Question: JUST NEED OPTION no need explain NO need for explanation i will rate you 4G 11:46 Ims.act.edu.om Question 30 Not yet answered Marked out of

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

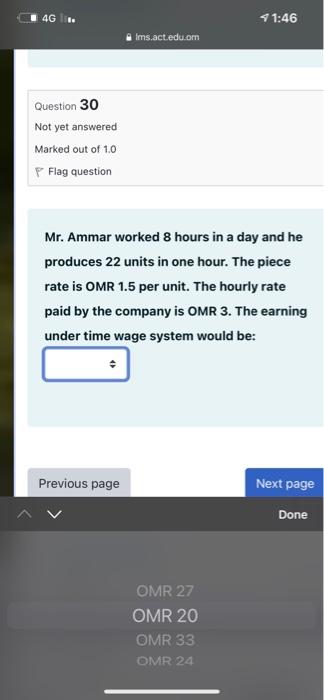

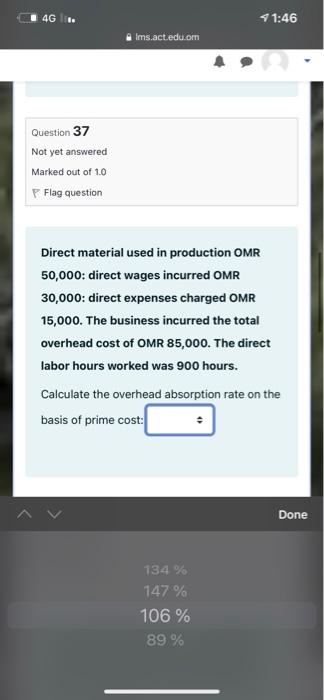

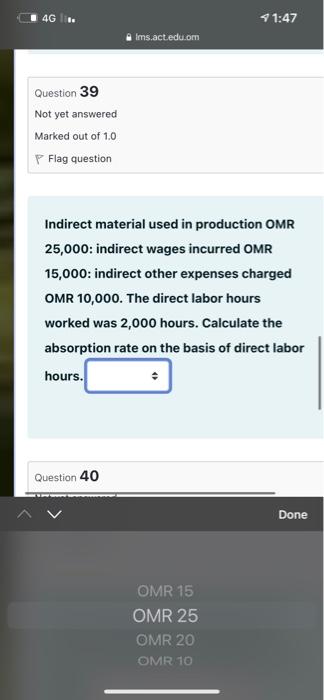

4G 11:46 Ims.act.edu.om Question 30 Not yet answered Marked out of 1.0 Flag question Mr. Ammar worked 8 hours in a day and he produces 22 units in one hour. The piece rate is OMR 1.5 per unit. The hourly rate paid by the company is OMR 3. The earning under time wage system would be: Previous page Next page Done OMR 27 OMR 20 OMR 33 OMR 24 4G 11:46 Ims.act.edu.om Question 37 Not yet answered Marked out of 10 Flag question Direct material used in production OMR 50,000: direct wages incurred OMR 30,000: direct expenses charged OMR 15,000. The business incurred the total overhead cost of OMR 85,000. The direct labor hours worked was 900 hours. Calculate the overhead absorption rate on the basis of prime cost: Done 134 % 147 % 106 % 89 % 146 11:47 Ims.act.edu.om Question 39 Not yet answered Marked out of 1.0 Flag question Indirect material used in production OMR 25,000: indirect wages incurred OMR 15,000: indirect other expenses charged OMR 10,000. The direct labor hours worked was 2,000 hours. Calculate the absorption rate on the basis of direct labor hours. Question 40 Done OMR 15 OMR 25 OMR 20 OMR 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts