks: 1595 for 5234 and $599 for 5361 2. Premier Bank made a posting error to the bank statement: check 7603 was issued for $425, not 5452. 3. The deposit made on June 20 was for $125 that Natalie received for teachine a class Natalle made ari erroe in recordinc thes transaction. 4. The electronic funds transfer(EFT) was for Natalle's utilities expense. 5. The NSF check was fram Ron Black. Natabie received this check tor teaching a class to Ron's children Natalie contacted Ron. asd he assured her that whe will recelve a check in the mail for the outstanding amount of the mivolice and the NSF bank charge. COOKIE CREATIONS INC. Bank Reconciliation June 30,2020 Cashbalance per bankstatement v Add v Gah balance per books eTectbook and Media If a balance sheet is prepared for Cookie Creations at June 30 , what balance will be reported as cash in the current assets section? If a balance sheet were prepared, cash at June 30th,2020 would be \$ eTextbook and Media List of Accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts