Question: Just need help on the balance sheet for adjusted, unadjusted and post closing please! 2 3 7 8 15 > Record the storage services provided

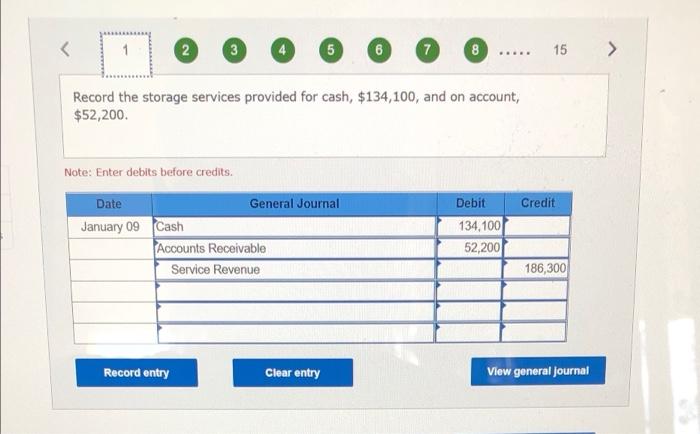

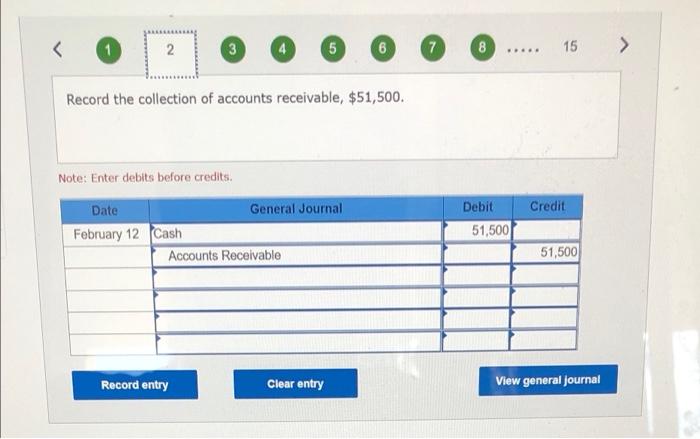

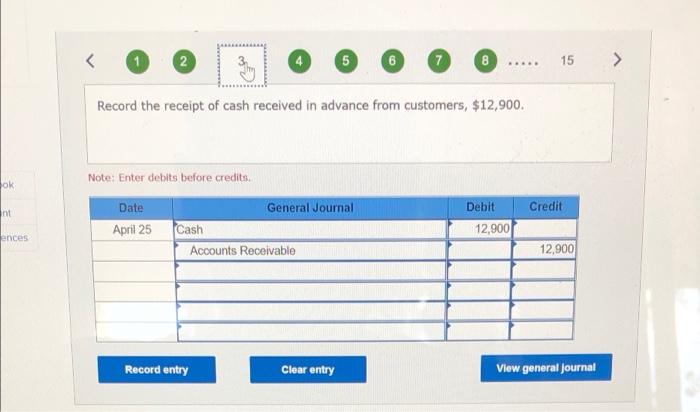

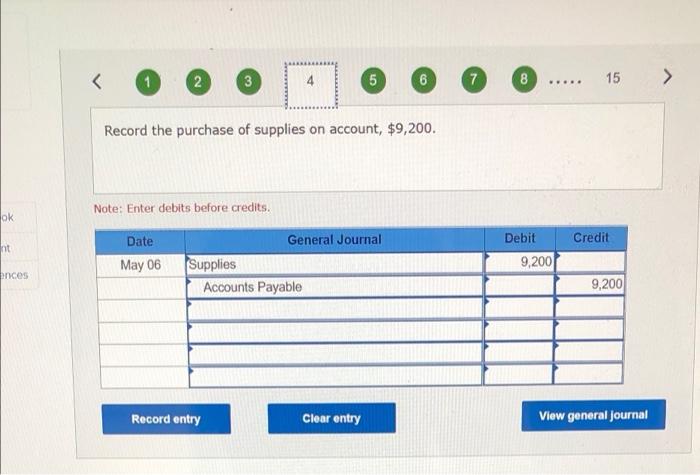

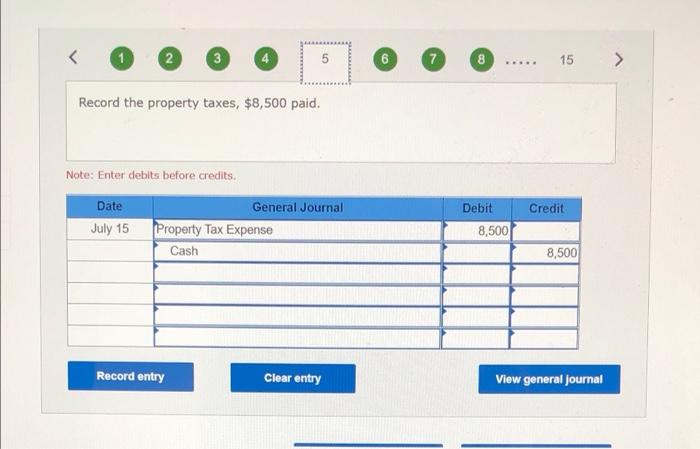

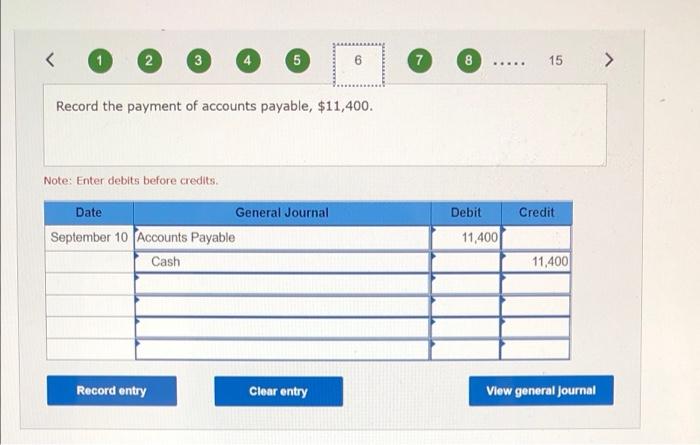

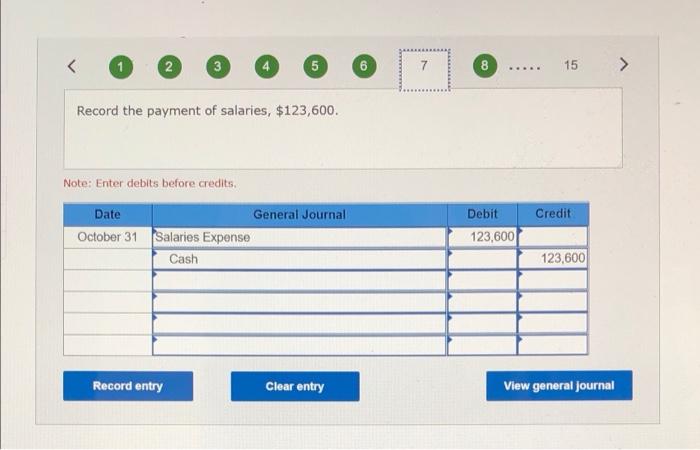

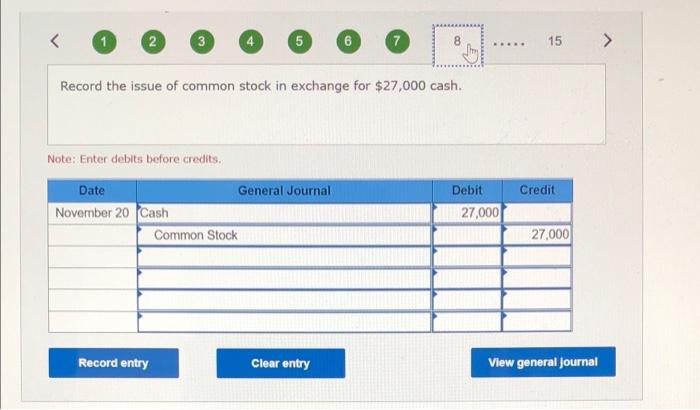

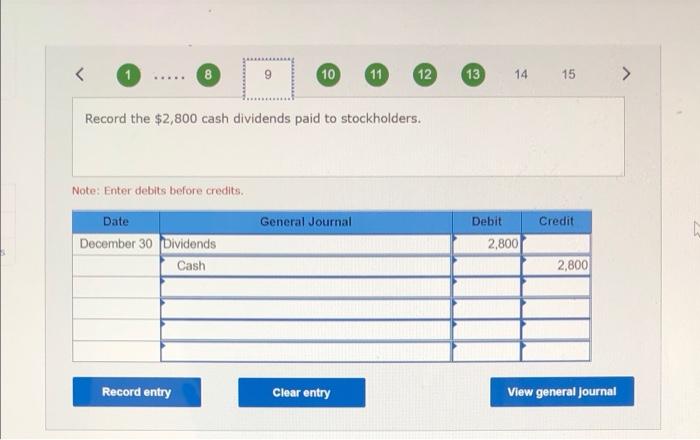

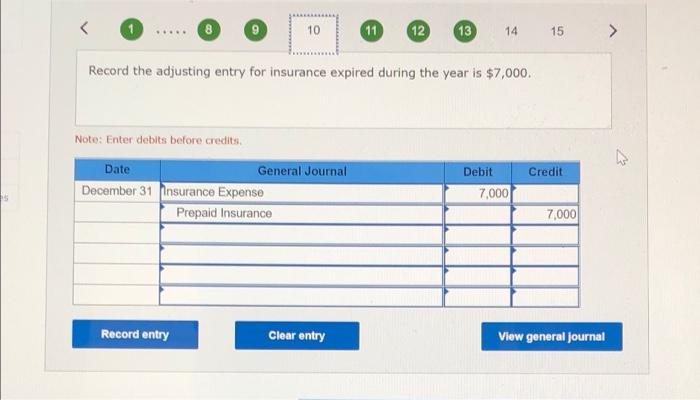

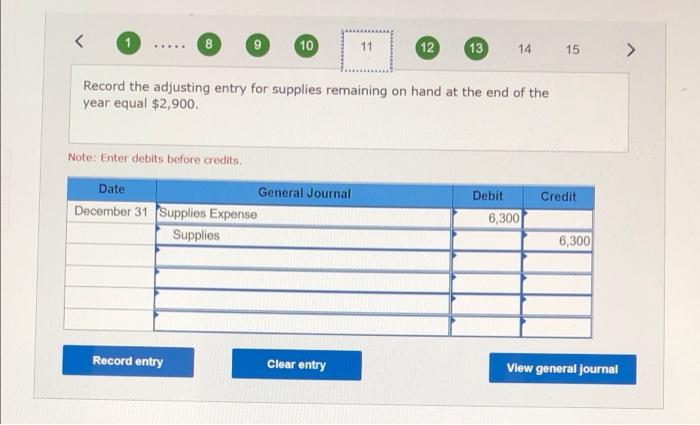

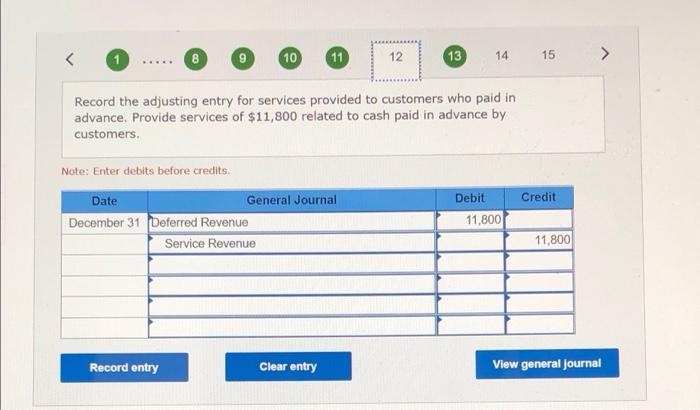

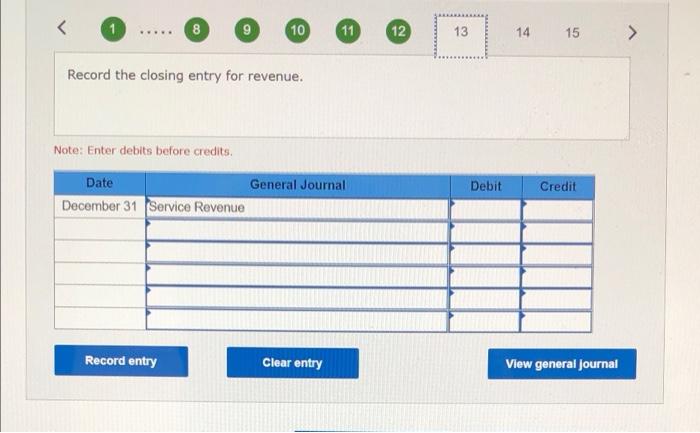

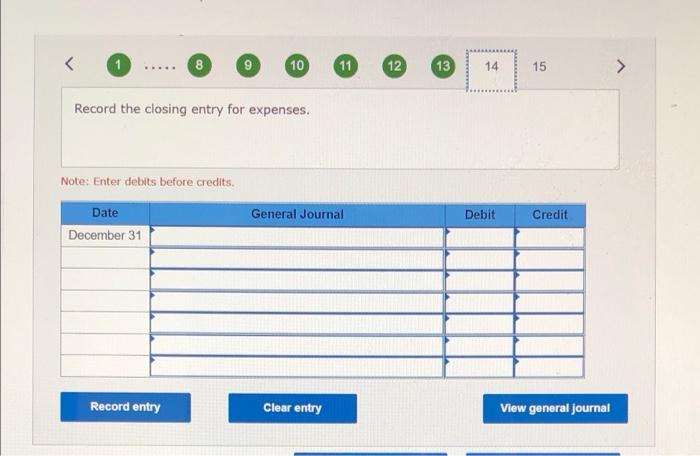

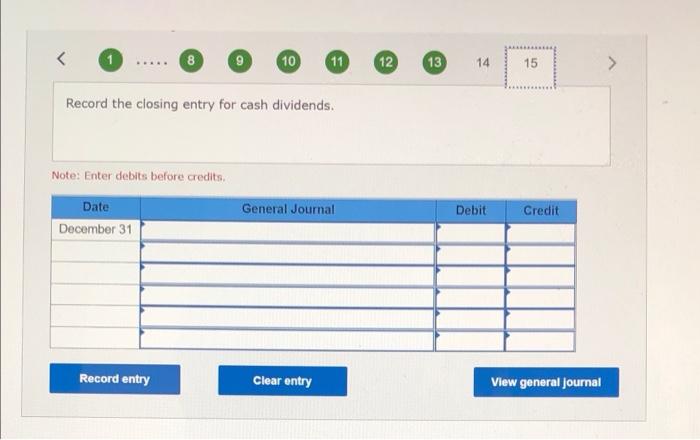

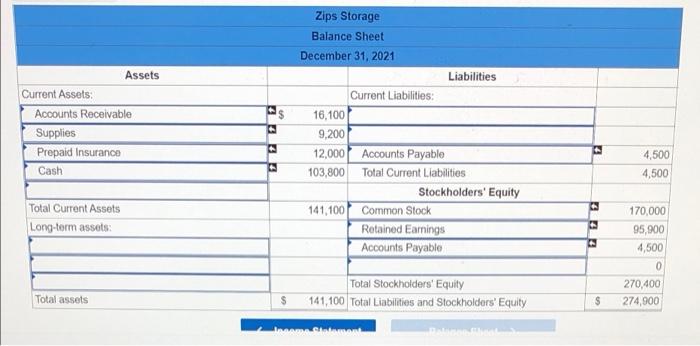

2 3 7 8 15 > Record the storage services provided for cash, $134,100, and on account, $52,200. Credit Note: Enter debits before credits. Date General Journal January 09 Cash Accounts Receivable Service Revenue Debit 134,100 52,200 186,300 Record entry Clear entry View general journal 2 N 3 8 15 > Record the collection of accounts receivable, $51,500. Note: Enter debits before credits Credit Date General Journal February 12 Cash Accounts Receivable Debit 51,500 51,500 Record entry Clear entry View general Journal 2 5 7 ... 15 > Record the receipt of cash received in advance from customers, $12,900. bok Note: Enter debits before credits. Date Debit nt Credit April 25 General Journal Cash Accounts Receivable 12,900 ences 12,900 Record entry Clear entry View general Journal .... Record the purchase of supplies on account, $9,200. Note: Enter debits before credits. ok Credit Int Date May 06 General Journal Supplies Accounts Payable Debit 9,200 onces 9,200 Record entry Clear entry View general Journal Record the property taxes, $8,500 paid. Note: Enter debits before credits. Credit Date July 15 General Journal Property Tax Expense Cash Debit 8,500 8,500 Record entry Clear entry View general Journal 1 2 3 5 6 7 8 ..... 15 > Record the payment of accounts payable, $11,400. Note: Enter debits before credits. Date General Journal September 10 Accounts Payable Cash Credit Debit 11,400 11,400 Record entry Clear entry View general Journal 6 7 8 ... 15 > Record the payment of salaries, $123,600. Note: Enter debits before credits. Credit Date October 31 General Journal Salaries Expense Cash Debit 123,600 123,600 Record entry Clear entry View general Journal 8 15 ..... > Record the issue of common stock in exchange for $27,000 cash. Note: Enter debits before credits. Date General Journal November 20 Cash Common Stock Credit Debit 27,000 27,000 Record entry Clear entry View general Journal Record the $2,800 cash dividends paid to stockholders. Note: Enter debits before credits. Date General Journal Debit Credit 2,800 December 30 Dividends Cash 2,800 Record entry Clear entry View general Journal 10 11 12 13 14 15 > Record the adjusting entry for insurance expired during the year is $7,000. Note: Enter debits before credits Date Debit Credit General Journal December 31 Insurance Expense Prepaid Insurance 7,000 7,000 Record entry Clear entry View general journal 8 9 10 11 12 13 14 15 > Record the adjusting entry for supplies remaining on hand at the end of the year equal $2,900 Note: Enter debits before credits Date General Journal December 31 Supplies Expense Supplies Credit Debit 6,300 6,300 Record entry Clear entry View general journal Record the closing entry for revenue. Note: Enter debits before credits. Debit Credit Date General Journal December 31 Service Revenue Record entry Clear entry View general Journal Record the closing entry for expenses. Note: Enter debits before credits. General Journal Debit Credit Date December 31 Record entry Clear entry View general Journal Record the closing entry for cash dividends. Note: Enter debits before credits. General Journal Debit Date December 31 Credit Record entry Clear entry View general Journal $ Assets Current Assets Accounts Receivable Supplies Prepaid Insuranon Cash Zips Storage Balance Sheet December 31, 2021 Liabilities Current Liabilities: 16,100 9,200 12,000 Accounts Payable 103,800 Total Current Liabilities Stockholders' Equity 141,100 Common Stock Retained Earnings Accounts Payable 4,500 4,500 Total Current Assets Long-term assets 2 2 2 170,000 95,900 4,500 0 Total Stockholders' Equity 141,100 Total Liabilities and Stockholders' Equity 270,400 274,900 Total assets $ $ Imamo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts