Question: just need help with the multiple choice questions Group Exercise: At the end of the current year, Accounts Receivable has a balance of $700,000; Allowance

just need help with the multiple choice questions

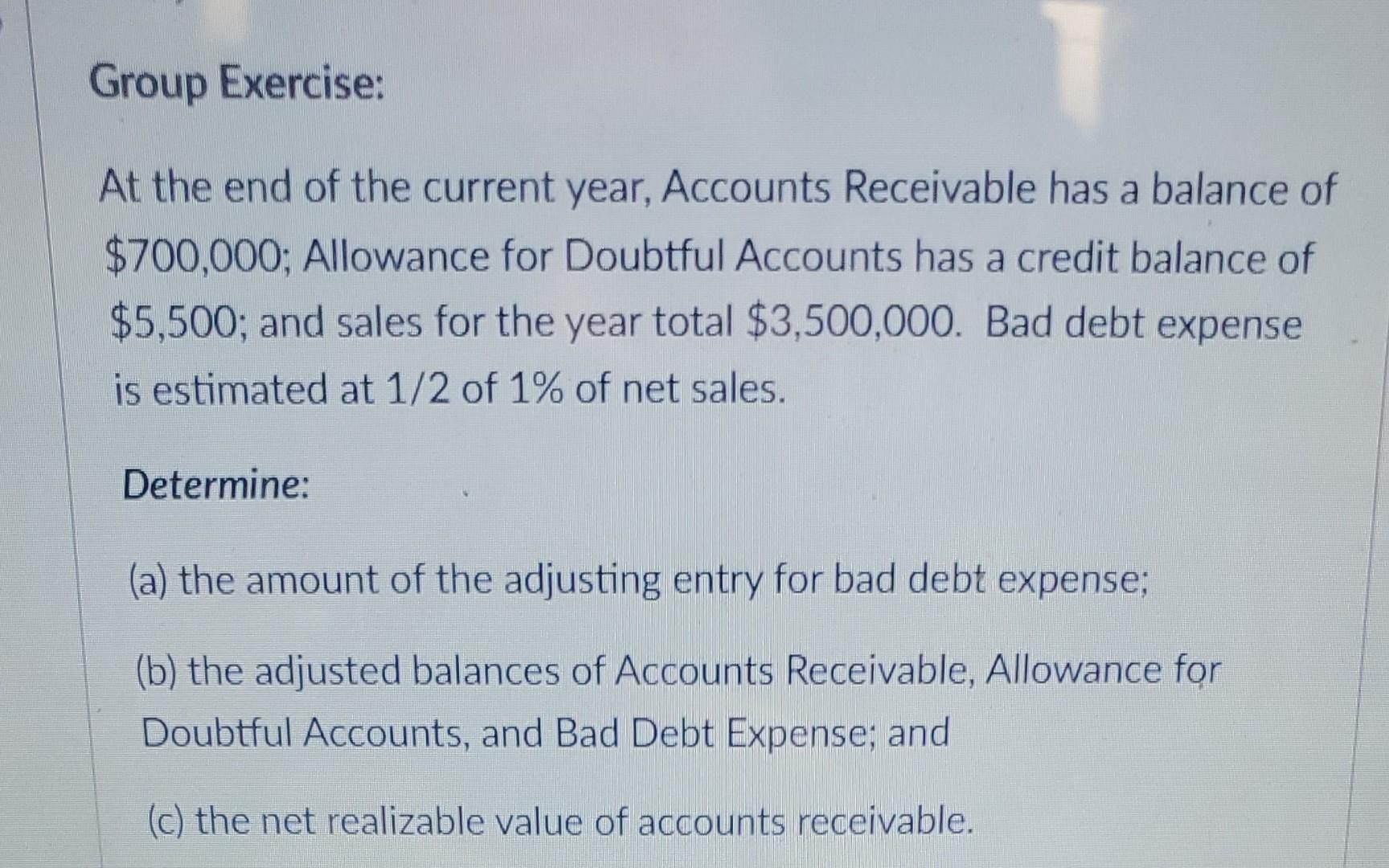

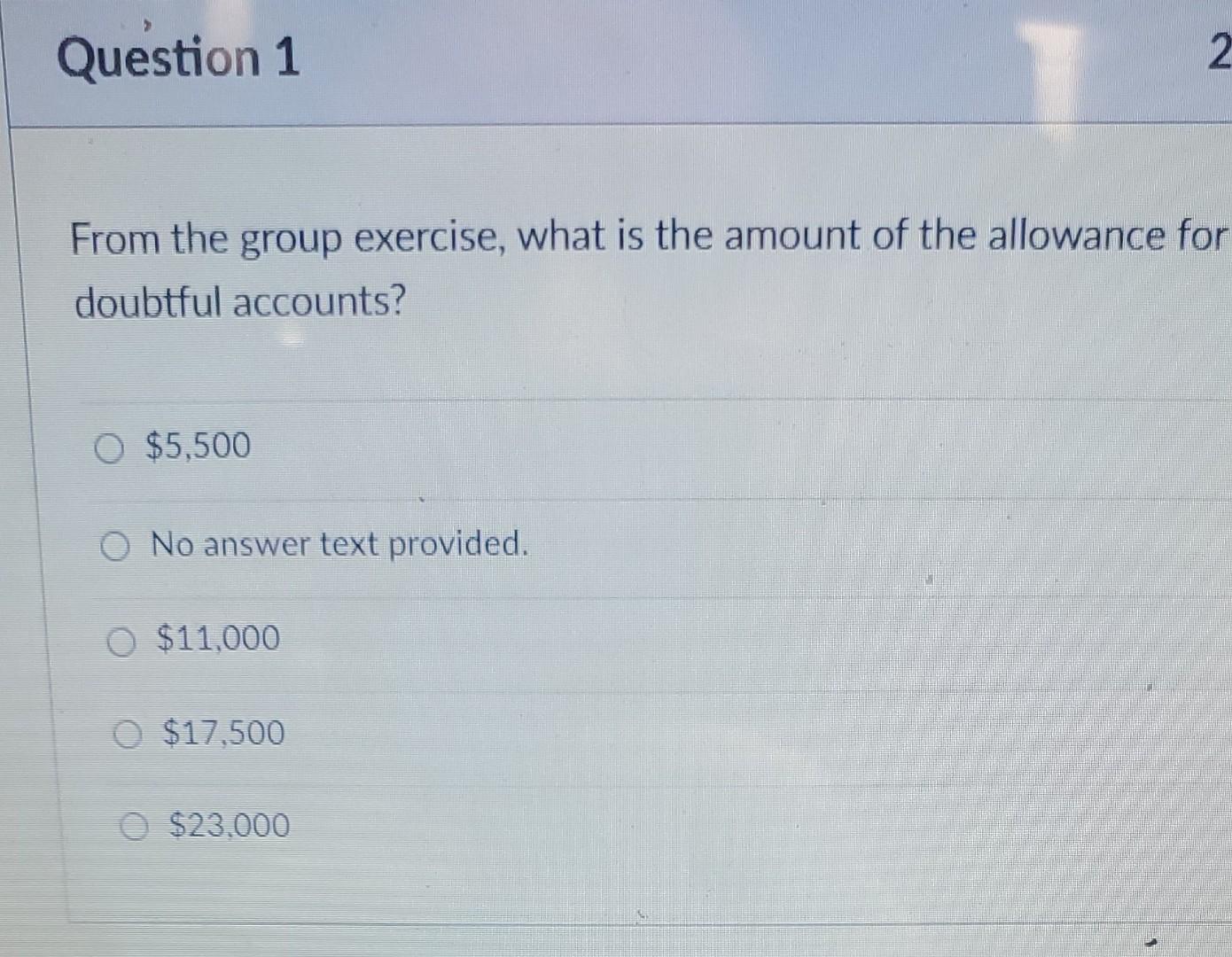

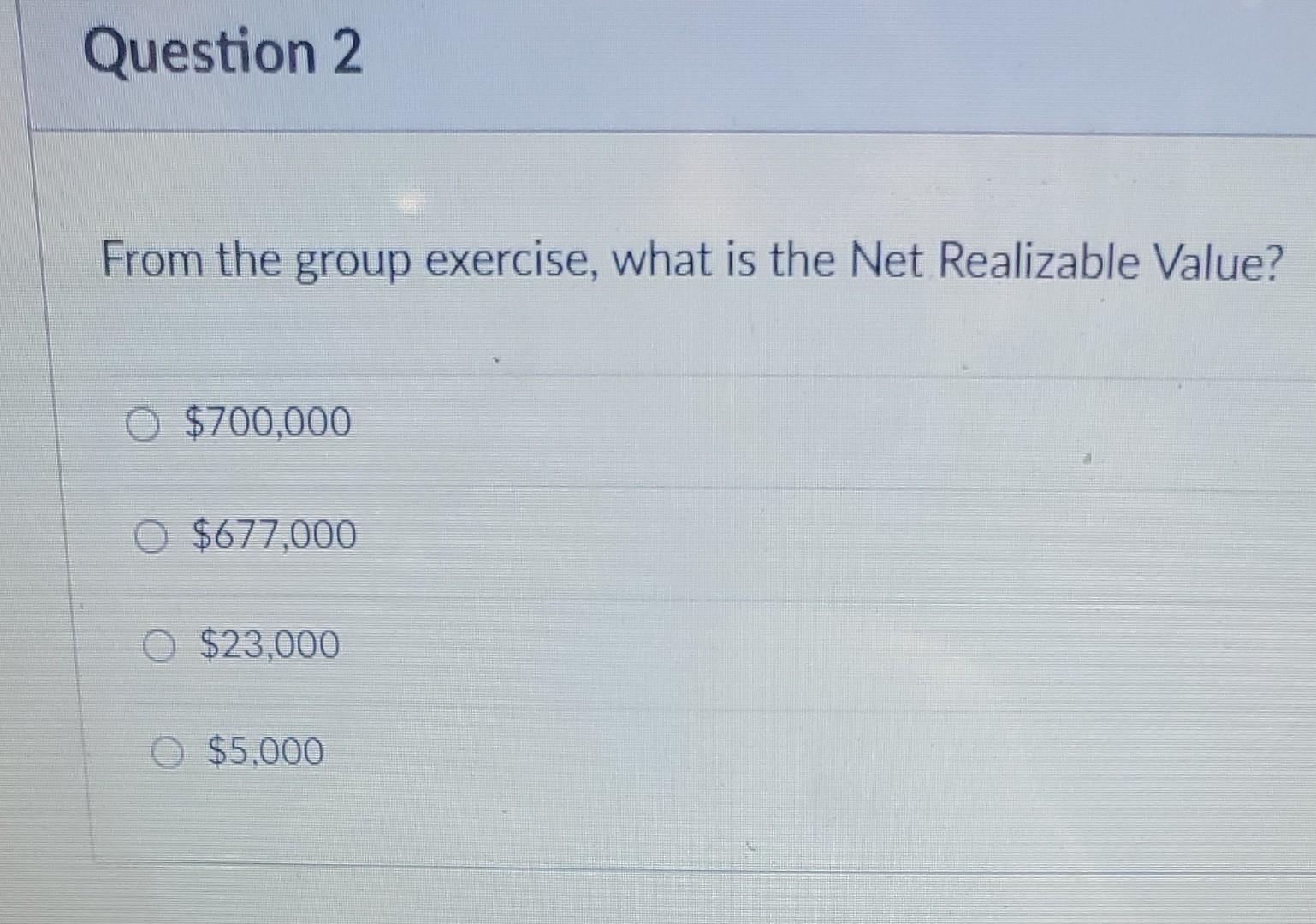

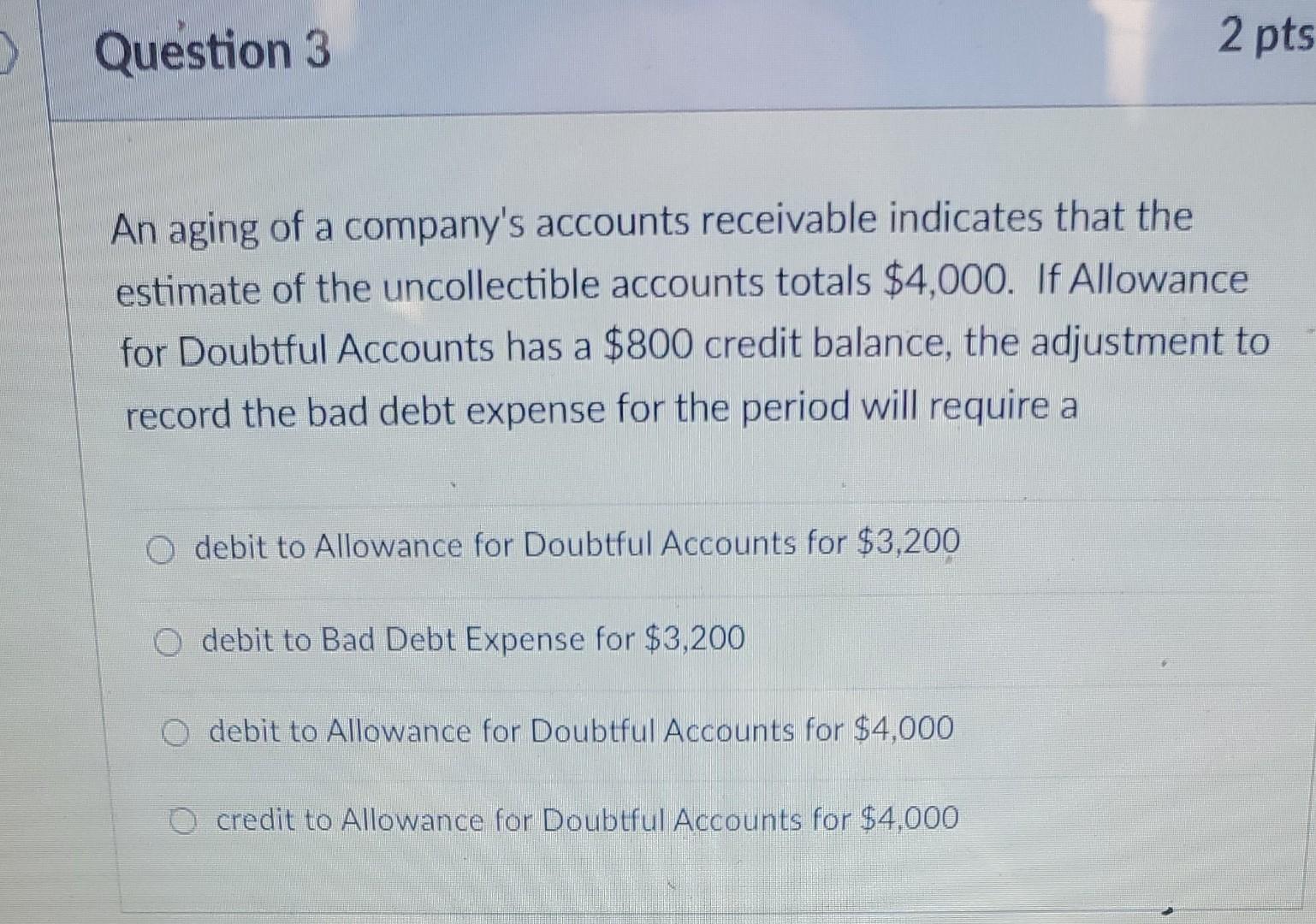

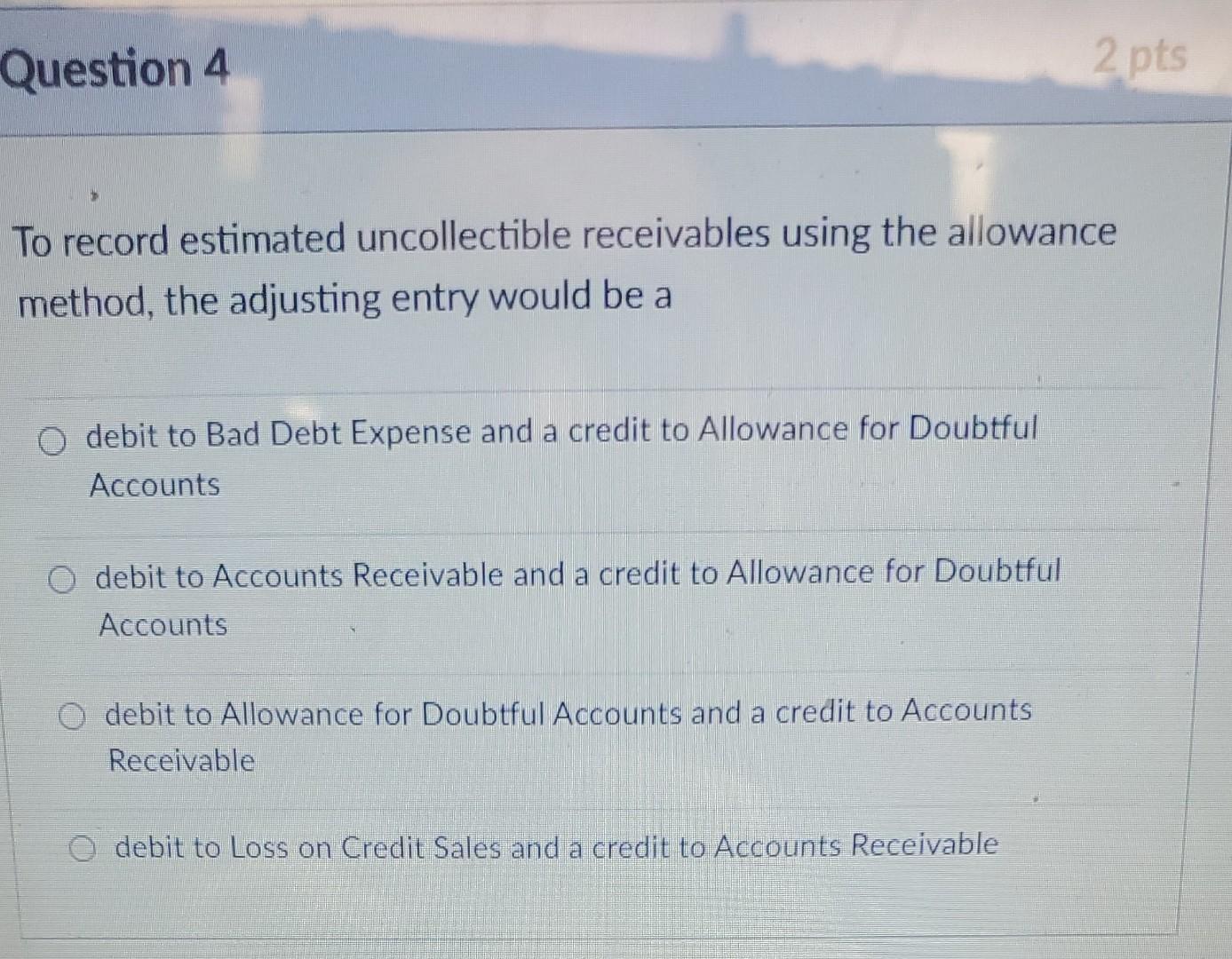

Group Exercise: At the end of the current year, Accounts Receivable has a balance of $700,000; Allowance for Doubtful Accounts has a credit balance of $5,500; and sales for the year total $3,500,000. Bad debt expense is estimated at 1/2 of 1% of net sales. Determine: (a) the amount of the adjusting entry for bad debt expense; (b) the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense; and (c) the net realizable value of accounts receivable. Question 1 2 From the group exercise, what is the amount of the allowance for doubtful accounts? 0 $5,500 No answer text provided. O $11,000 $17.500 0 $23.000 Question 2 From the group exercise, what is the Net Realizable Value? O $700,000 $677,000 O $23,000 0 $5,000 ) Question 3 2 pts An aging of a company's accounts receivable indicates that the estimate of the uncollectible accounts totals $4,000. If Allowance for Doubtful Accounts has a $800 credit balance, the adjustment to record the bad debt expense for the period will require a O debit to Allowance for Doubtful Accounts for $3,200 O debit to Bad Debt Expense for $3,200 O debit to Allowance for Doubtful Accounts for $4,000 o credit to Allowance for Doubtful Accounts for $4,000 Question 4 2 pts To record estimated uncollectible receivables using the allowance method, the adjusting entry would be a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts debit to Accounts Receivable and a credit to Allowance for Doubtful Accounts a O debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable O debit to Loss on Credit Sales and a credit to Accounts Receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts