Question: Just need help with wrong answers and why they're wrong please. The trial balance for Lindor Corporation, a manufacturing company, for the year ended December

Just need help with wrong answers and why they're wrong please.

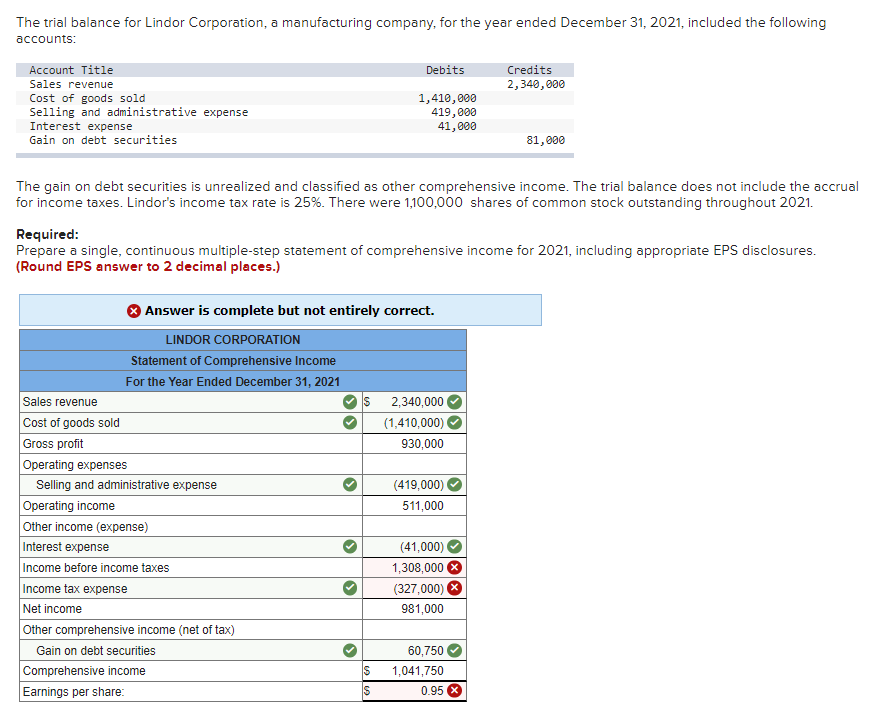

The trial balance for Lindor Corporation, a manufacturing company, for the year ended December 31, 2021, included the following accounts: Debits Credits 2,340,000 Account Title Sales revenue Cost of goods sold Selling and administrative expense Interest expense Gain on debt securities 1,410,000 419,000 41,000 81,000 The gain on debt securities is unrealized and classified as other comprehensive income. The trial balance does not include the accrual for income taxes. Lindor's income tax rate is 25%. There were 1,100,000 shares of common stock outstanding throughout 2021. Required: Prepare a single, continuous multiple-step statement of comprehensive income for 2021, including appropriate EPS disclosures. (Round EPS answer to 2 decimal places.) Answer is complete but not entirely correct. LINDOR CORPORATION Statement of Comprehensive Income For the Year Ended December 31, 2021 Sales revenue S 2,340,000 Cost of goods sold (1,410,000) Gross profit 930,000 Operating expenses Selling and administrative expense (419,000) Operating income 511,000 Other income (expense) Interest expense (41,000) Income before income taxes 1,308,000 Income tax expense (327,000) Net income 981,000 Other comprehensive income (net of tax) Gain on debt securities 60,750 Comprehensive income S 1,041,750 Earnings per share: S 0.95

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts