Question: just need the formulas when figuring this. Does not have to be in spread sheet This case requires that you use Excel to calculate the

just need the formulas when figuring this. Does not have to be in spread sheet

This case requires that you use Excel to calculate the Net Present Value, Internal Rate of Return, Modified Internal Rate of Return, and payback period of a project. You will need to provide answers to Steps 1 and 2 in the exercise using Excel to present your calculations (Step 3 is not required.).

For Step 1: You must use Excel functions and formulas to perform all necessary calculations. Submissions with only numbers and no formulas or functions will not receive credit for this assignment. Your submission must be neatly organized and must clearly present your work and results.

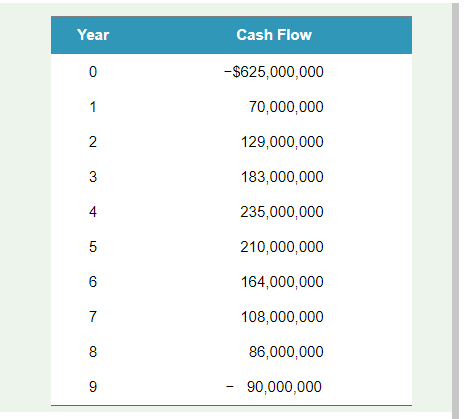

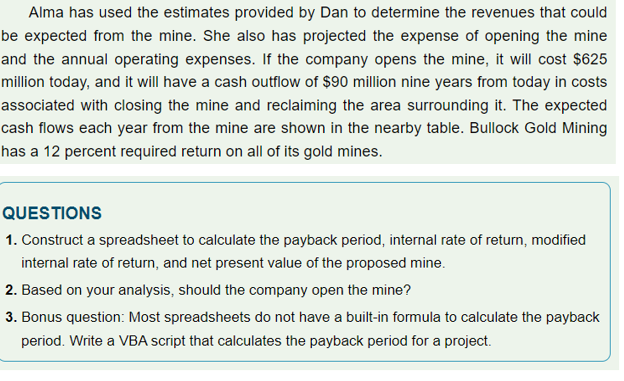

\begin{tabular}{rr} Year & \multicolumn{1}{c}{ Cash Flow } \\ \hline 0 & $625,000,000 \\ 1 & 70,000,000 \\ 2 & 129,000,000 \\ 3 & 183,000,000 \\ 4 & 235,000,000 \\ 5 & 210,000,000 \\ 6 & 164,000,000 \\ 7 & 108,000,000 \\ 8 & 86,000,000 \\ 9 & 90,000,000 \\ \hline \end{tabular} Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She also has projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $625 million today, and it will have a cash outflow of $90 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the nearby table. Bullock Gold Mining has a 12 percent required return on all of its gold mines. QUESTIONS 1. Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine. 2. Based on your analysis, should the company open the mine? 3. Bonus question: Most spreadsheets do not have a built-in formula to calculate the payback period. Write a VBA script that calculates the payback period for a project. \begin{tabular}{rr} Year & \multicolumn{1}{c}{ Cash Flow } \\ \hline 0 & $625,000,000 \\ 1 & 70,000,000 \\ 2 & 129,000,000 \\ 3 & 183,000,000 \\ 4 & 235,000,000 \\ 5 & 210,000,000 \\ 6 & 164,000,000 \\ 7 & 108,000,000 \\ 8 & 86,000,000 \\ 9 & 90,000,000 \\ \hline \end{tabular} Alma has used the estimates provided by Dan to determine the revenues that could be expected from the mine. She also has projected the expense of opening the mine and the annual operating expenses. If the company opens the mine, it will cost $625 million today, and it will have a cash outflow of $90 million nine years from today in costs associated with closing the mine and reclaiming the area surrounding it. The expected cash flows each year from the mine are shown in the nearby table. Bullock Gold Mining has a 12 percent required return on all of its gold mines. QUESTIONS 1. Construct a spreadsheet to calculate the payback period, internal rate of return, modified internal rate of return, and net present value of the proposed mine. 2. Based on your analysis, should the company open the mine? 3. Bonus question: Most spreadsheets do not have a built-in formula to calculate the payback period. Write a VBA script that calculates the payback period for a project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts