Question: just need the first example with 810 million and 910 million. i attached a similar problem with correct work so i hope that helps. i

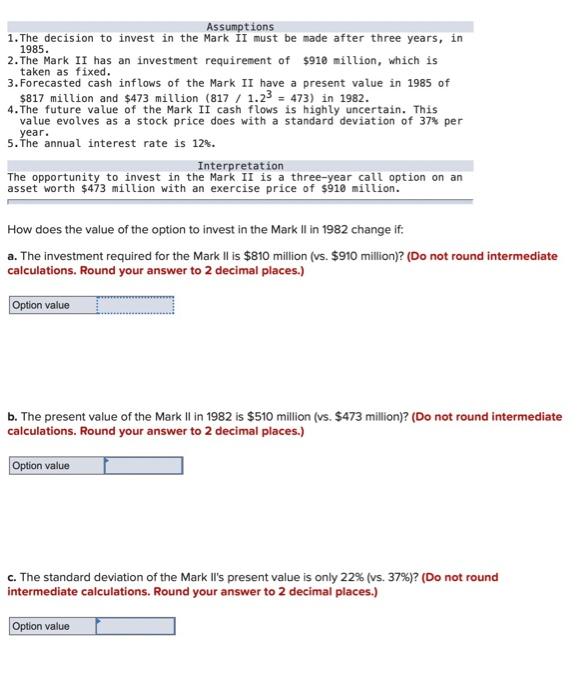

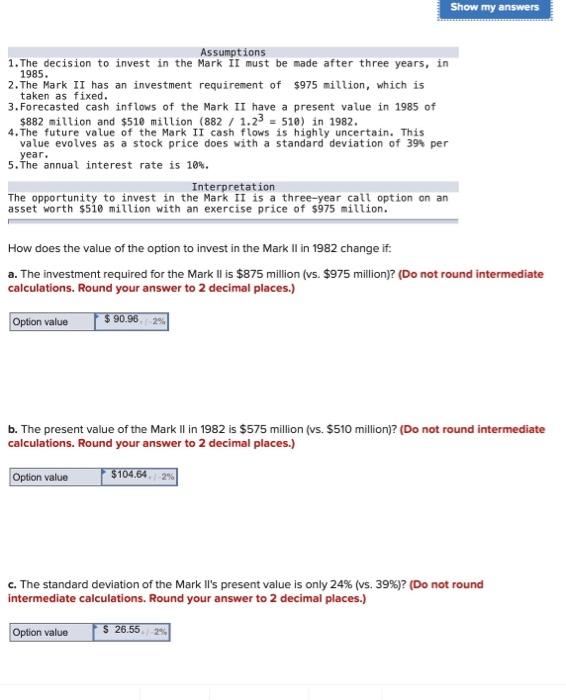

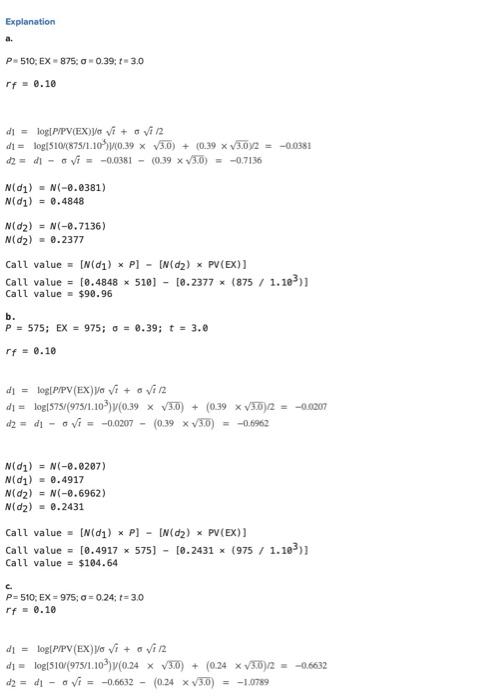

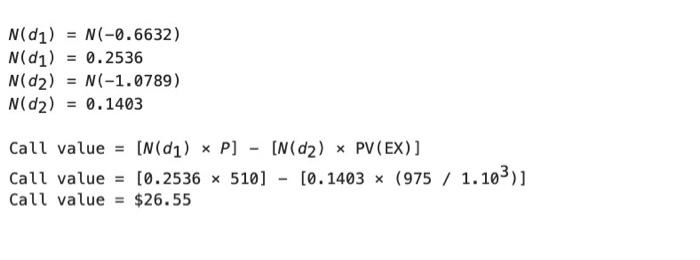

Assumptions 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $910 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $817million and $473million(817/1.23=473) in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 37% per year. 5. The annual interest rate is 12%. How does the value of the option to invest in the Mark II in 1982 change if: a. The investment required for the Mark II is $810 milion (vs. $910 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. The present value of the Mark II in 1982 is $510 million (v5. $473 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. The standard deviation of the Mark Il's present value is only 22% (vs. 37\%)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $975 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $882million and $510million(882/1.23=510) in 1982 . 4. The future value of the Mark II cash flows is highty uncertain. This value evolves as a stock price does with a standard deviation of 394 per year. 5. The annual interest rate is 10%. How does the value of the option to invest in the Mark II in 1982 change if: a. The investment required for the Mark II is $875 million (vs. $975 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. The present value of the Mark II in 1982 is $575 million (vs. $510 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. The standard deviation of the Mark Il's present value is only 24% (vs. 39\%)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Explanation a. =510;EX=875;=0.39;t=3.0rf=0.10 d1=log[PrPV(EX)]/t+t/2d1=log(5109(875/1.105)/(0.393.0)+(0.393.0)2=0.0381d2=d1t=0.0381(0.39350)=0.7136N(d1)=N(6.0381)N(d1)=0.4848N(d2)=N(6,7136)N(d2)=0.2377Callvalue=[N(d1)P][N(d2)PV(EX)]Callvalue=[0.4848510][0.2377(875/1.103)]Callvalue=$90.96 b. P=575;EX=975;=0.39;t=3.0rf=8.18d1=log[P/PV(EX)]t+at/2d1=log[575/(975/1.103)y(0.393.0)+(0.393.0)=0.0307d2=d1t=0.0207(0.393.0)=0.6962N(d1)=N(6.6207)N(d1)=0.4917N(d2)=N(8.6962)N(d2)=0.2431Callvalue=[N(d1)P][N(d2)PV(EX)]Callvalue=[0.4917575][0.2431(975/1.103)]Callvalue=$104.64c.P=510;EX=975;=0.24;t=3.0rf=0.10d1=log[P/PV(EX)]r+t/2d1=log[510(975/1.103)](0.243.0)+(0.243.0)/2=0.6632d2=d1t=0.6632(0.243.0)=1.0789 N(d1)=N(0.6632)N(d1)=0.2536N(d2)=N(1.0789)N(d2)=0.1403Callvalue=[N(d1)P][N(d2)PV(EX)]Callvalue=[0.2536510][0.1403(975/1.103)]Callvalue=$26.55 Assumptions 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $910 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $817million and $473million(817/1.23=473) in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 37% per year. 5. The annual interest rate is 12%. How does the value of the option to invest in the Mark II in 1982 change if: a. The investment required for the Mark II is $810 milion (vs. $910 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. The present value of the Mark II in 1982 is $510 million (v5. $473 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. The standard deviation of the Mark Il's present value is only 22% (vs. 37\%)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 1. The decision to invest in the Mark II must be made after three years, in 1985. 2. The Mark II has an investment requirement of $975 million, which is taken as fixed. 3. Forecasted cash inflows of the Mark II have a present value in 1985 of $882million and $510million(882/1.23=510) in 1982 . 4. The future value of the Mark II cash flows is highty uncertain. This value evolves as a stock price does with a standard deviation of 394 per year. 5. The annual interest rate is 10%. How does the value of the option to invest in the Mark II in 1982 change if: a. The investment required for the Mark II is $875 million (vs. $975 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. The present value of the Mark II in 1982 is $575 million (vs. $510 million)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) c. The standard deviation of the Mark Il's present value is only 24% (vs. 39\%)? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Explanation a. =510;EX=875;=0.39;t=3.0rf=0.10 d1=log[PrPV(EX)]/t+t/2d1=log(5109(875/1.105)/(0.393.0)+(0.393.0)2=0.0381d2=d1t=0.0381(0.39350)=0.7136N(d1)=N(6.0381)N(d1)=0.4848N(d2)=N(6,7136)N(d2)=0.2377Callvalue=[N(d1)P][N(d2)PV(EX)]Callvalue=[0.4848510][0.2377(875/1.103)]Callvalue=$90.96 b. P=575;EX=975;=0.39;t=3.0rf=8.18d1=log[P/PV(EX)]t+at/2d1=log[575/(975/1.103)y(0.393.0)+(0.393.0)=0.0307d2=d1t=0.0207(0.393.0)=0.6962N(d1)=N(6.6207)N(d1)=0.4917N(d2)=N(8.6962)N(d2)=0.2431Callvalue=[N(d1)P][N(d2)PV(EX)]Callvalue=[0.4917575][0.2431(975/1.103)]Callvalue=$104.64c.P=510;EX=975;=0.24;t=3.0rf=0.10d1=log[P/PV(EX)]r+t/2d1=log[510(975/1.103)](0.243.0)+(0.243.0)/2=0.6632d2=d1t=0.6632(0.243.0)=1.0789 N(d1)=N(0.6632)N(d1)=0.2536N(d2)=N(1.0789)N(d2)=0.1403Callvalue=[N(d1)P][N(d2)PV(EX)]Callvalue=[0.2536510][0.1403(975/1.103)]Callvalue=$26.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts