Question: Just need help with question 2 please. And please show how it is done in excel Suppose you are considering a project has an initial

Just need help with question 2 please. And please show how it is done in excel

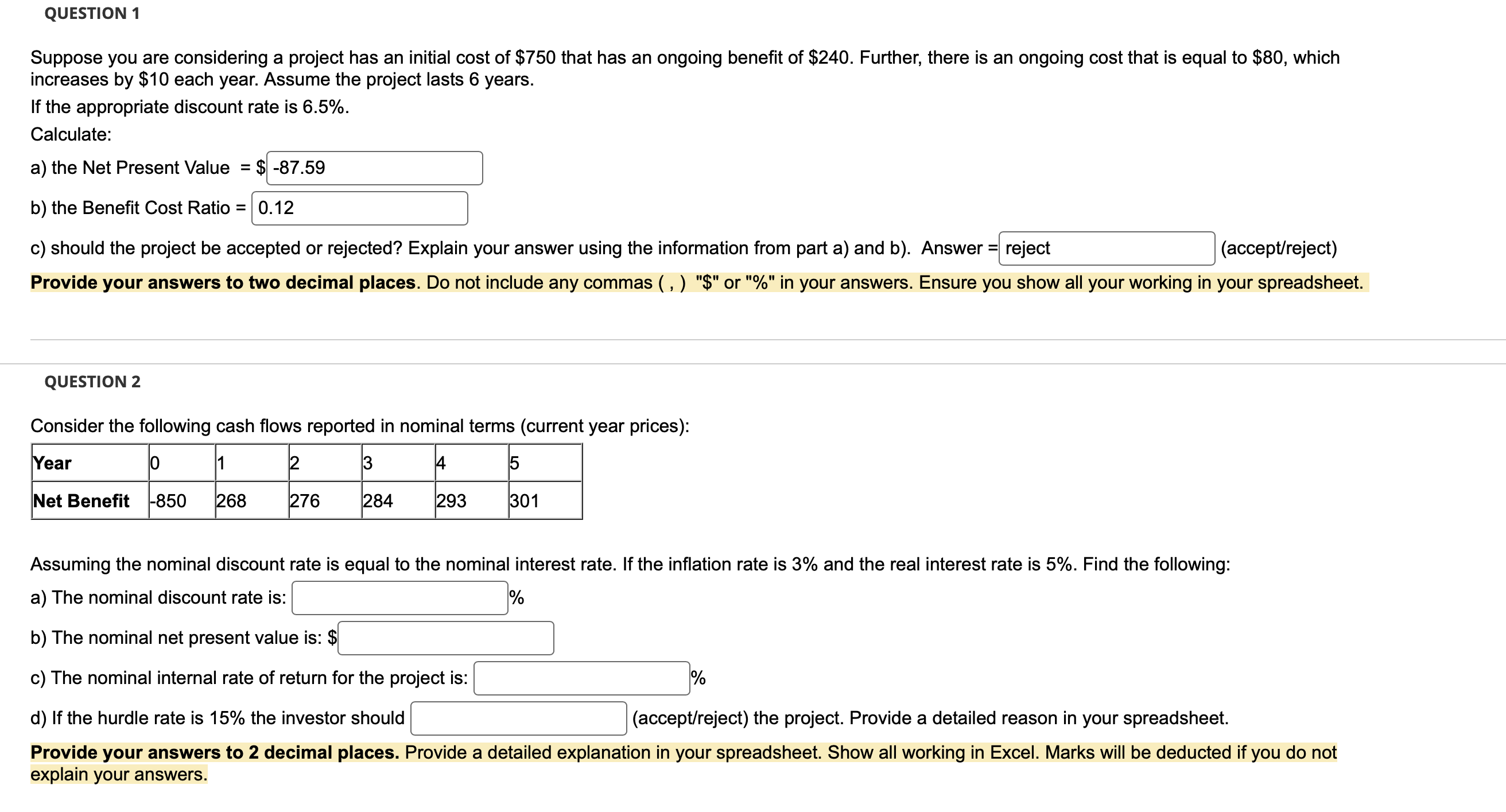

Suppose you are considering a project has an initial cost of $750 that has an ongoing benefit of $240. Further, there is an ongoing cost that is equal to $80, which increases by $10 each year. Assume the project lasts 6 years. If the appropriate discount rate is 6.5%. Calculate: a) the Net Present Value =$ b) the Benefit Cost Ratio = c) should the project be accepted or rejected? Explain your answer using the information from part a) and b). Answer = (accept/reject) Provide your answers to two decimal places. Do not include any commas ( , ) "\$" or "\%" in your answers. Ensure you show all your working in your spreadsheet. QUESTION 2 Consider the following cash flows reported in nominal terms (current year prices): Assuming the nominal discount rate is equal to the nominal interest rate. If the inflation rate is 3% and the real interest rate is 5%. Find the following: a) The nominal discount rate is: % b) The nominal net present value is: $ c) The nominal internal rate of return for the project is: % d) If the hurdle rate is 15% the investor should (accept/reject) the project. Provide a detailed reason in your spreadsheet. Provide your answers to 2 decimal places. Provide a detailed explanation in your spreadsheet. Show all working in Excel. Marks will be deducted if you do not explain your answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts