Question: Just need help with the first part. Please show work. Thanks!! Assuming that for Specific identification method (item 1d) the March 14 sale was selected

Just need help with the first part. Please show work. Thanks!!

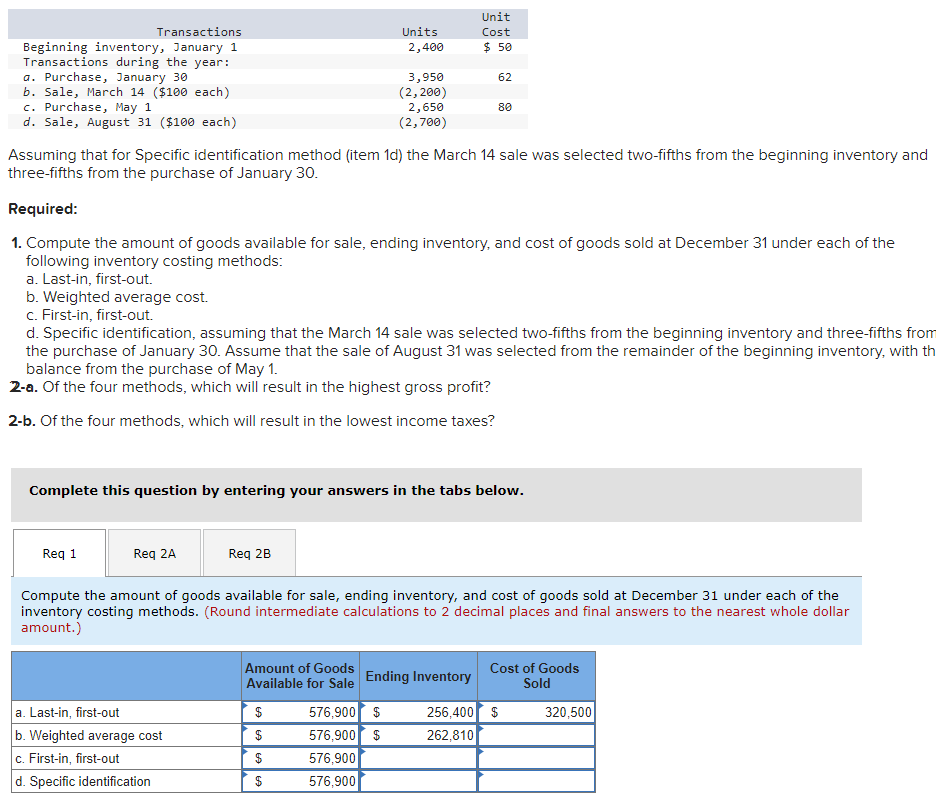

Assuming that for Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30 . Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: a. Last-in, first-out. b. Weighted average cost. c. First-in, first-out. d. Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths fron the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with th balance from the purchase of May 1. 2-a. Of the four methods, which will result in the highest gross profit? 2-b. Of the four methods, which will result in the lowest income taxes? Complete this question by entering your answers in the tabs below. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31 under each of the inventory costing methods. (Round intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts