Question: Just need help with 16.4. 16 CAPM - 25 points You are given the following information about the distributions of two stocks. Expected Return Variance

Just need help with 16.4.

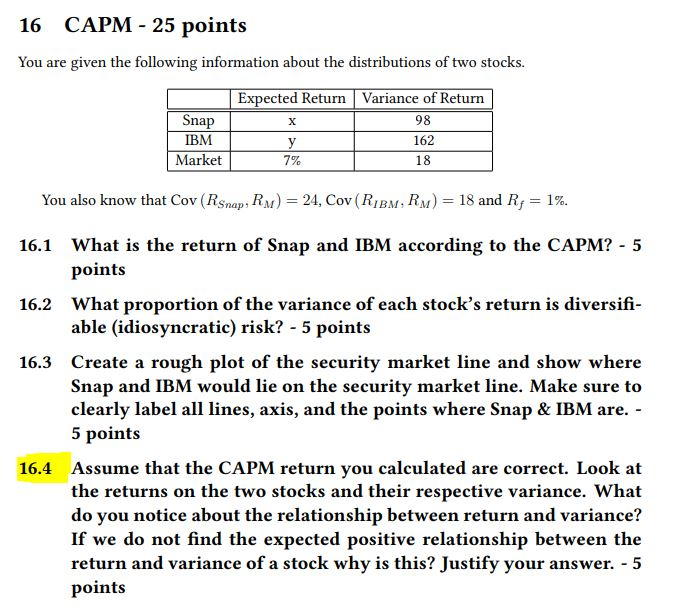

16 CAPM - 25 points You are given the following information about the distributions of two stocks. Expected Return Variance of Return 98 162 Snap IBM Market X 7% 18 You also know that Cov (Rsnap, Rj) = 24, Cov(RIBM, RM)= 18 and R; = 1%. 16.1 What is the return of Snap and IBM according to the CAPM? - 5 points 16.2 What proportion of the variance of each stock's return is diversifi- able (idiosyncratic) risk? - 5 points 16.3 Create a rough plot of the security market line and show where Snap and IBM would lie on the security market line. Make sure to clearly label all lines, axis, and the points where Snap & IBM are. - 5 points 16.4 Assume that the CAPM return you calculated are correct. Look at the returns on the two stocks and their respective variance. What do you notice about the relationship between return and variance? If we do not find the expected positive relationship between the return and variance of a stock why is this? Justify your answer. - 5 points 16 CAPM - 25 points You are given the following information about the distributions of two stocks. Expected Return Variance of Return 98 162 Snap IBM Market X 7% 18 You also know that Cov (Rsnap, Rj) = 24, Cov(RIBM, RM)= 18 and R; = 1%. 16.1 What is the return of Snap and IBM according to the CAPM? - 5 points 16.2 What proportion of the variance of each stock's return is diversifi- able (idiosyncratic) risk? - 5 points 16.3 Create a rough plot of the security market line and show where Snap and IBM would lie on the security market line. Make sure to clearly label all lines, axis, and the points where Snap & IBM are. - 5 points 16.4 Assume that the CAPM return you calculated are correct. Look at the returns on the two stocks and their respective variance. What do you notice about the relationship between return and variance? If we do not find the expected positive relationship between the return and variance of a stock why is this? Justify your answer. - 5 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts