Question: Just need the answer answer to compare In the development of a publicly owned, commercial waterfront area, three possible independent plans are being considered. Their

Just need the answer answer to compare

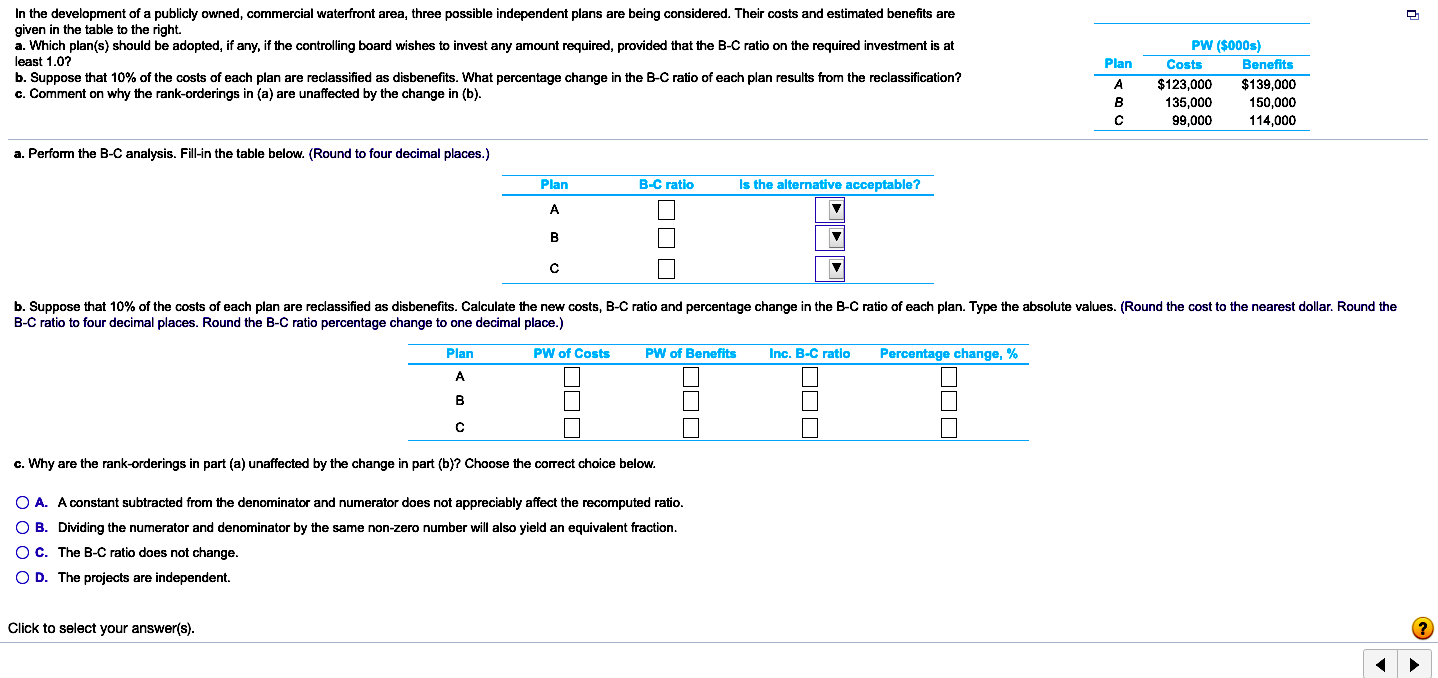

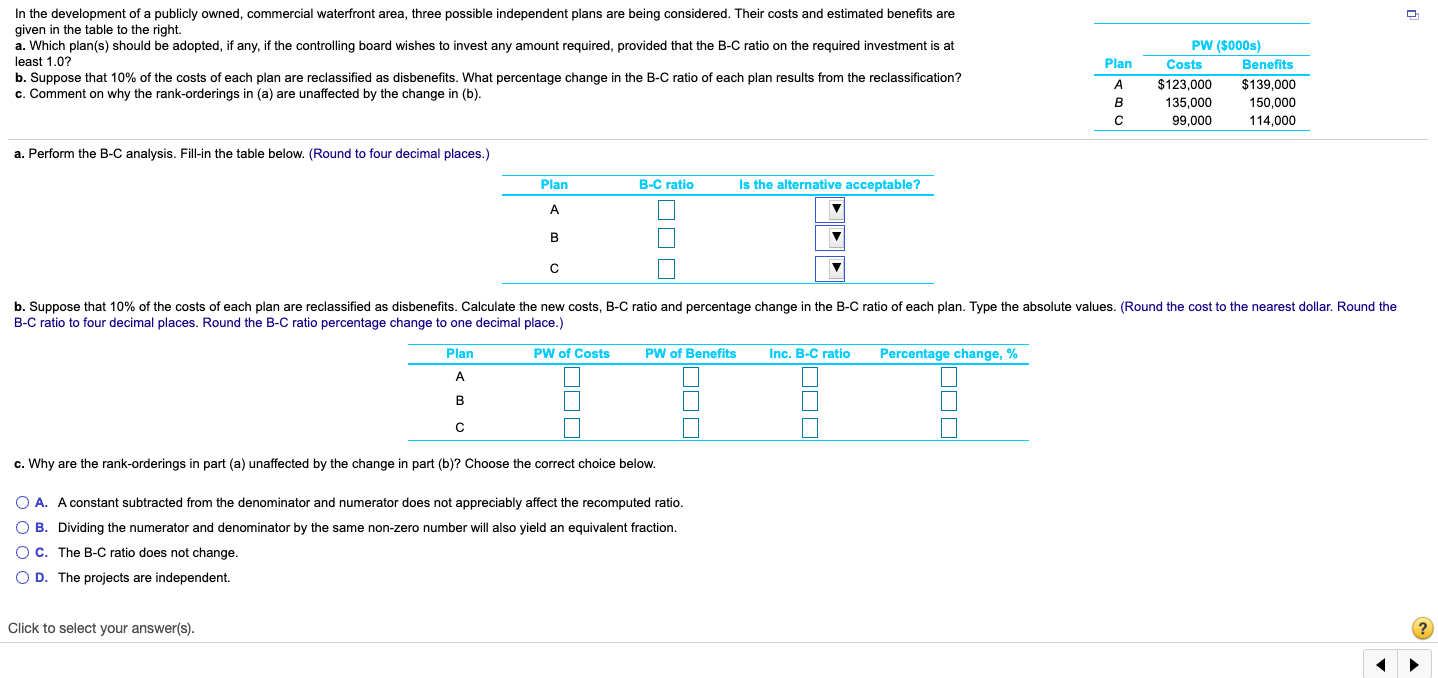

In the development of a publicly owned, commercial waterfront area, three possible independent plans are being considered. Their costs and estimated benefits are given in the table to the right. a. Which plan(s) should be adopted, if any, if the controlling board wishes to invest any amount required, provided that the B-C ratio on the required investment is at least 1.0? b. Suppose that 10% of the costs of each plan are reclassified as disbenefits. What percentage change in the B-C ratio of each plan results from the reclassification? c. Comment on why the rank-orderings in (a) are unaffected by the change in (b). Plan A B PW ($000s) Costs Benefits $123,000 $139,000 135,000 150,000 99,000 114,000 a. Perform the B-C analysis. Fill-in the table below. (Round to four decimal places.) Plan B-C ratio is the alternative acceptable? b. Suppose that 10% of the costs of each plan are reclassified as disbenefits. Calculate the new costs, B-C ratio and percentage change in the B-C ratio of each plan. Type the absolute values. (Round the cost to the nearest dollar. Round the B-C ratio to four decimal places. Round the B-C ratio percentage change to one decimal place.) Plan PW of Costs PW of Benefits Inc. B-C ratio Percentage change, % ODD DO c. Why are the rank-orderings in part (a) unaffected by the change in part (b)? Choose the correct choice below. O A. A constant subtracted from the denominator and numerator does not appreciably affect the recomputed ratio. OB. Dividing the numerator and denominator by the same non-zero number will also yield an equivalent fraction. OC. The B-C ratio does not change. OD. The projects are independent. Click to select your answer(s). In the development of a publicly owned, commercial waterfront area, three possible independent plans are being considered. Their costs and estimated benefits are given in the table to the right. a. Which plan(s) should be adopted, if any, if the controlling board wishes to invest any amount required, provided that the B-C ratio on the required investment is at least 1.0? b. Suppose that 10% of the costs of each plan are reclassified as disbenefits. What percentage change in the B-C ratio of each plan results from the reclassification? c. Comment on why the rank-orderings in (a) are unaffected by the change in (b). Plan A B PW ($000s) Costs Benefits $123,000 $139,000 135,000 150,000 99,000 114,000 a. Perform the B-C analysis. Fill-in the table below. (Round to four decimal places.) Plan B-C ratio is the alternative acceptable? b. Suppose that 10% of the costs of each plan are reclassified as disbenefits. Calculate the new costs, B-C ratio and percentage change in the B-C ratio of each plan. Type the absolute values. (Round the cost to the nearest dollar. Round the B-C ratio to four decimal places. Round the B-C ratio percentage change to one decimal place.) Plan PW of Costs PW of Benefits Inc. B-C ratio Percentage change, % ODD c. Why are the rank-orderings in part (a) unaffected by the change in part (b)? Choose the correct choice below. O A. A constant subtracted from the denominator and numerator does not appreciably affect the recomputed ratio. OB. Dividing the numerator and denominator by the same non-zero number will also yield an equivalent fraction. O C. The B-C ratio does not change. OD. The projects are independent. Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts