Question: Just need help understanding. Part B (15 marks) Suppose that you are part of the Management team at BusBoard. Suppose that it is the end

Just need help understanding.

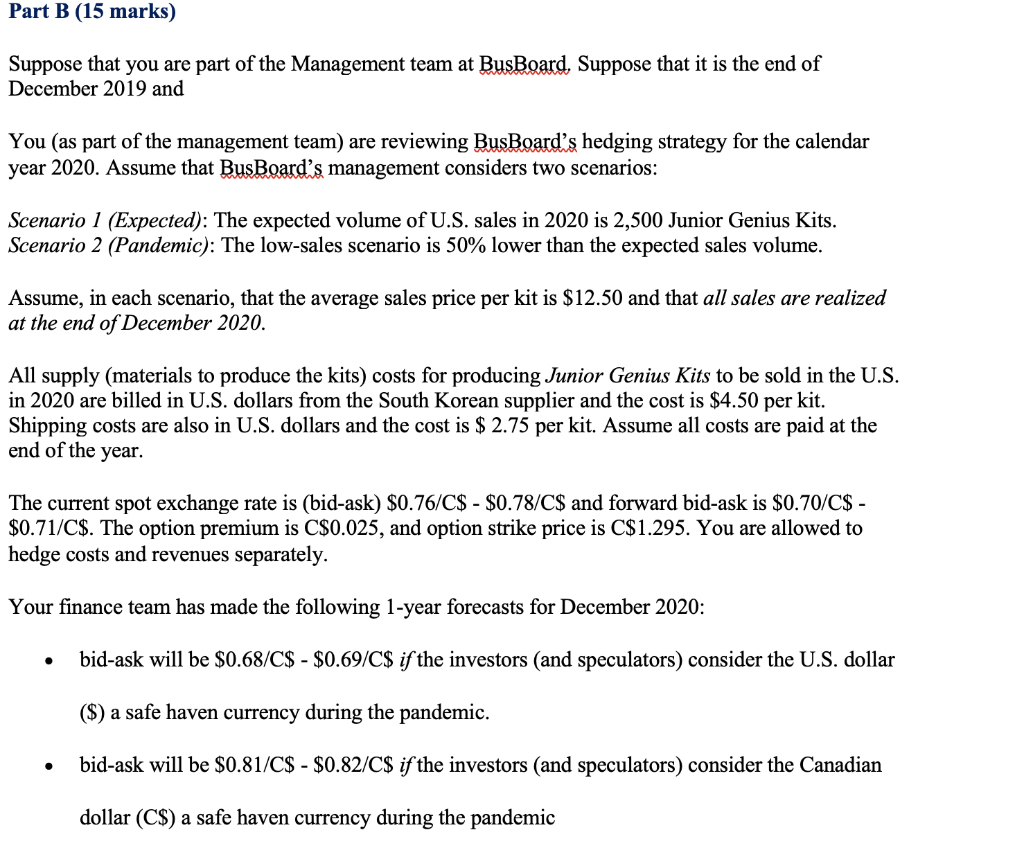

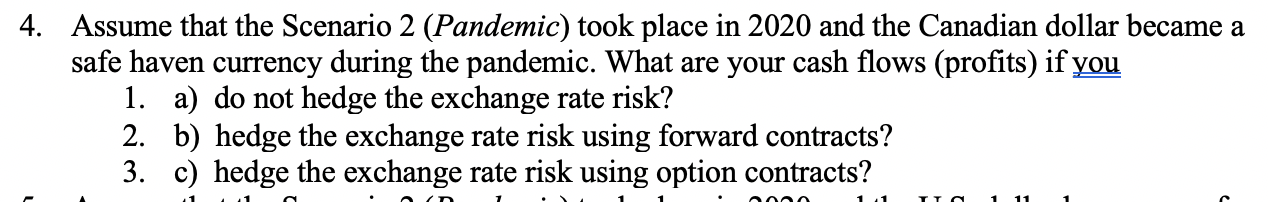

Part B (15 marks) Suppose that you are part of the Management team at BusBoard. Suppose that it is the end of December 2019 and You (as part of the management team) are reviewing BusBoard's hedging strategy for the calendar year 2020. Assume that BusBoard's management considers two scenarios: Scenario 1 (Expected): The expected volume of U.S. sales in 2020 is 2,500 Junior Genius Kits. Scenario 2 (Pandemic): The low-sales scenario is 50% lower than the expected sales volume. Assume, in each scenario, that the average sales price per kit is $12.50 and that all sales are realized at the end of December 2020. All supply (materials to produce the kits) costs for producing Junior Genius Kits to be sold in the U.S. in 2020 are billed in U.S. dollars from the South Korean supplier and the cost is $4.50 per kit. Shipping costs are also in U.S. dollars and the cost is $ 2.75 per kit. Assume all costs are paid at the end of the year. The current spot exchange rate is (bid-ask) $0.76/C$ - $0.78/C$ and forward bid-ask is $0.70/C$ - $0.71/C$. The option premium is C$0.025, and option strike price is C$1.295. You are allowed to hedge costs and revenues separately. Your finance team has made the following 1-year forecasts for December 2020: bid-ask will be $0.68/C$ - $0.69/C$ if the investors (and speculators) consider the U.S. dollar ($) a safe haven currency during the pandemic. bid-ask will be $0.81/C$ - $0.82/C$ if the investors (and speculators) consider the Canadian dollar (C$) a safe haven currency during the pandemic 4. Assume that the Scenario 2 (Pandemic) took place in 2020 and the Canadian dollar became a safe haven currency during the pandemic. What are your cash flows (profits) if you 1. a) do not hedge the exchange rate risk? 2. b) hedge the exchange rate risk using forward contracts? 3. c) hedge the exchange rate risk using option contracts? o in 0000 | 1 11 1 Part B (15 marks) Suppose that you are part of the Management team at BusBoard. Suppose that it is the end of December 2019 and You (as part of the management team) are reviewing BusBoard's hedging strategy for the calendar year 2020. Assume that BusBoard's management considers two scenarios: Scenario 1 (Expected): The expected volume of U.S. sales in 2020 is 2,500 Junior Genius Kits. Scenario 2 (Pandemic): The low-sales scenario is 50% lower than the expected sales volume. Assume, in each scenario, that the average sales price per kit is $12.50 and that all sales are realized at the end of December 2020. All supply (materials to produce the kits) costs for producing Junior Genius Kits to be sold in the U.S. in 2020 are billed in U.S. dollars from the South Korean supplier and the cost is $4.50 per kit. Shipping costs are also in U.S. dollars and the cost is $ 2.75 per kit. Assume all costs are paid at the end of the year. The current spot exchange rate is (bid-ask) $0.76/C$ - $0.78/C$ and forward bid-ask is $0.70/C$ - $0.71/C$. The option premium is C$0.025, and option strike price is C$1.295. You are allowed to hedge costs and revenues separately. Your finance team has made the following 1-year forecasts for December 2020: bid-ask will be $0.68/C$ - $0.69/C$ if the investors (and speculators) consider the U.S. dollar ($) a safe haven currency during the pandemic. bid-ask will be $0.81/C$ - $0.82/C$ if the investors (and speculators) consider the Canadian dollar (C$) a safe haven currency during the pandemic 4. Assume that the Scenario 2 (Pandemic) took place in 2020 and the Canadian dollar became a safe haven currency during the pandemic. What are your cash flows (profits) if you 1. a) do not hedge the exchange rate risk? 2. b) hedge the exchange rate risk using forward contracts? 3. c) hedge the exchange rate risk using option contracts? o in 0000 | 1 11 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts