Question: Just need help with the last journal entry for part 2 a. Raw materials purchased on account, $209,000. b. Raw materials used in production, $190,000

Just need help with the last journal entry for part 2

Just need help with the last journal entry for part 2

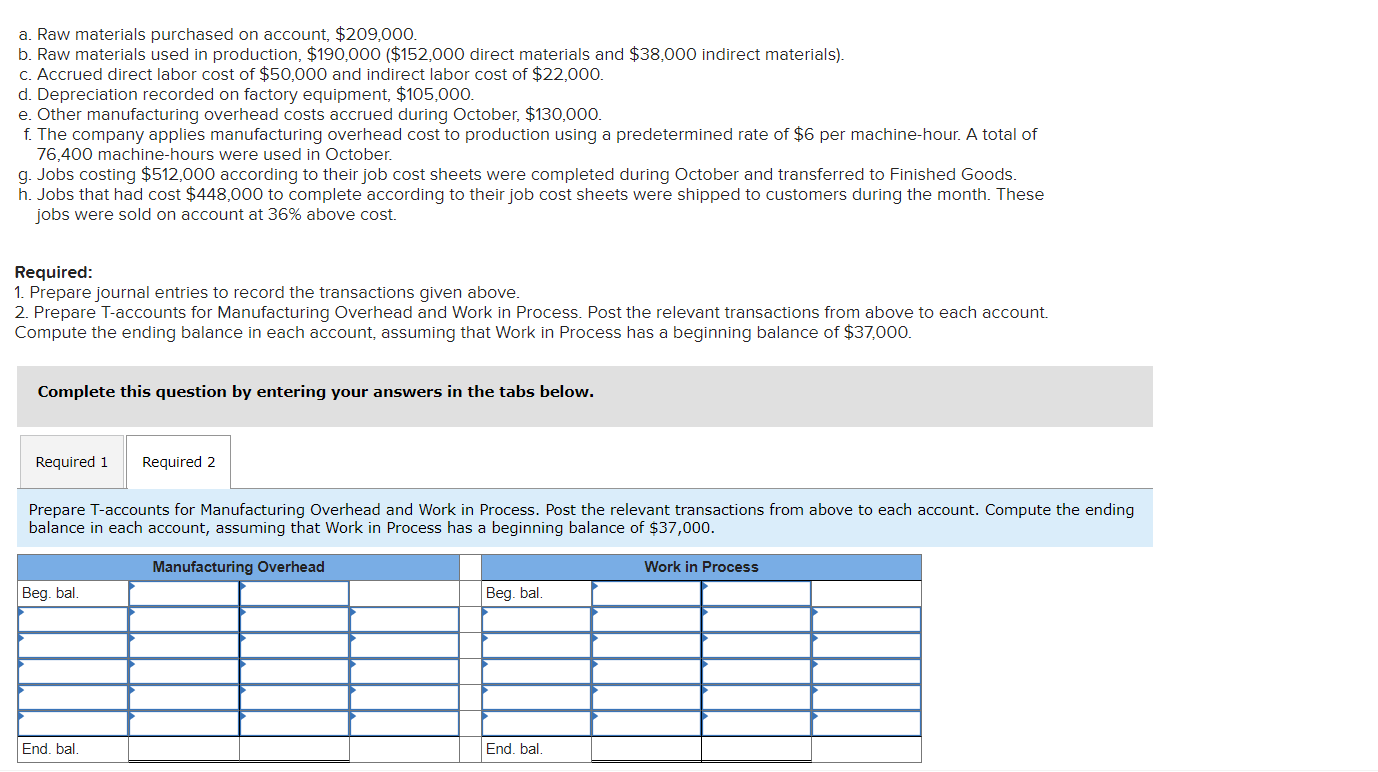

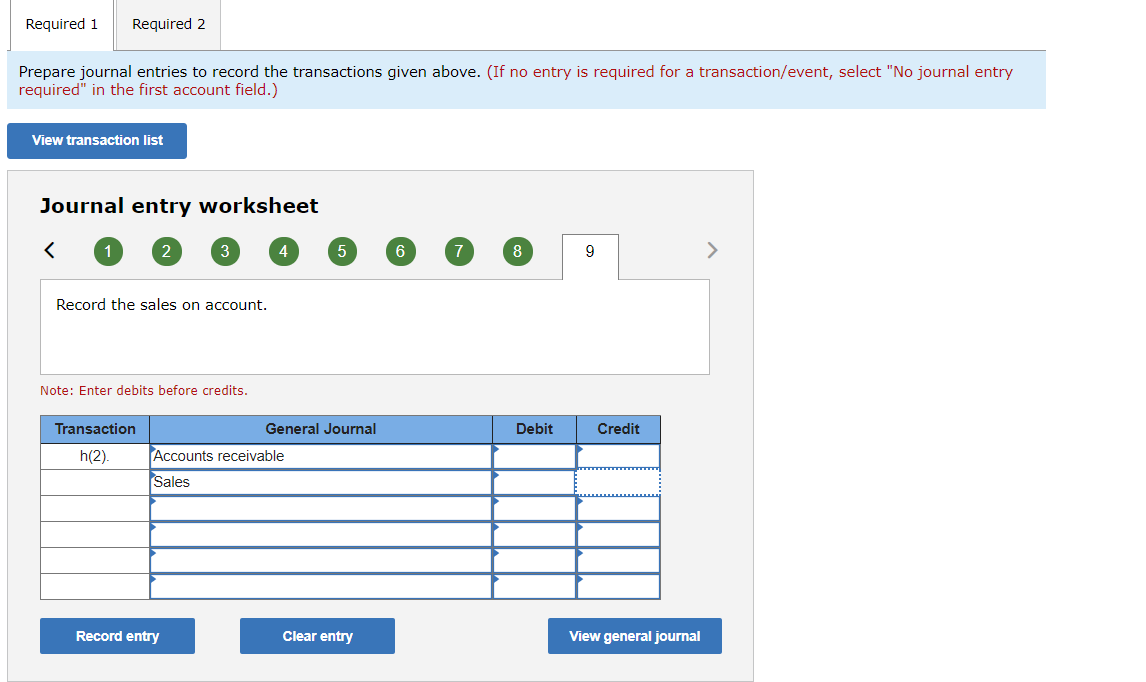

a. Raw materials purchased on account, $209,000. b. Raw materials used in production, $190,000 ($152,000 direct materials and $38,000 indirect materials). C. Accrued direct labor cost of $50,000 and indirect labor cost of $22,000. d. Depreciation recorded on factory equipment, $105,000. e. Other manufacturing overhead costs accrued during October, $130,000. f. The company applies manufacturing overhead cost to production using a predetermined rate of $6 per machine-hour. A total of 76,400 machine-hours were used in October. g. Jobs costing $512,000 according to their job cost sheets were completed during October and transferred to Finished Goods. h. Jobs that had cost $448,000 to complete according to their job cost sheets were shipped to customers during the month. These jobs were sold on account at 36% above cost. Required: 1. Prepare journal entries to record the transactions given above. 2. Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $37,000. Complete this question by entering your answers in the tabs below. Wired 2 Prepare T-accounts for Manufacturing Overhead and Work in Process. Post the relevant transactions from above to each account. Compute the ending balance in each account, assuming that Work in Process has a beginning balance of $37,000. Manufacturing Overhead Work in Process Beg. bal. Beg. bal. End. bal. End. bal. Required 1 Required 2 Prepare journal entries to record the transactions given above. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the sales on account. Note: Enter debits before credits. Transaction General Journal Debit Credit h(2) Accounts receivable Sales Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts