Question: just need help with part e mainly 7. Growth Company's current share price is $20.25 and it is expected to pay a $1.15 dividend per

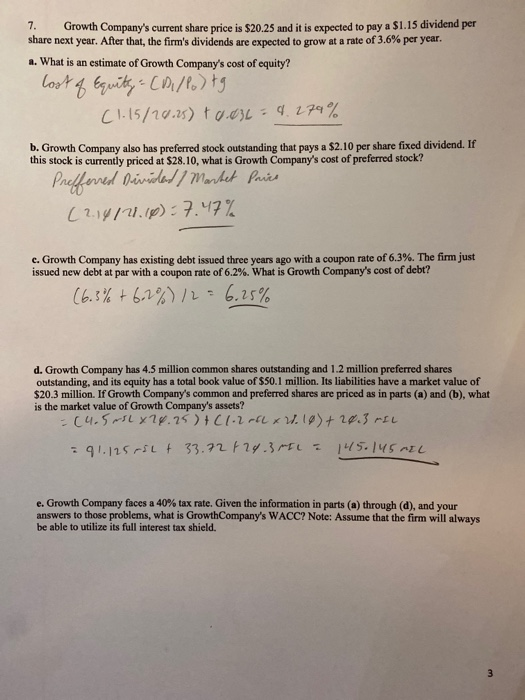

7. Growth Company's current share price is $20.25 and it is expected to pay a $1.15 dividend per share next year. After that, the firm's dividends are expected to grow at a rate of 3.6% per year. a. What is an estimate of Growth Company's cost of equity? lost of Equity - CD /Potg (1.15/20.25) to.036=4.279% b. Growth Company also has preferred stock outstanding that pays a $2.10 per share fixed dividend. If this stock is currently priced at $28.10. what is Growth Company's cost of preferred stock? Preferred Divided / Market Price ( 2.14/2.10):7.47% c. Growth Company has existing debt issued three years ago with a coupon rate of 6.3%. The firm just issued new debt at par with a coupon rate of 6.2%. What is Growth Company's cost of debt? (6.3% + 6.2%)/2 = 6.25% d. Growth Company has 4.5 million common shares outstanding and 1.2 million preferred shares outstanding, and its equity has a total book value of $50.1 million. Its liabilities have a market value of $20.3 million. If Growth Company's common and preferred shares are priced as in parts (a) and (b), what is the market value of Growth Company's assets? - (4.5ml x 28.25)+(1-2 ofL x W.10)+20.3 MIL 91.125 Ft + 33.72 +243ML = 145.145 MEL e. Growth Company faces a 40% tax rate. Given the information in parts (a) through (d), and your answers to those problems, what is Growth Company's WACC? Note: Assume that the firm will always be able to utilize its full interest tax shield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts