Question: Just need help with the last calculation on the office building. Casper used the following assets in his Schedule C trade or business in the

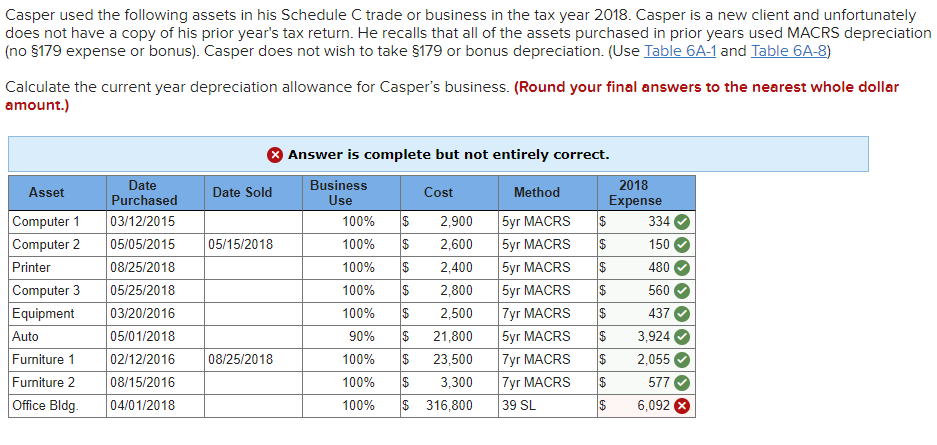

Just need help with the last calculation on the office building.

Casper used the following assets in his Schedule C trade or business in the tax year 2018. Casper is a new client and unfortunately does not have a copy of his prior year's tax return. He recalls that all of the assets purchased in prior years used MACRS depreciation (no $179 expense or bonus). Casper does not wish to take $179 or bonus depreciation. (Use Table 6A-1 and Table 6A-8) Calculate the current year depreciation allowance for Casper's business. (Round your final answers to the nearest whole dollar amount.) Asset Date Sold 100% 05/15/2018 Computer 1 Computer 2 Printer Computer 3 Equipment Auto Furniture 1 Furniture 2 Office Bldg. Date Purchased 03/12/2015 05/05/2015 08/25/2018 05/25/2018 03/20/2016 05/01/2018 02/12/2016 08/15/2016 04/01/2018 Answer is complete but not entirely correct. Business 2018 Use Method Cost Expense $ 2,900 5yr MACRS $ 334 100% $ 2,600 5yr MACRS $ 150 100% $ 2,400 5yr MACRS $ 480 100% $ 2,800 5yr MACRS $ 560 100% $ 2,500 7yr MACRS $ 437 90% $ 21,800 5yr MACRS $ 3,924 $ 23,500 7yr MACRS $ 2,055 100% 3,300 7yr MACRS $ 577 100% $ 316,800 39 SL $ 6,092 08/25/2018 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts