Question: Just need help with the answers value on John's expected cash flows given that the proxy interest rate is 12% per year. (note: round your

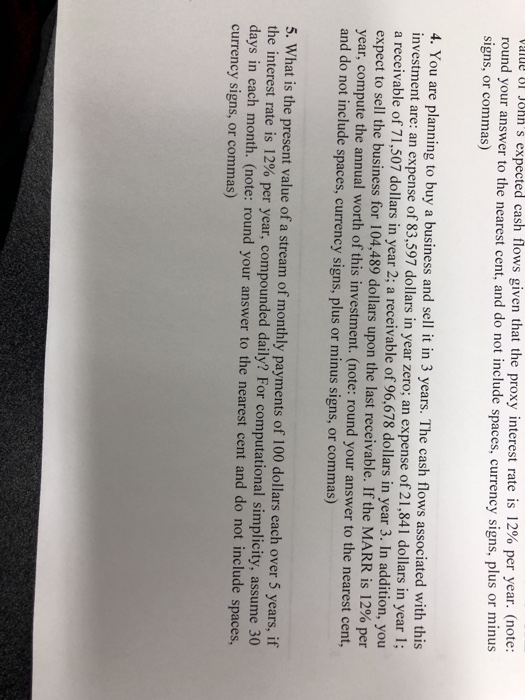

value on John's expected cash flows given that the proxy interest rate is 12% per year. (note: round your answer to the nearest cent, and do not include spaces, currency signs, plus or minus signs, or commas) 4. You are planning to buy a business and sell it in 3 years. The cash flows associated with this investment are: an expense of 83,597 dollars in year zero; an expense of 21,841 dollars in year 1; a receivable of 71,507 dollars in year 2; a receivable of 96,678 dollars in year 3. In addition, you expect to sell the business for 104,489 dollars upon the last receivable. If the MARR is 12% per year, compute the annual worth of this investment. (note: round your answer to the nearest cent, and do not include spaces, currency signs, plus or minus signs, or commas) 5. What is the present value of a stream of monthly payments of 100 dollars each over 5 years, if the interest rate is 12% per year, compounded daily? For computational simplicity, assume 3 days in each month. (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts