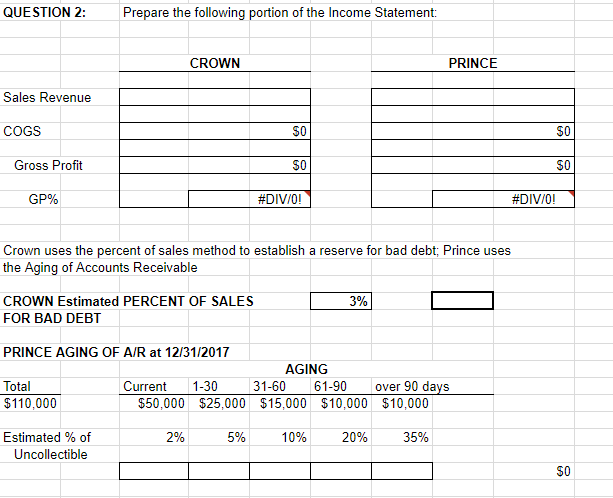

Question: Just need Question 2. (question 1 was already solved) CROWN and PRINCE Crown & Prince are virtually identical companies, both companies began operations at the

Just need Question 2. (question 1 was already solved)

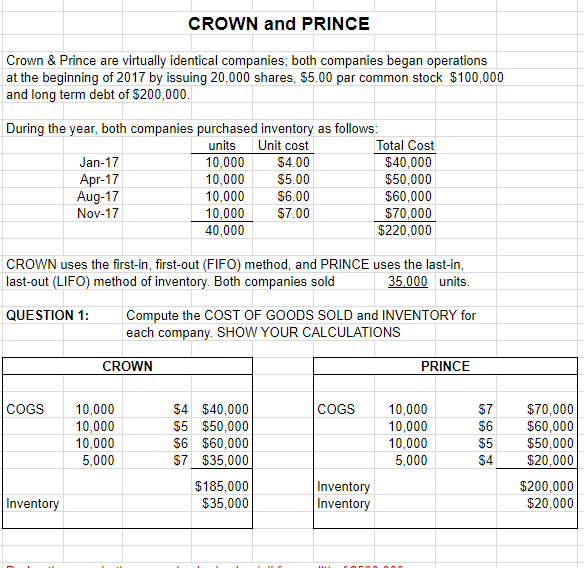

CROWN and PRINCE Crown & Prince are virtually identical companies, both companies began operations at the beginning of 2017 by issuing 20,000 shares, $5.00 par common stock $100,000 and long term debt of $200,000 During the year, both companies purchased inventory as follows Jan-17 Apr-17 Aug-17 units Unit cost 10,000 10,000 10,000 10,000 40,000 $4.00 $5.00 $6.00 $7.00 Total Cost $40,000 $50,000 $60,000 $70,000 $220,000 Nov-17 CROWN uses the first-in, first-out (FIFO) method, and PRINCE uses the last-in last-out (LIFO) method of inventory. Both companies sold units Compute the COST OF GOODS SOLD and INVENTORY for each company. SHOW YOUR CALCULATIONS QUESTION 1: CROWN PRINCE COGS 10,000 10,000 10,000 5,000 4 $40,000 $5 $50,000 $6 $60,000 S7 $35,000 COGS 10,000 10,000 10,000 5,000 7 $70,000 $6$60,000 S5 S50,000 S4 $20,000 $185,000 $35,000 Inventory Inventory $200,000 $20,000 Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts