Question: just need the answer for b please Winston Sporting Goods is considering a public offering of common stock. Its investment banker has informed the company

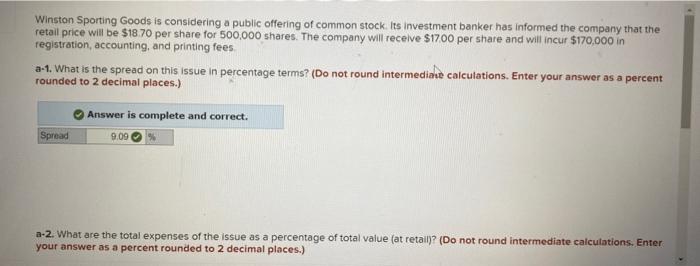

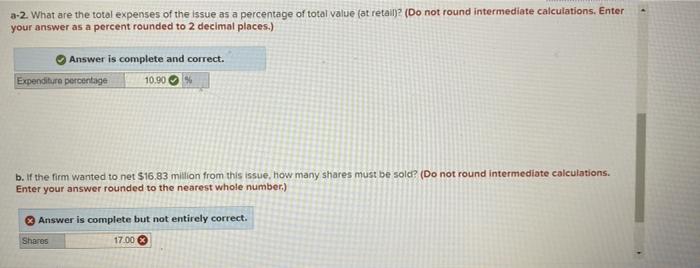

Winston Sporting Goods is considering a public offering of common stock. Its investment banker has informed the company that the retail price will be $18.70 per share for 500,000 shares. The company will recelve $17.00 per share and will incur $170,000 in registration, accounting, and printing fees a-1. What is the spread on this issue in percentage terms? (Do not round intermediane calculations. Enter your answer as a percent rounded to 2 decimal places.) Answer is complete and correct. a-2. What are the total expenses of the issue as a percentage of total value (at retall)? (Do not round intermediate calculations, Enter your answer as a percent rounded to 2 decimal places.) a-2. What are the total expenses of the issue as a percentage of total value (at retail)? (Do not round intermediate calculations, Enter your answer as a percent rounded to 2 decimal places.) b. If the firm wanted to net $16.83 million from this issue, how many shares must be sold? (Do not round intermediate calculations. Enter your answer rounded to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts