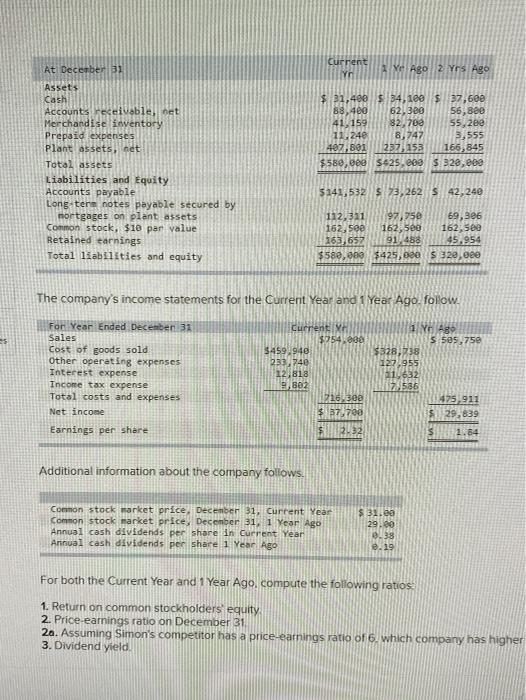

Question: just need help with 1 and 2 please current Yn Me Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable net Merchandise inventory

current Yn Me Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-tere notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,400 $ 34,180 37,600 88,400 62,380 56,800 41.159 82.788 55,280 11:240 8,747 3,555 407,801 237, 153 166,845 $589,88 5425, 860 S 328,000 5141,532 $ 73,262 S 42,240 112,311 97,75 69,386 162,500 162,500 162,50 163,652 91.488 45,954 $589,000 $425,000 S 320,000 The company's income statements for the Current Year and 1 Year Ago follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Currently MAS $254.000 5 505,750 $459.940 $328238 233740 127.955 12,818 11,632 B 802 70536 226,300 475,911 $ 27.700 29,839 2.32 S 1.64 Earnings per share Additional information about the company follows Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividends per share in Current Year Annual cash dividends per share 1 Year Ago $31.00 29.00 0.38 2.19 For both the Current Year and 1 Year Ago, compute the following ratios. 1. Return on common stockholders' equity 2. Price earnings ratio on December 31 20. Assuming Simon's competitor has a price-earnings ratio of 6 which company has higher 3. Dividend yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts