Question: JUST NEED OPTION no need explain NO need for explanation i will rate you Question 3 Not yet answered Marked out of 1.00 Flag question

JUST NEED OPTION

no need explain

NO need for explanation

i will rate you

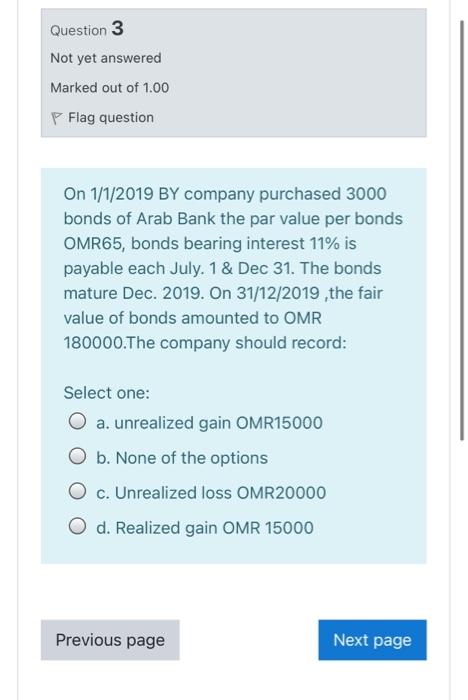

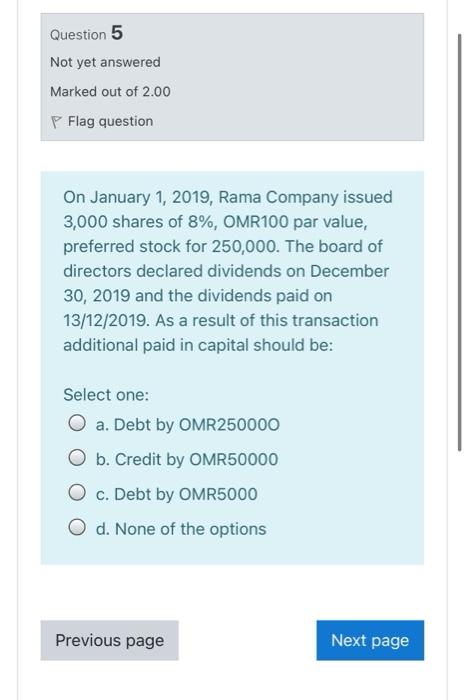

Question 3 Not yet answered Marked out of 1.00 Flag question On 1/1/2019 BY company purchased 3000 bonds of Arab Bank the par value per bonds OMR65, bonds bearing interest 11% is payable each July. 1 & Dec 31. The bonds mature Dec. 2019. On 31/12/2019, the fair value of bonds amounted to OMR 180000.The company should record: Select one: O a. unrealized gain OMR15000 O b. None of the options O c. Unrealized loss OMR20000 O d. Realized gain OMR 15000 Previous page Next page Question 5 Not yet answered Marked out of 2.00 P Flag question On January 1, 2019, Rama Company issued 3,000 shares of 8%, OMR100 par value, preferred stock for 250,000. The board of directors declared dividends on December 30, 2019 and the dividends paid on 13/12/2019. As a result of this transaction additional paid in capital should be: Select one: a. Debt by OMR250000 O b. Credit by OMR50000 O c. Debt by OMR5000 O d. None of the options Previous page Next page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts