Question: Just need the correct answer where the red X is. All the others are correct. Required information [The following information applies to the questions displayed

Just need the correct answer where the red X is. All the others are correct.

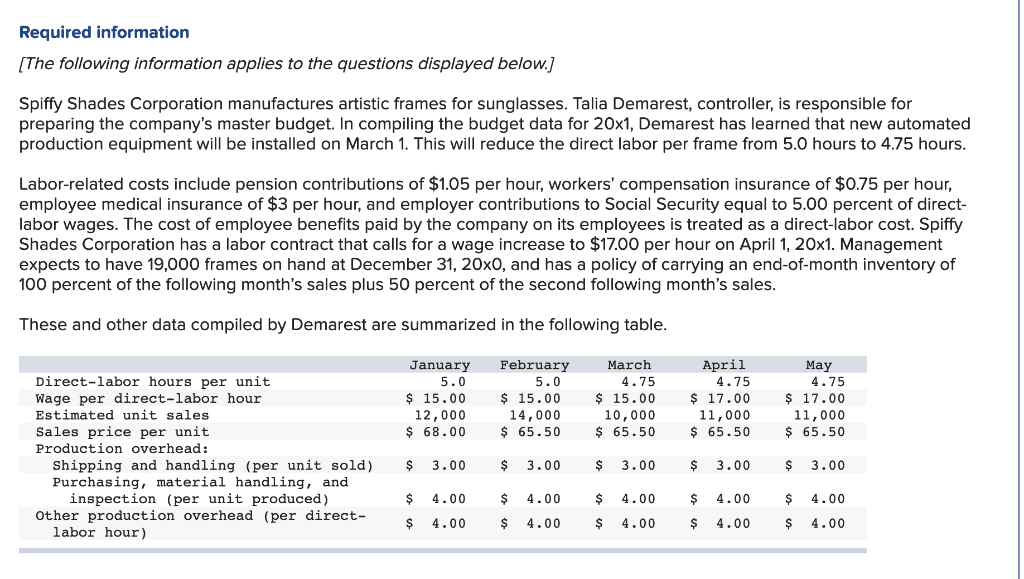

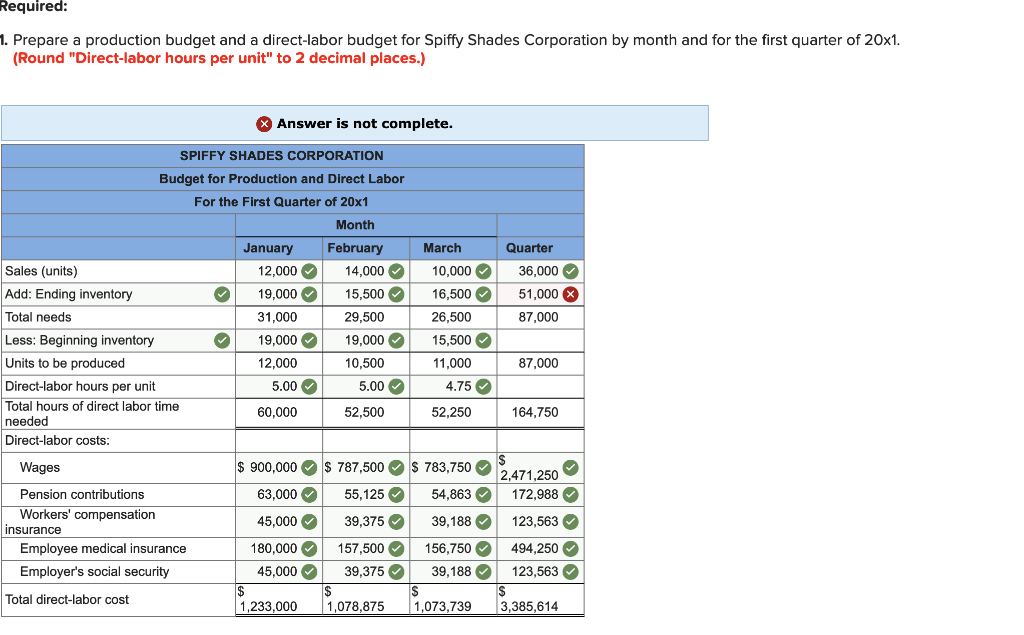

Required information [The following information applies to the questions displayed below.] Spiffy Shades Corporation manufactures artistic frames for sunglasses. Talia Demarest, controller, is responsible for preparing the company's master budget. In compiling the budget data for 20x1, Demarest has learned that new automated production equipment will be installed on March 1. This will reduce the direct labor per frame from 5.0 hours to 4.75 hours Labor-related costs include pension contributions of $1.05 per hour, workers' compensation insurance of $0.75 per hour, employee medical insurance of $3 per hour, and employer contributions to Social Security equal to 5.00 percent of direct- labor wages. The cost of employee benefits paid by the company on its employees is treated as a direct-labor cost. Spiffy Shades Corporation has a labor contract that calls for a wage increase to $1700 per hour on April 1, 20x1. Management expects to have 19,000 frames on hand at December 31, 20x0, and has a policy of carrying an end-of-month inventory of 100 percent of the following month's sales plus 50 percent of the second following month's sales These and other data compiled by Demarest are summarized in the following table April 4.75 15.00 15.0015.00 17.00 11,000 $ 68.00 65.50 65.50 65.50 January February March May Direct-labor hours per unit Wage per direct-labor hour Estimated unit sales Sales price per unit Production overhead: 4.75 4.75 17.00 11,000 65.50 12,000 14,000 10,000 Shipping and handling (per unit sold) Purchasing, material handling, and 3.00 4.00 $ 4.00 4.00 4.00 4.00 4.00 3.003.00 3.00 3.00 inspection (per unit produced) Other production overhead (per direct- $ 4.00 4.00 4.00 $4.00 labor hour) Required 1. Prepare a production budget and a direct-labor budget for Spiffy Shades Corporation by month and for the first quarter of 20x1. (Round "Direct-labor hours per unit" to 2 decimal places.) Answer is not complete SPIFFY SHADES CORPORATION Budget for Production and Direct Labor For the First Quarter of 20x1 Month January February March Quarter 0,00036 Sales (units) Add: Ending inventory Total needs Less: Beginning inventory Units to be produced Direct-labor hours per unit Total hours of direct labor time needed Direct-labor costs 36,000 19,005,50016,50051,000 87,000 14,000 31,000 29,500 26,500 19,000 19,00015,500 12,000 11,000 5.004.75 52,250 10,500 87,000 60,000 52,500 164,750 $ 900,000 787,500S 783,750 Wages Pension contributions Workers' compensation Employee medical insurance Employer's social security 2.471,250 ,0055,12554,863172,988 5,000 39,37539,188123,563 180,000 157,500156,750494,250 5,00039,37539,18123,563 4 insurance Total direct-labor cost 1,233,000 1,078,875 1,073,739 3,385,61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts