Question: Just need help with an example. Does not have to be a real scenario but does have to make sense. Please explain in detail if

Just need help with an example. Does not have to be a real scenario but does have to make sense. Please explain in detail if possible.

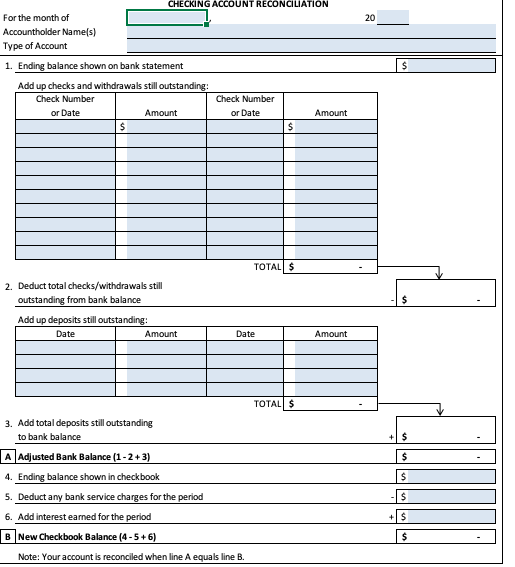

20 CHECKING ACCOUNT RECONCILIATION For the month of Accountholder Name(s) Type of Account 1. Ending balance shown on bank statement Add up checks and withdrawals still outstanding: Check Number Check Number or Date Amount or Date Amount $ $ $ TOTAL $ 2. Deduct total checks/withdrawals still outstanding from bank balance Add up deposits still outstanding: Date Amount Date Amount TOTAL $ + $ $ $ 3. Add total deposits still outstanding to bank balance A Adjusted Bank Balance (1-2+3) 4. Ending balance shown in checkbook 5. Deduct any bank service charges for the period 6. Add interest eamed for the period B New Checkbook Balance (4-5 + 6) Note: Your account is reconciled when line A equals line B. + $ $ 20 CHECKING ACCOUNT RECONCILIATION For the month of Accountholder Name(s) Type of Account 1. Ending balance shown on bank statement Add up checks and withdrawals still outstanding: Check Number Check Number or Date Amount or Date Amount $ $ $ TOTAL $ 2. Deduct total checks/withdrawals still outstanding from bank balance Add up deposits still outstanding: Date Amount Date Amount TOTAL $ + $ $ $ 3. Add total deposits still outstanding to bank balance A Adjusted Bank Balance (1-2+3) 4. Ending balance shown in checkbook 5. Deduct any bank service charges for the period 6. Add interest eamed for the period B New Checkbook Balance (4-5 + 6) Note: Your account is reconciled when line A equals line B. + $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts