Question: Just need help on part a. What do they mean perform a DuPont analysis? Ratio analysis-comprehensive problem, 2017 data This problem is based on the

Just need help on part a.

What do they mean perform a DuPont analysis?

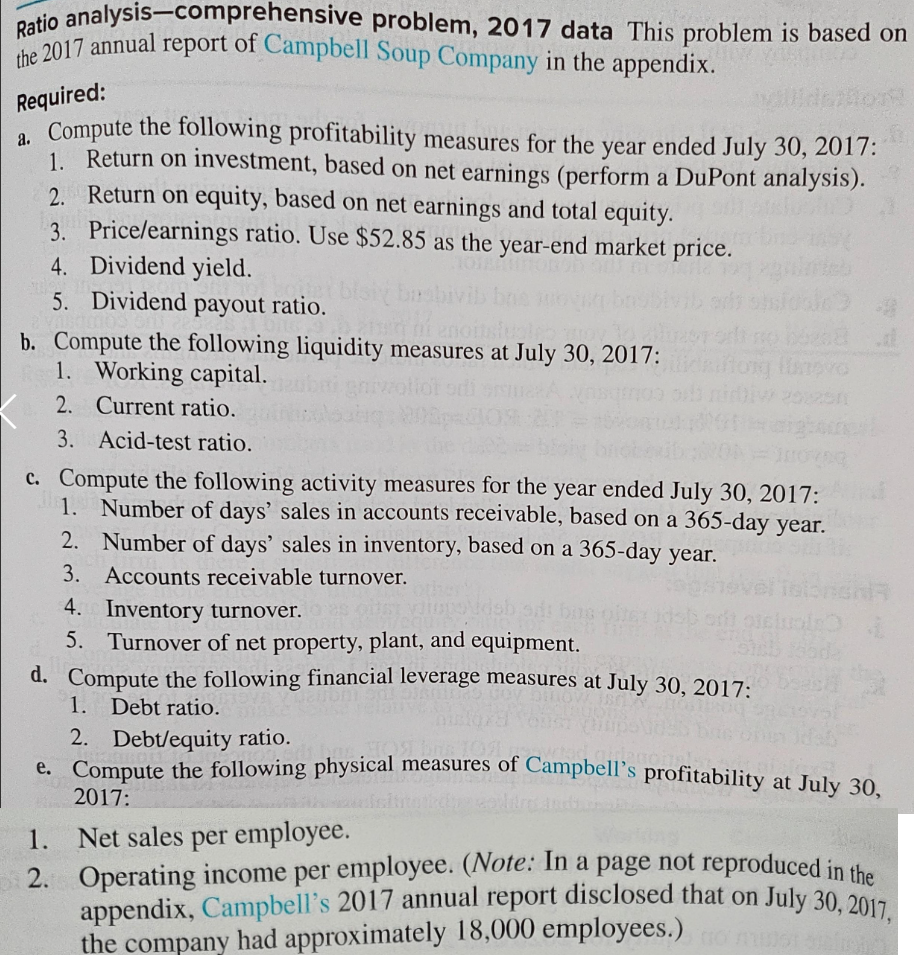

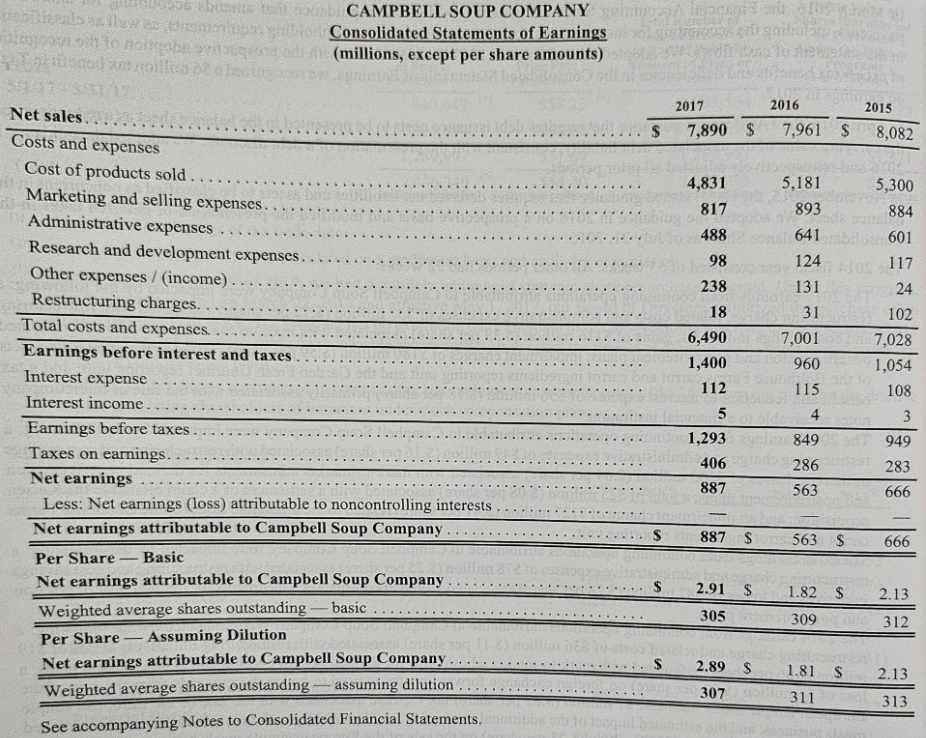

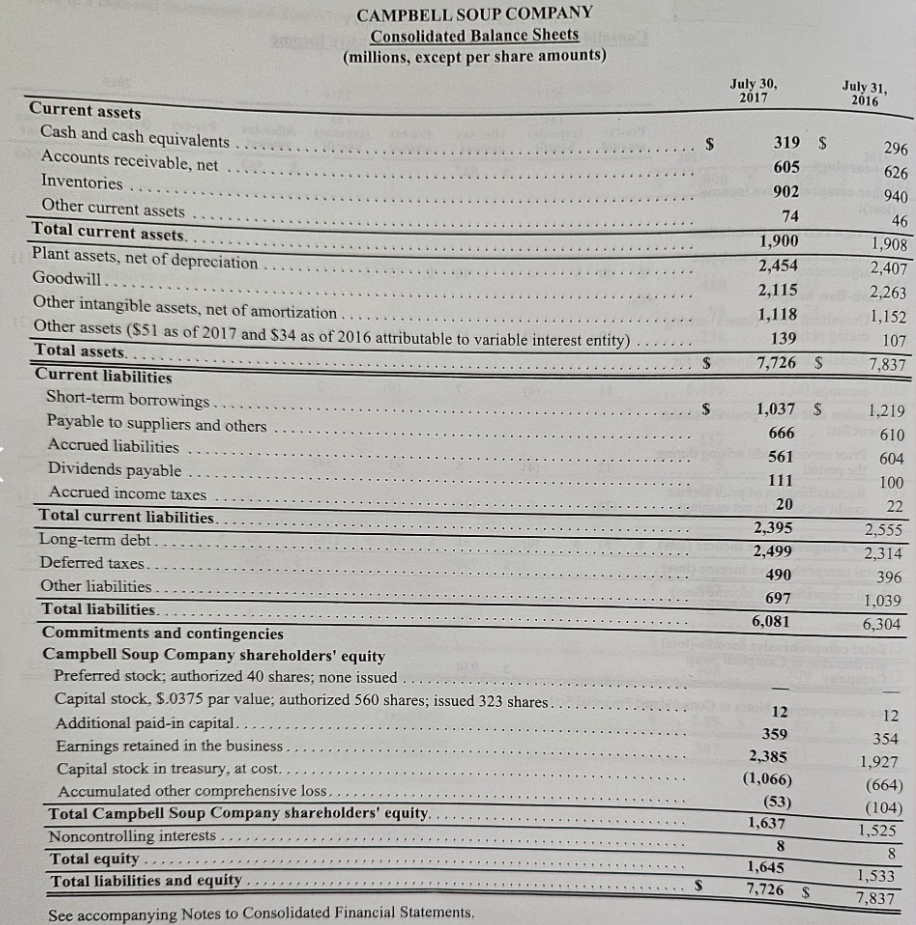

Ratio analysis-comprehensive problem, 2017 data This problem is based on the 2017 annual report of Campbell Soup Company in the appendix. Required: a. Compute the following profitability measures for the year ended July 30, 2017: 1. Return on investment, based on net earnings (perform a DuPont analysis). 2. Return on equity, based on net earnings and total equity. 3. Price/earnings ratio. Use $52.85 as the year-end market price. 4. Dividend yield. 5. Dividend payout ratio. b. Compute the following liquidity measures at July 30, 2017 : 1. Working capital. 2. Current ratio. 3. Acid-test ratio. c. Compute the following activity measures for the year ended July 30, 2017: 1. Number of days' sales in accounts receivable, based on a 365-day year. 2. Number of days' sales in inventory, based on a 365-day year. 3. Accounts receivable turnover. 4. Inventory turnover. 5. Turnover of net property, plant, and equipment. CAMPBELL SOUP COMPANY Consolidated Statements of Earnings (millions, except per share amounts) \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{2}{*}{ Net sales.......... } & 2017 & \multicolumn{2}{|c|}{2016} & \multicolumn{2}{|c|}{2015} \\ \hline & 7,890 & $ & 7,961 & s & 8,082 \\ \hline \multicolumn{6}{|l|}{ Costs and expenses } \\ \hline Cost of products sold . ........... & 4,831 & & 5,181 & & 5,300 \\ \hline Marketing and selling expenses.... & 817 & & 893 & & 884 \\ \hline Administrative expenses . . . . . . . . . . & 488 & & 641 & & 601 \\ \hline Research and development expenses....... & 98 & & 124 & & 117 \\ \hline Other expenses / (income) ................ & 238 & & 131 & & 24 \\ \hline Restructuring charges. . . . . . & 18 & & 31 & & 102 \\ \hline Total costs and expenses. . . . . . . . & 6,490 & & 7,001 & & 7,028 \\ \hline Earnings before interest and taxes... & 1,400 & & 960 & & 1,054 \\ \hline Interest expense & 112 & & 115 & & 108 \\ \hline Interest income & 5 & & 4 & & 3 \\ \hline Earnings before taxes & 1,293 & & 849 & & 949 \\ \hline Taxes on earnings. . & 406 & & 286 & & 283 \\ \hline & 887 & & 563 & & 666 \\ \hline Less: Net earnings (loss) attributable to noncontrolling interests .. & - & & - & & - \\ \hline Net earnings attributable to Campbell Soup Company. & 887 & $ & 563 & $ & 666 \\ \hline \multicolumn{6}{|l|}{ Per Share - Basic } \\ \hline Net earnings attributable to Campbell Soup Company. & 2.91 & $ & 1.82 & $ & 2.13 \\ \hline Weighted average shares outstanding - basic .......... & 305 & & 309 & & 312 \\ \hline \multicolumn{6}{|l|}{ Per Share - Assuming Dilution } \\ \hline Net earnings attributable to Campbell Soup Company ................. s & 2.89 & $ & 1.81 & $ & 2.13 \\ \hline Weighted average shares outstanding - assuming dilution ..... & 307 & & 311 & & 313 \\ \hline \end{tabular} See accompanying Notes to Consolidated Financial Statements. CAMPBELL SOUP COMPANY Consolidated Balance Sheets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts