Question: JUST NEED OPTION no need explain NO need for explanation i will rate you 3 Not yet answered 3 Marked out of 0.50 Ahmed, Amir

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

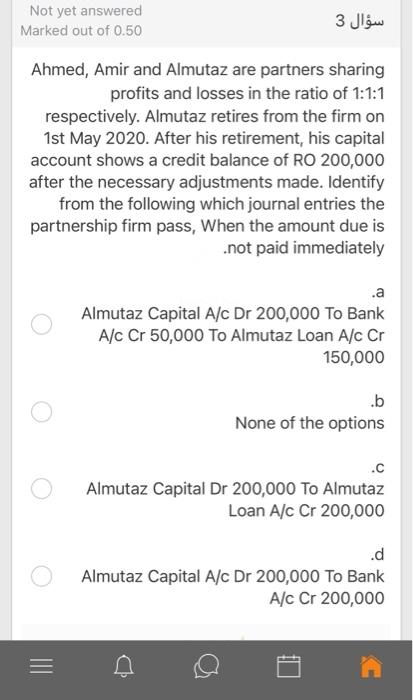

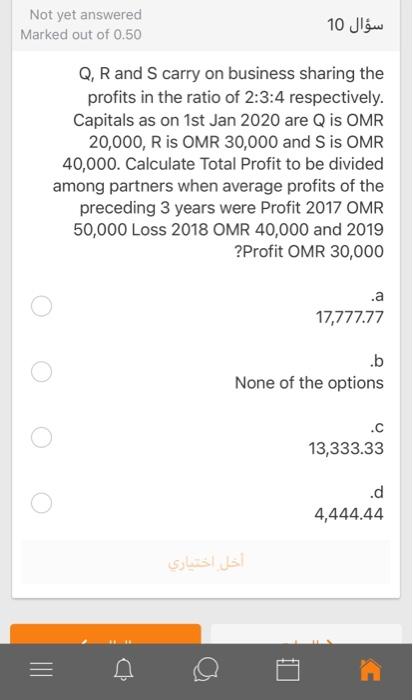

3 Not yet answered 3 Marked out of 0.50 Ahmed, Amir and Almutaz are partners sharing profits and losses in the ratio of 1:1:1 respectively. Almutaz retires from the firm on 1st May 2020. After his retirement, his capital account shows a credit balance of RO 200,000 after the necessary adjustments made. Identify from the following which journal entries the partnership firm pass, When the amount due is .not paid immediately .a Almutaz Capital A/c Dr 200,000 To Bank A/c Cr 50,000 To Almutaz Loan A/c Cr 150,000 .b None of the options .c Almutaz Capital Dr 200,000 To Almutaz Loan A/c Cr 200,000 .d Almutaz Capital A/c Dr 200,000 To Bank A/c Cr 200,000 = 10 Not yet answered Marked out of 0.50 Q, R and S carry on business sharing the profits in the ratio of 2:3:4 respectively. Capitals as on 1st Jan 2020 are Q is OMR 20,000, R is OMR 30,000 and Sis OMR 40,000. Calculate Total Profit to be divided among partners when average profits of the preceding 3 years were Profit 2017 OMR 50,000 Loss 2018 OMR 40,000 and 2019 ?Profit OMR 30,000 .a 17,777.77 .b None of the options . 13,333.33 .d 4,444.44 solusi Jol

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts