Question: Just need the correct answer to the one in red, please (answers are not 4,200 or 42,000). Return to question Mr. A, who has a

Just need the correct answer to the one in red, please (answers are not 4,200 or 42,000).

Just need the correct answer to the one in red, please (answers are not 4,200 or 42,000).

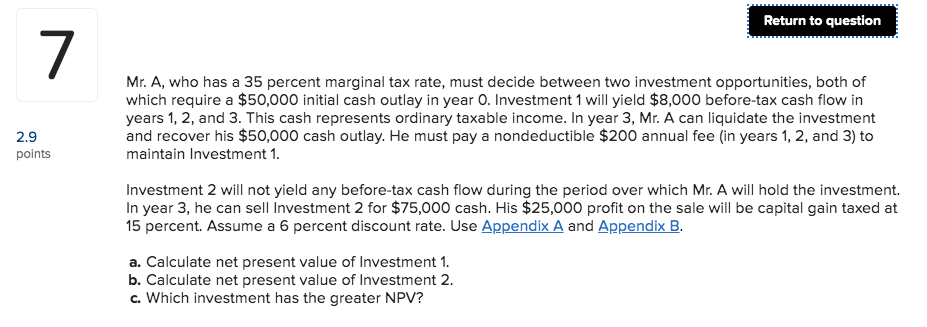

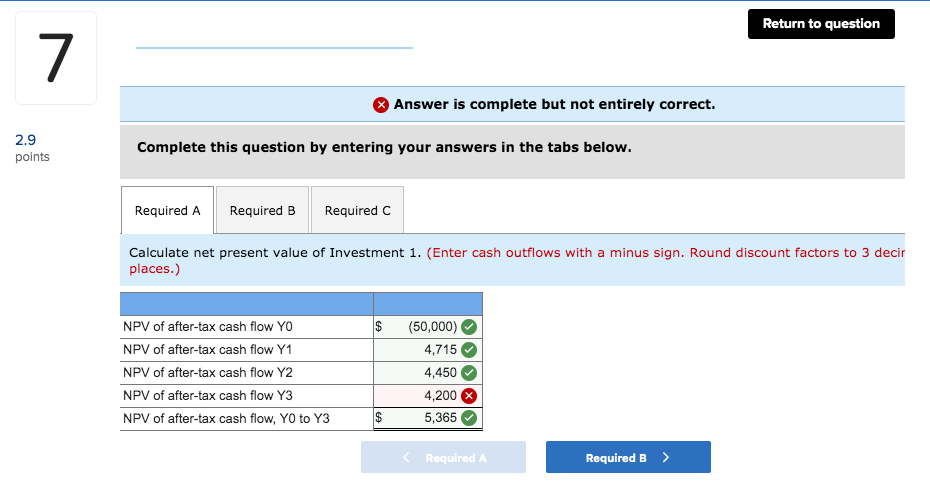

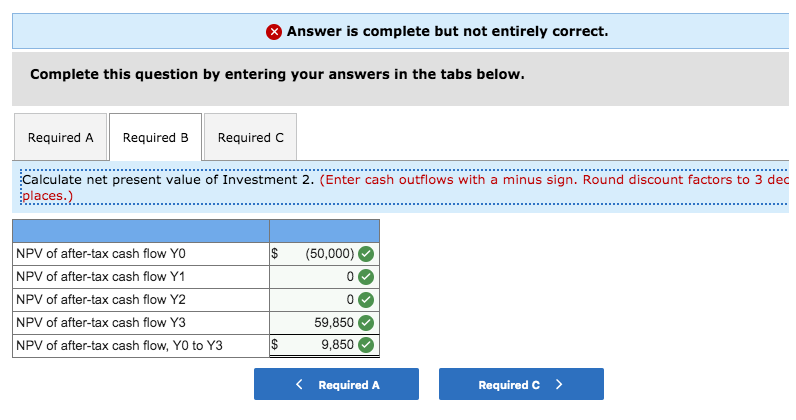

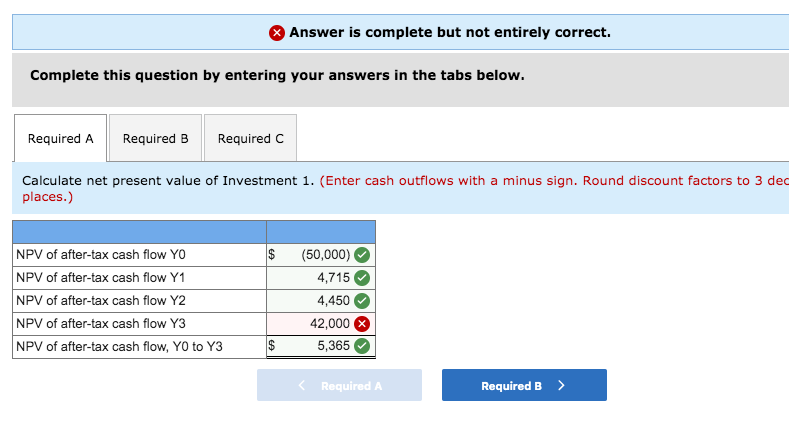

Return to question Mr. A, who has a 35 percent marginal tax rate, must decide between two investment opportunities, both of which require a $50,000 initial cash outlay in year O. Investment 1 will yield $8,000 before-tax cash flow in years 1, 2, and 3. This cash represents ordinary taxable income. In year 3, Mr. A can liquidate the investment and recover his $50,000 cash outlay. He must pay a nondeductible $200 annual fee (in years 1, 2, and 3) to maintain Investment 1 2.9 points Investment 2 will not yield any before-tax cash flow during the period over which Mr. A will hold the investment. In year 3, he can sell Investment 2 for $75,000 cash. His $25,000 profit on the sale will be capital gain taxed at 15 percent. Assume a 6 percent discount rate. Use Appendix A and Appendix B a. Calculate net present value of Investment 1. b. Calculate net present value of Investment 2. c. Which investment has the greater NPV? Return to question 7 Answer is complete but not entirely correct. 2.9 Complete this question by entering your answers in the tabs below. points Required A Required B Required C Calculate net present value of Investment 1. (Enter cash outflows with a minus sign. Round discount factors to 3 deci places.) NPV of after-tax cash flow YO $ (50,000) 4,715 4,450 NPV of after-tax cash flow Y1 NPV of after-tax cash flow Y2 NPV of after-tax cash flow Y3 |$ 5,365 NPV of after-tax cash flow, Y0 to Y3 Required A Required B Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate net present value of Investment 2. (Enter cash outflows with a minus sign. Round discount factors to 3 dec olaces. NPV of after-tax cash flow YO $ (50,000) NPV of after-tax cash flow Y1 NPV of after-tax cash flow Y2 NPV of after-tax cash flow Y3 59,850 NPV of after-tax cash flow, YO to Y3 9,850 Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate net present value of Investment 1. (Enter cash outflows with a minus sign. Round discount factors to 3 dec places.) $ (50,000) 4,715 NPV of after-tax cash flow YO NPV of after-tax cash flow Y1 NPV of after-tax cash flow Y2 4,450 O 42,000 0 NPV of after-tax cash flow Y3 | |$ 5,365 NPV of after-tax cash flow, Y0 to Y3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts